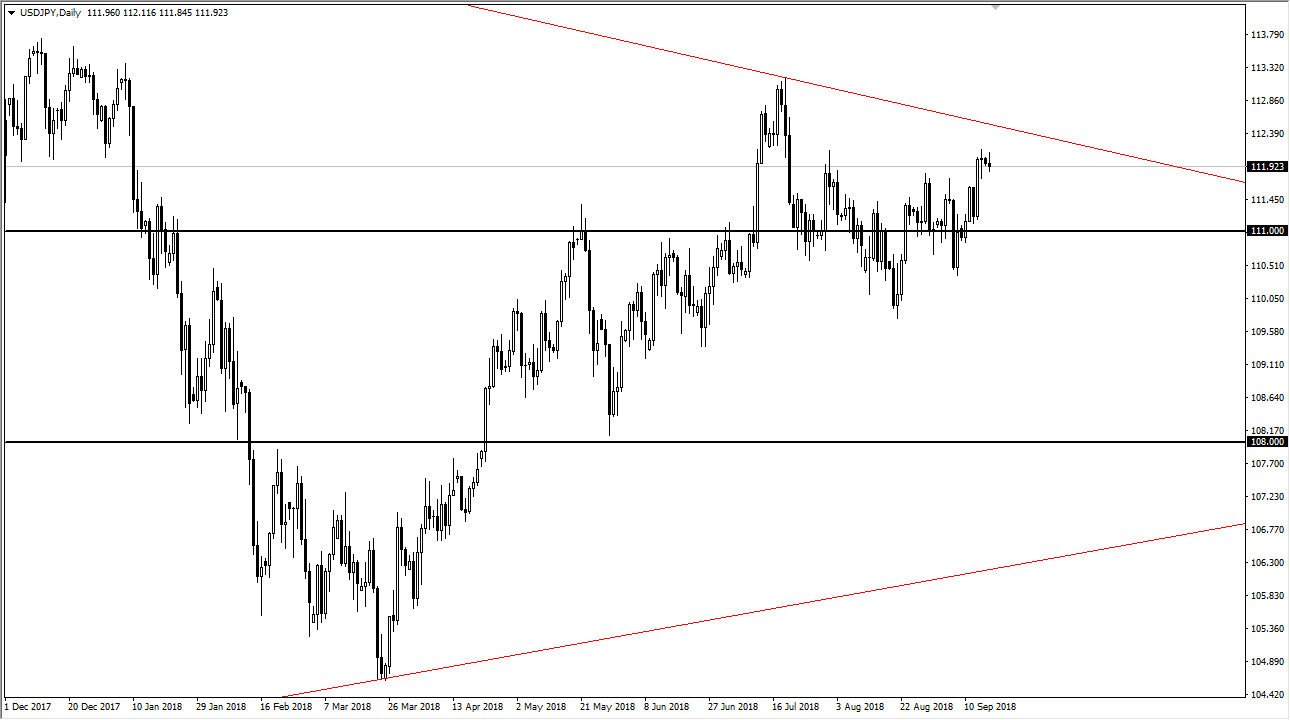

USD/JPY

The US dollar did very little against the Japanese yen on Monday as traders continue to worry about the impending tariffs being slapped on the Chinese by the Americans, as the pair tends to be very sensitive to trading in Asia and of course stock markets in general. I think that the downtrend line above should continue to offer resistance, but if we can break above the ¥112.50 level, the market should continue to go higher. I think at this point, it’s likely that we pull back towards the ¥111 level, which has been supportive more than once. Essentially, I think this is a marketplace that is going to continue to be very noisy as we await the announced tariffs. So far, we have not had rumors of tariffs that didn’t turn out to be true later, so I think the market is bracing for what’s going happen next.

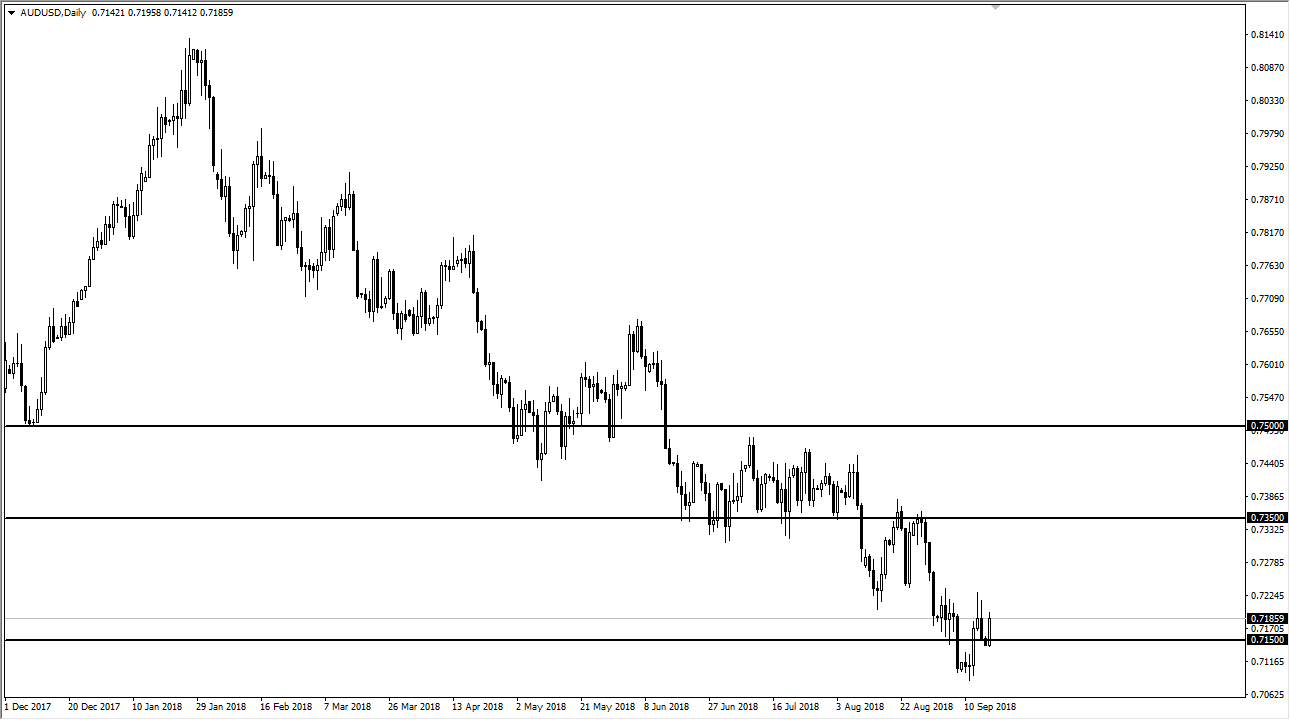

AUD/USD

The Australian dollar rallied rather significantly during the trading session on Monday, but failed to break above the top of the shooting star from the previous week, so I think at this point it looks likely that we are going to continue to struggle to go higher, but if we were to break above the 0.7250 level, the market could continue to go towards the 0.7350 level, but I think it needs some type of good news coming out of the US/China relations or perhaps just the market essentially ignoring the potential turmoil between the Americans and the Chinese. Looking at this market, it is most certainly in a downtrend, and that of course hasn’t changed. At this point, I believe that you continue to sell the rallies, and simply look for signs of exhaustion to do so.