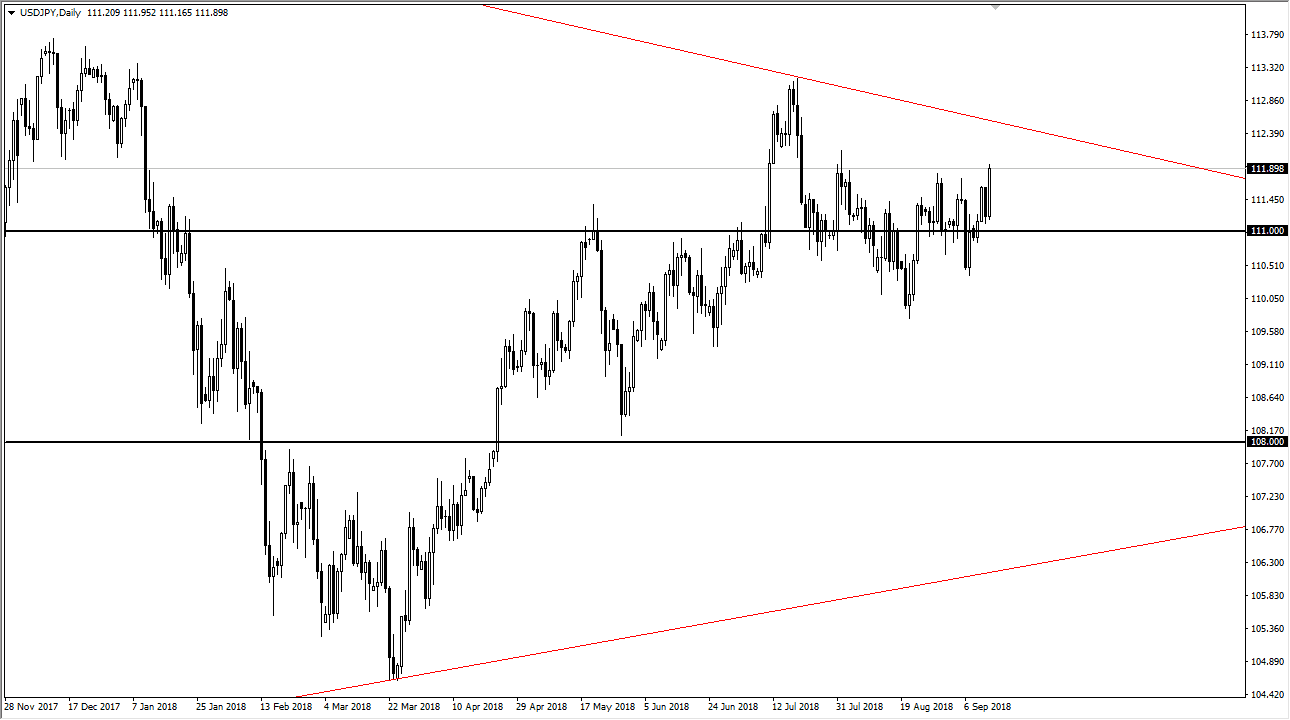

USD/JPY

The US dollar rallied significantly against the Japanese yen during trading on Thursday as stock markets rallied overall. By doing so, we tested the ¥112 level, but couldn’t quite break above there. That’s not a huge surprise because the market has been very tight. At this point we are getting fairly close to a major downtrend line, so I think the buyers would be paying more attention to that than anything else. With that in mind, I think that we could very well see a short-term pullback but I don’t know that there is a trade here other than to buying those pullbacks. I would necessarily be shorting this pair, as it will move right along with stock markets which of course look very bullish as of late. A CPI number that missed in America had people thinking that the Federal Reserve would have to pause on any type or rate hike cycle. I suspect they will be disappointed.

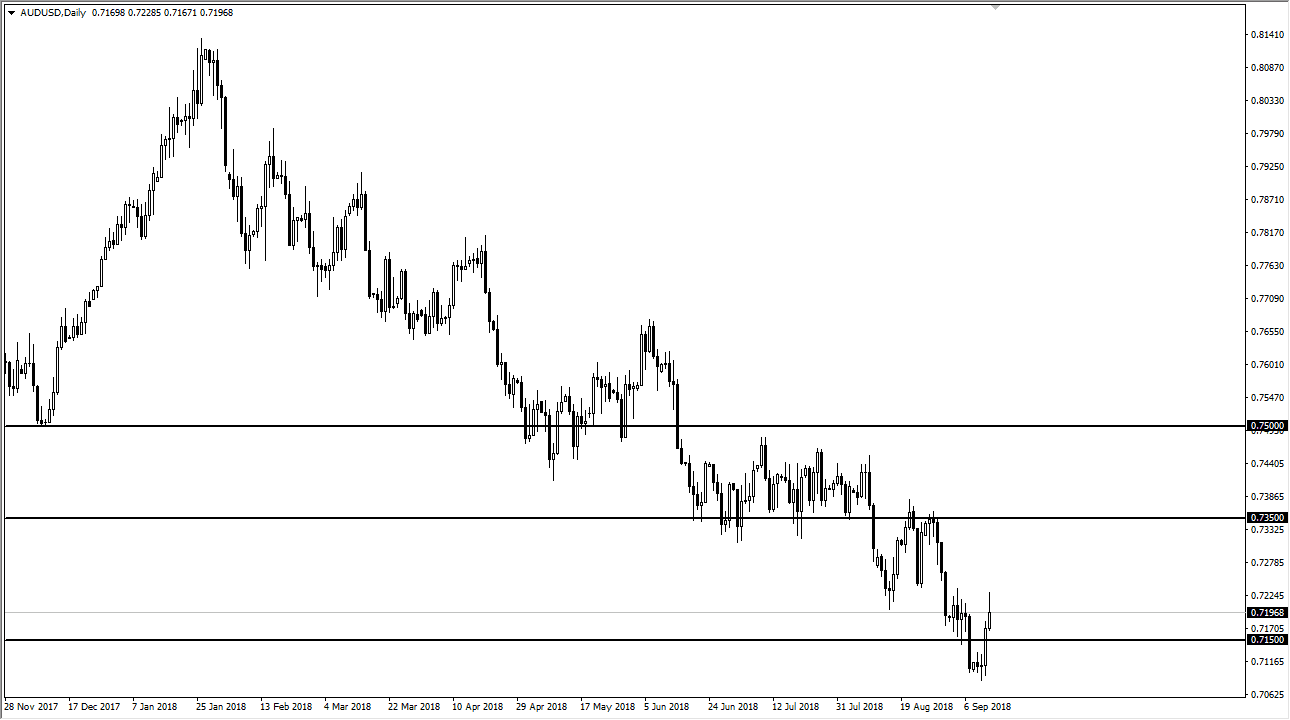

AUD/USD

The Australian dollar initially rallied due to the CPI miss in America, reaching towards the 0.7225 handle, an area that has featured a lot of resistance recently. At this point, we have turned around quite a bit gave up about half of the gains though, and I think that is probably due to President Donald Trump suggesting that he wasn’t concerned about striking a deal with the Chinese right away. Remember, a lot of the bullish momentum to the upside was after it was announced that the Americans and the Chinese are getting ready to talk. This shows just what this pair is focusing on, and that’s mainly China. I still look to sell rallies on signs of exhaustion, and it worked out quite nicely during intraday trading on Thursday. I suspect that if you are patient enough, you should see another selling opportunity soon.