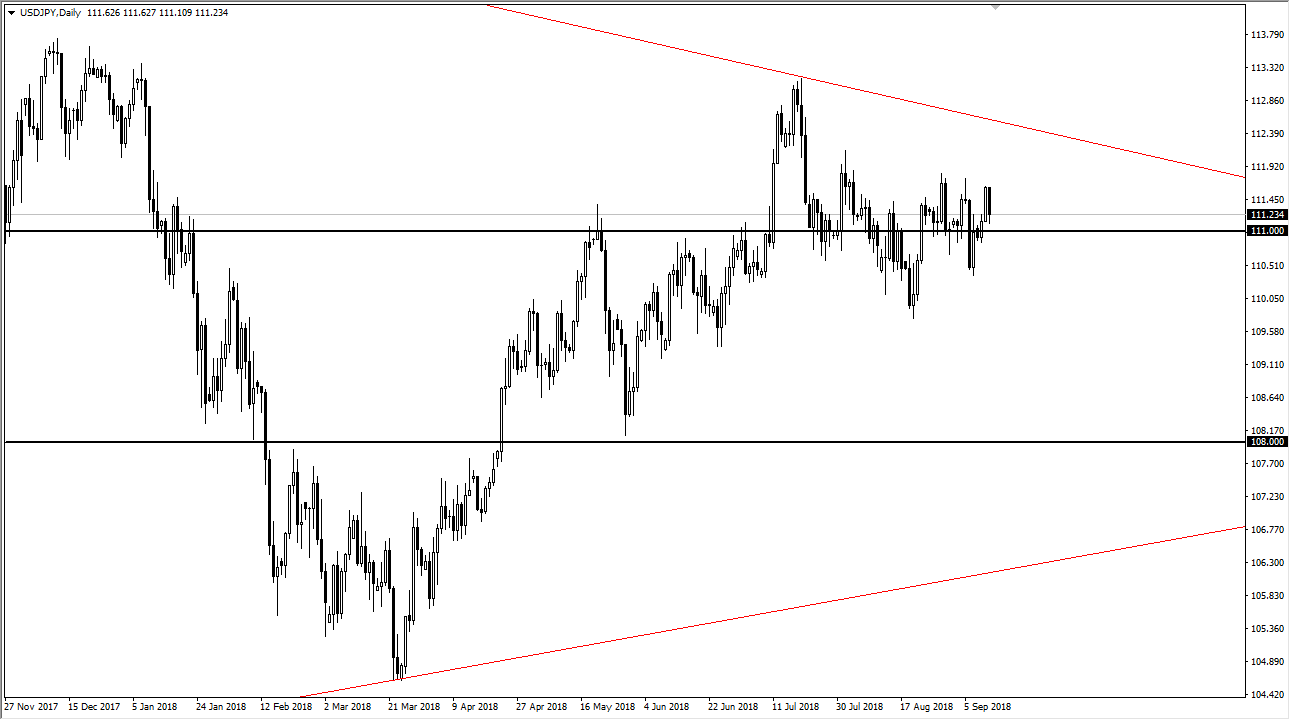

USD/JPY

The US dollar has fallen against the Japanese yen during trading on Wednesday, reaching down towards the vital ¥111 level. This is an area that has been important more than once, and therefore it makes sense that we would refrain from breaking below it. However, when I look at this market’s obvious that we are simply going back and forth and therefore it is a situation where short-term trading continues the lead the way. It makes a lot of sense though, because this pair is highly sensitive to the overall risk appetite, which is developing right along with the US/China trade talks. Ultimately, I do think that this market goes higher, but it is one that’s going to be very stubborn. 50 pips increments continue to be the best way to trade this market, as it continues to struggle to make a longer-term move.

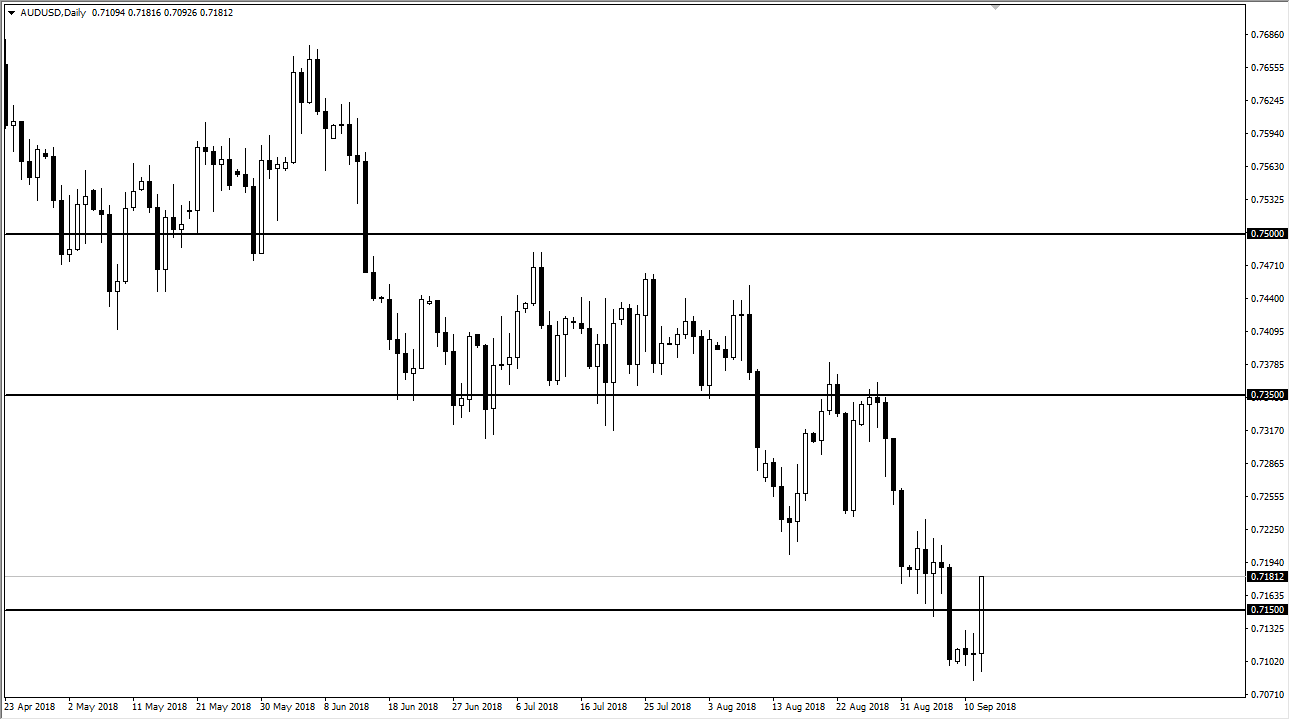

AUD/USD

The Australian dollar rallied significantly during trading on Wednesday after it was reported that the US and China will be meeting again. Ultimately, that is one of the biggest drivers of this marketplace, as the Australian dollar is so sensitive to commodity flow from Australia to China. It makes sense that this market would rally after that noise, but ultimately we are still very much in a downtrend and we are very much a long way from some type of resolution. With that being the case, there has been a significant turnaround. However, I think there is more than enough selling pressure above that will ultimately overwhelm the buyers unless we get even more good news. At this point, I think this is a selling opportunity at the first signs of significant exhaustion.