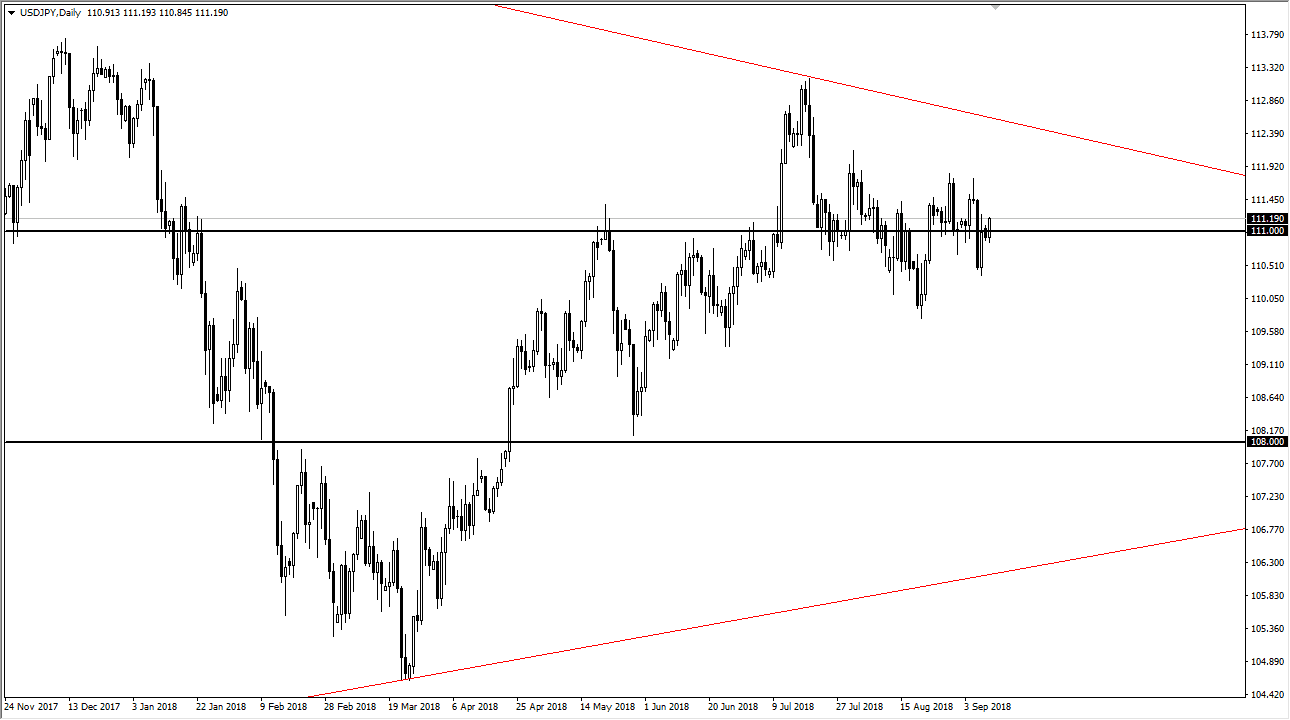

USD/JPY

The US dollar rallied a bit during the trading session on Monday, as we continue to bounce around the ¥111 level. This is an area that continues to attract a lot of attention, and it makes sense that this market can’t seem to get its mind made up as to where we go next, as global trade threats continue. This pair tends to be very sensitive to Sino-American relations, which of course are very stretched at the moment. Overall, we need clarity in that situation for this market to finally behave the way it typically will, trading with interest rate differentials. It typically rises in a “risk on” environment, but obviously nothing is quite the “normal” environment that we are used to. I believe that the ¥110 level underneath is supportive, and of course the downtrend line above which is from higher time frames is resistance.

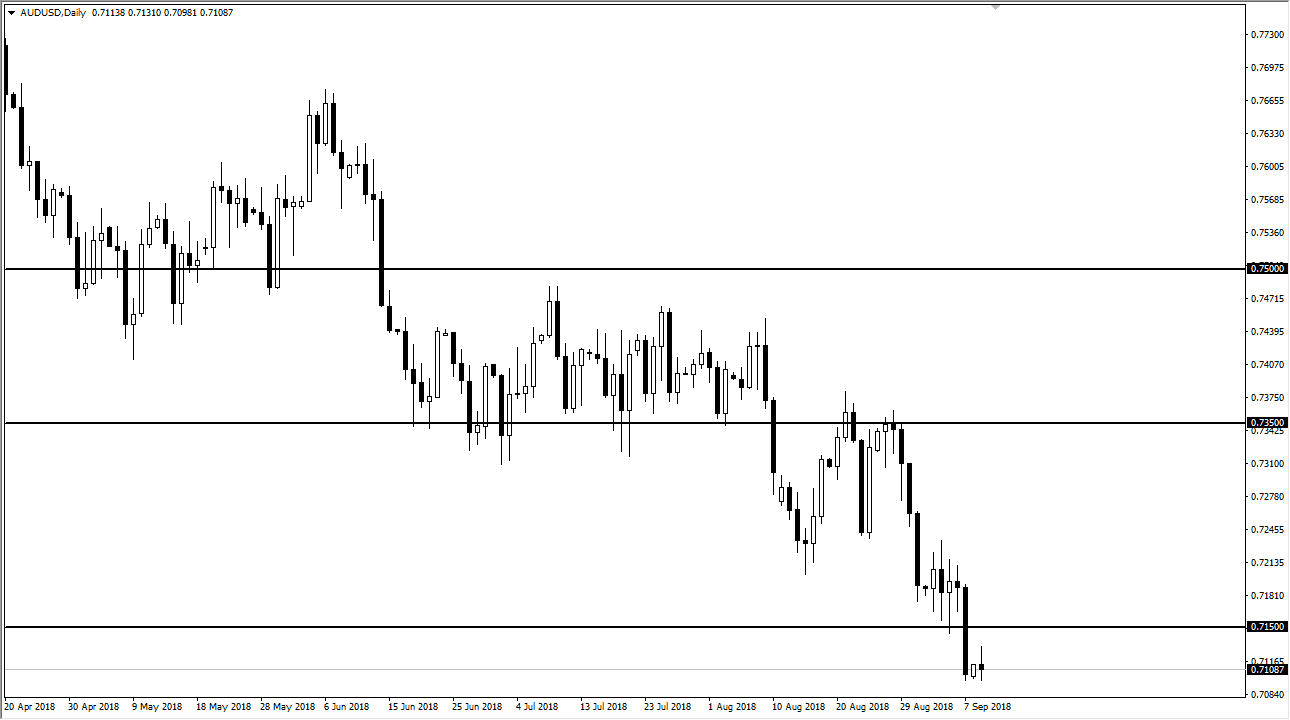

AUD/USD

The Australian dollar has gone back and forth during the trading session on Monday, showing signs of indecision. If we can break down below the bottom of the candle stick for the day on Monday, the marketplace will continue to go much lower, as it would clear the 0.71 handle and go looking towards the 0.70 level after that. That’s an area that has a lot of psychological importance based upon it, and of course has shown interest in the past from both sides of the market. Because of that, it makes a perfect target. Overall, I believe that this market will continue to break down based upon the deteriorating Sino-American relations. Australia is particularly sensitive to the Chinese economy, and all things China related as it is the main supplier of a lot of hard commodities to the mainland.