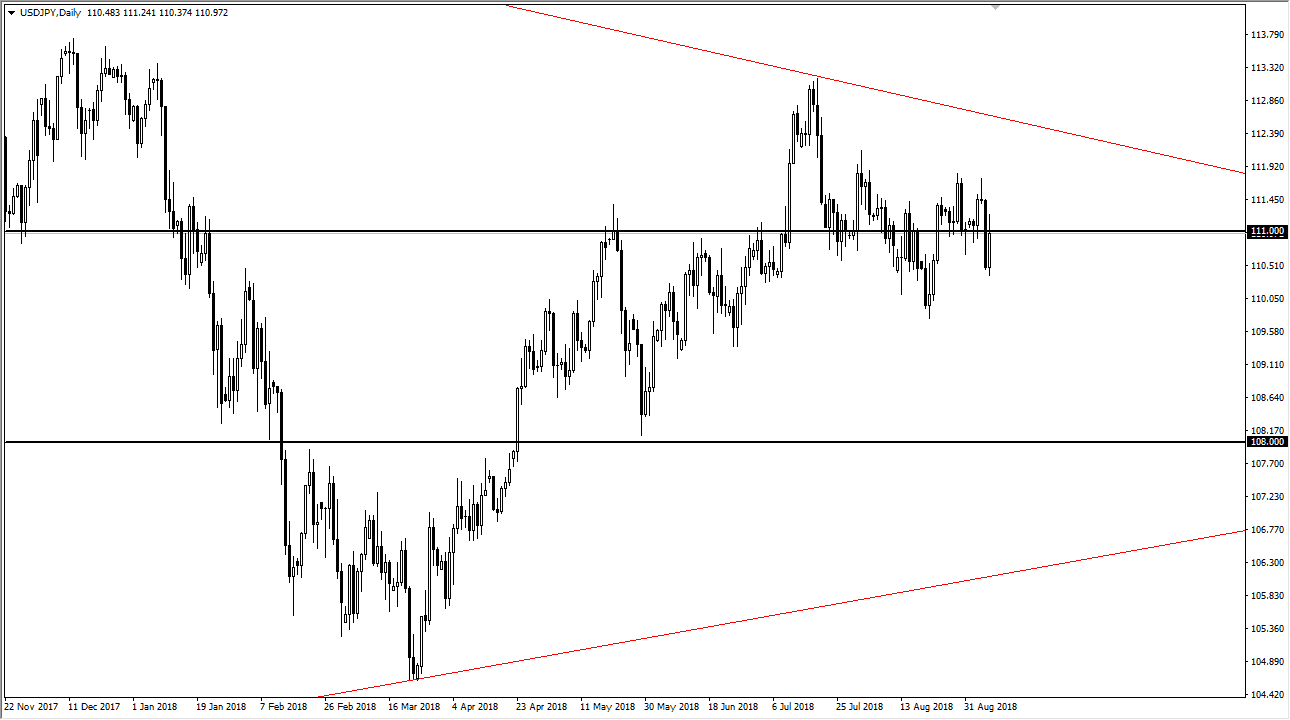

USD/JPY

The US dollar bounced a bit during the Friday session after the stronger than anticipated jobs number came out, with a lot of underlying bullishness in the report. Because of this, the market raced right back to the ¥111 level, an area that seems to be very comfortable with. We are forming a wedge within a larger symmetrical triangle, showing just how tight this market is. While we do have US dollar strength and for good reason, the trade war fears continue to have people buying the Japanese yen. In other words, this market doesn’t know what to do with itself and I think that will continue to be the way. Trade for 50 pips in either direction is about the best information that I think I’ve heard over the last couple of weeks. Expect a lot of choppiness.

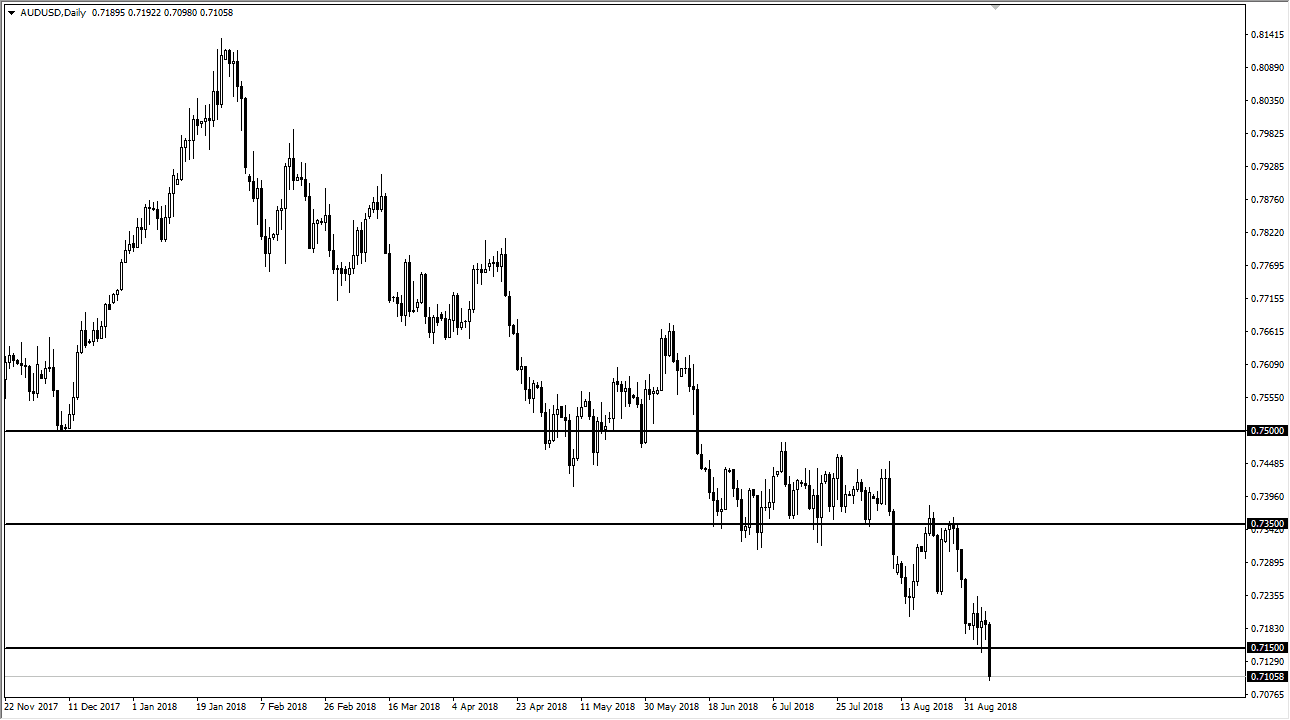

AUD/USD

The Australian dollar has broken down during the trading session on Friday, finally clearing the 0.7150 level. At this point, rallies are to be sold as the Australian dollar will most certainly go looking towards the 0.70 level now. This will only get worse as President Trump has announced that he’s ready to put even more tariffs on the Chinese, upping the stakes in the trade war. If that’s going to be the case, the Australian dollar will certainly be one of the first places that traders start to sell again. The US dollar is strengthening because of the bond market and emerging market currencies collapsing, so the bit of a “double whammy” for the Aussie dollar at this point. The Friday close was very bearish and leaves very little doubt as to which direction this pair goes.