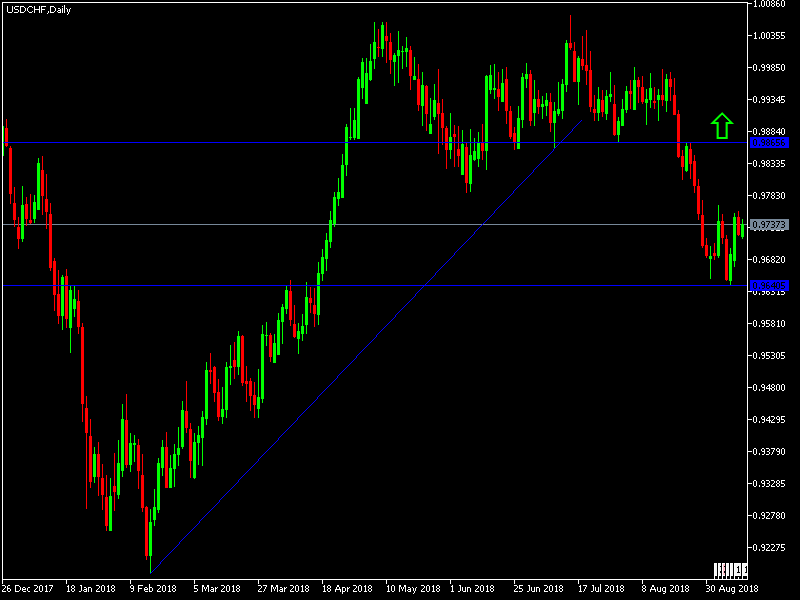

Today’s USD/CHF Signals

Risk 0.75%.

Trades may only be taken between 8am and 5pm London time today.

Short Trades

Short entry following a bearish price action reversal upon the next touch of 0.9777 or 0.9830.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CHF Analysis

This pair is in a bullish correction move from the support level of 0.9641, the pair's lowest level for five months, for the fourth day in a row, and it reached the level 0.9758. To confirm the bullish correction, this pair needs to move towards resistance levels 0.9842 and 0.9920. The volatility of the pair's movements is because both the US dollar and the Swiss franc are considered now safe havens, as the US-China trade war intensifies. But the US dollar is still stronger with strong expectations for the Federal Reserve to raise interest rates this month. If Trump's approval of the upcoming tariffs of 200 billion US dollars on Chinese products is confirmed, it will support the continued strength of the US dollar, and thus more gains for the pair.

There is nothing important due today concerning the CHF. Regarding the USD, there will be the release of PPI data and crude oil inventories.