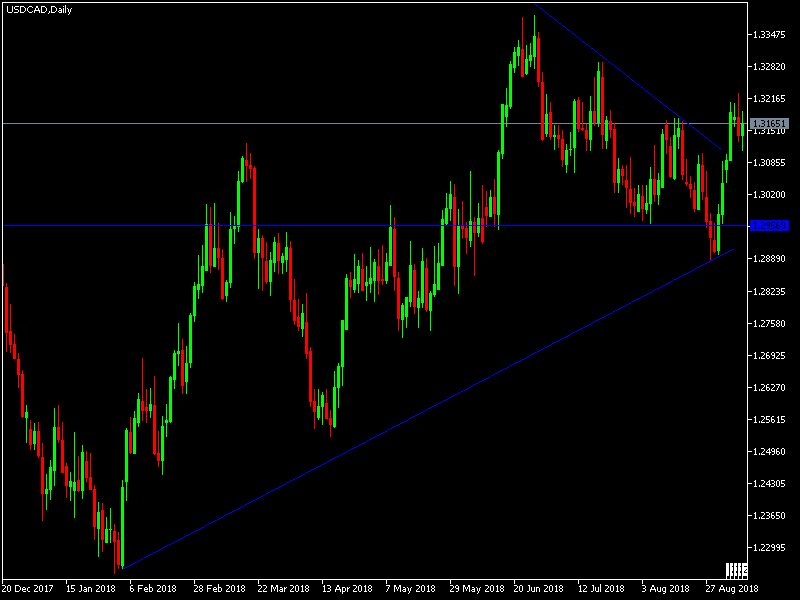

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today.

Short Trade

- Short entry after the next strongly bearish price action rejection following the next touch of 1.3230 or 1.3350.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trades

- Long entry after the next strongly bullish price action rejection following the next touch of 1.3070.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CAD Analysis

US Job data and ongoing US-Chinese trade war continue to give strong momentum to the US dollar and therefore the USD/CAD pair reversed trend to the upside after stabilizing above the 1.3000 resistance level, reaching 1.3226 level before closing last week trades at 1.3165. The strength of the correction is evident on the daily chart, and this trend will remain intact as long as the pair continue to move above 1.3000.

There is nothing important due today concerning the USD or CAD.