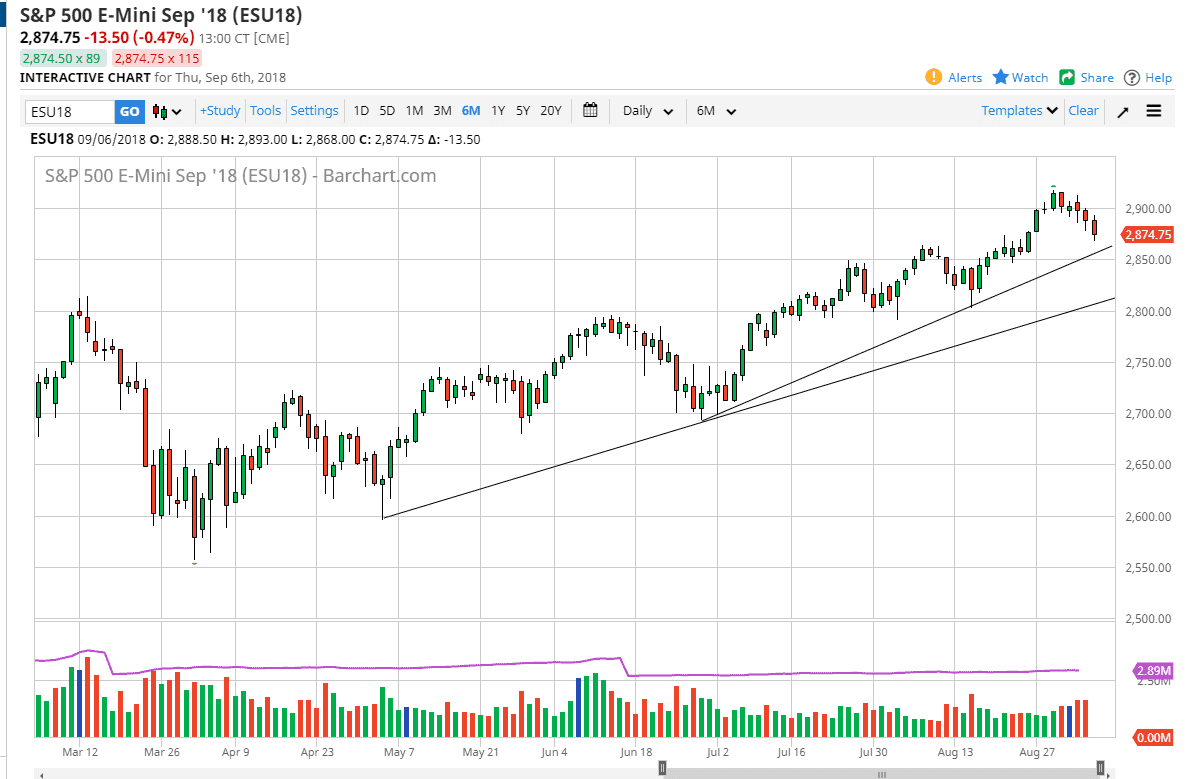

S&P 500

The S&P 500 fell during the trading session on Thursday, reaching down towards the 2875 level. This is a market that got spooked during the day but there are still plenty of support of areas underneath to keep this market afloat. If we can pull back towards one of these of trendlines, we could have an opportunity to go long. I think that with the jobs number coming out during the trading session, is very likely that we will see a lot of volatility. A lot of position squaring, and a lack of liquidity could be an issue. I would like to see the market pull back towards the uptrend lines, and then perhaps showing signs of support that I can buy. At this point, I think it’s likely that we could get some value in this market if we are patient enough. Until then, stand on the sidelines and wait for the trendlines to be tested.

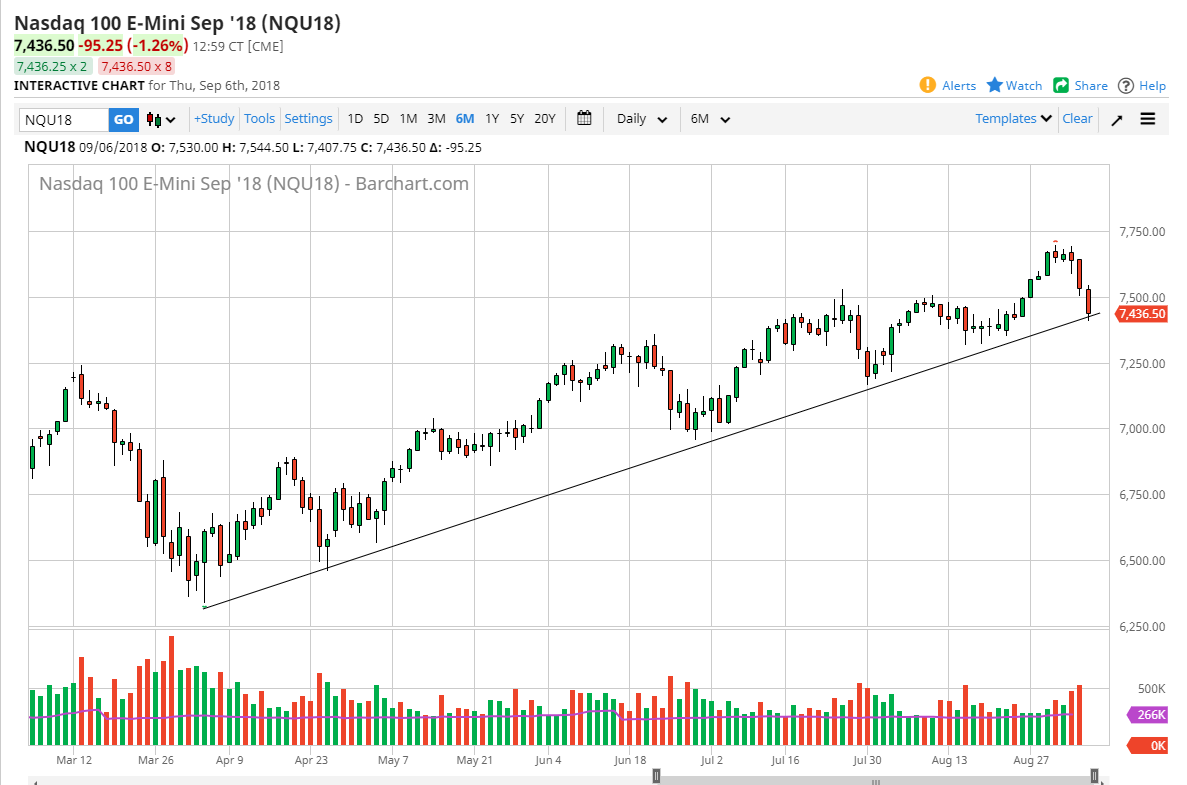

NASDAQ 100

The NASDAQ 100 broke down during the trading session, testing the uptrend line that has been drawn on the chart. At this point, if we can turn around and recapture the 7500 level, then I think the NASDAQ 100 could go higher. However, if we can break down below the 7300 level, that would be a serious trend line break, and could send this market much lower. Overall, that could lead to moves as low as 7250, followed by 7000 which would be even more supportive. With the tech stocks in America under serious pressure, it’s likely that the NASDAQ 100 will follow right along. Otherwise, if we turn around and break to the upside I think that we will go looking towards the highs again.