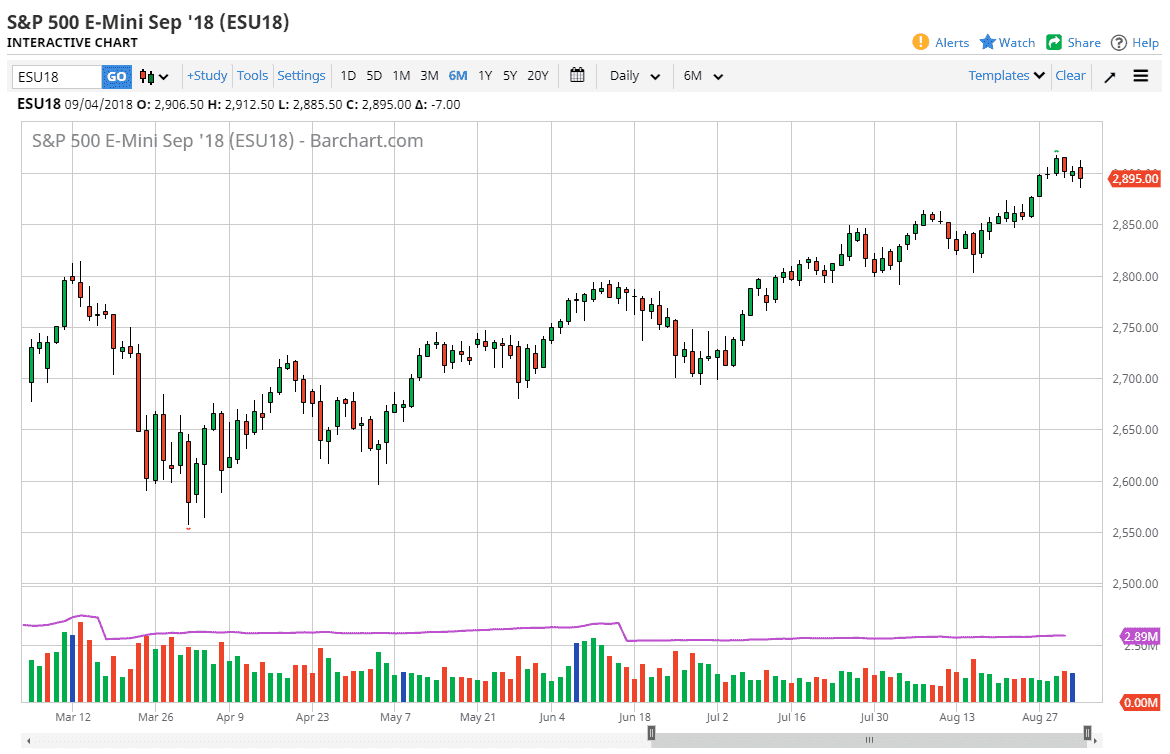

S&P 500

The S&P 500 has been a complete mess during trading on Tuesday, as we simply have no directionality overall. This is a market that continues to be very difficult to short, but quite frankly buying is in helping your situation either. I think we need to pull back, and as a result it’s probably best to avoid this market over the next couple of days. That being said, I think there is plenty of support down at the 2850 level, so keep that in mind. If we can break above that recent high, then I think we will have cleared the 2900 level and will start looking towards the 3000 level. My longer-term target is 3000, but I’m at the first to admit that the volatility is absolutely sickening at the moment, as nobody seems to really know where they want to go.

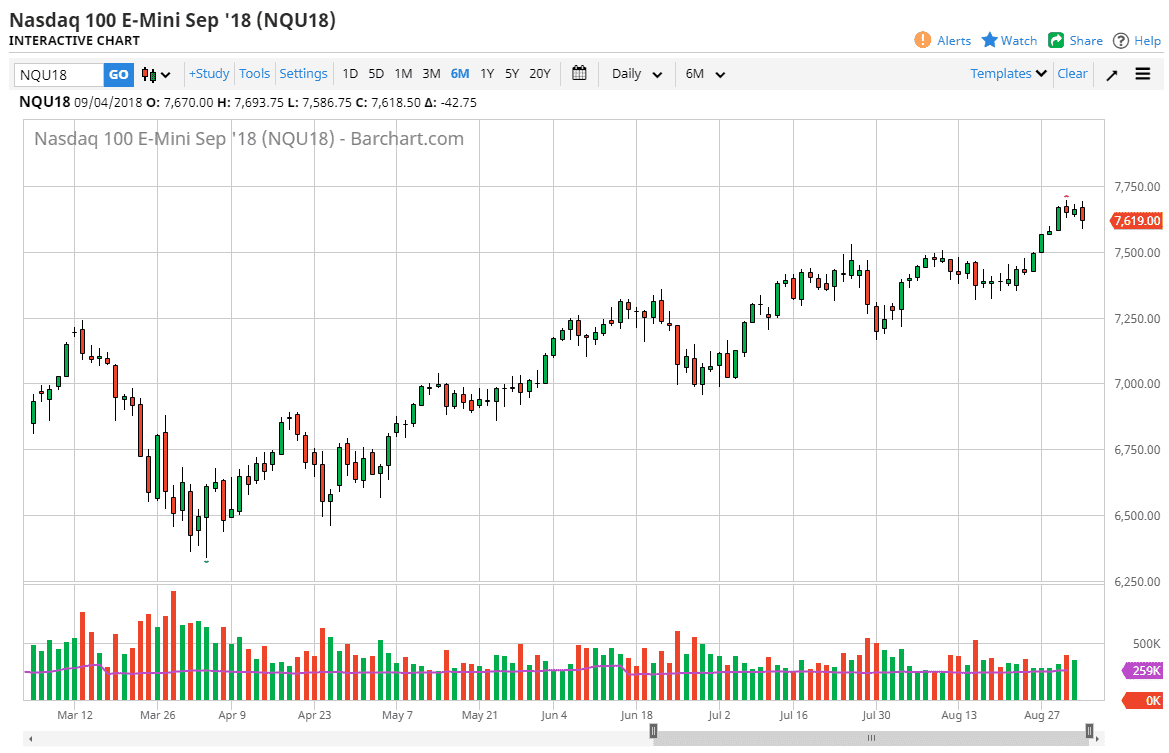

NASDAQ 100

The NASDAQ 100 continues to be noisy as well, pulling back significantly during the day, but rallying later. This ends up forming a bit of a hammer, but at the end of the day we are probably still in a “buy the dips” attitude, but certainly volatility is starting to come back into play. I think the 7500 level underneath would be an excellent buying area, if we can get down to it. Otherwise, a fresh, new high would be a buy signal as well. I think the NASDAQ 100 will continue to follow global risk appetite, which seems to change every 30 seconds. These are very difficult trading conditions, so by all means I would use a small position so as to mitigate any damage that you do by Ms. timing a trade. Overall, I am bullish but I recognize money management is crucial in these times.