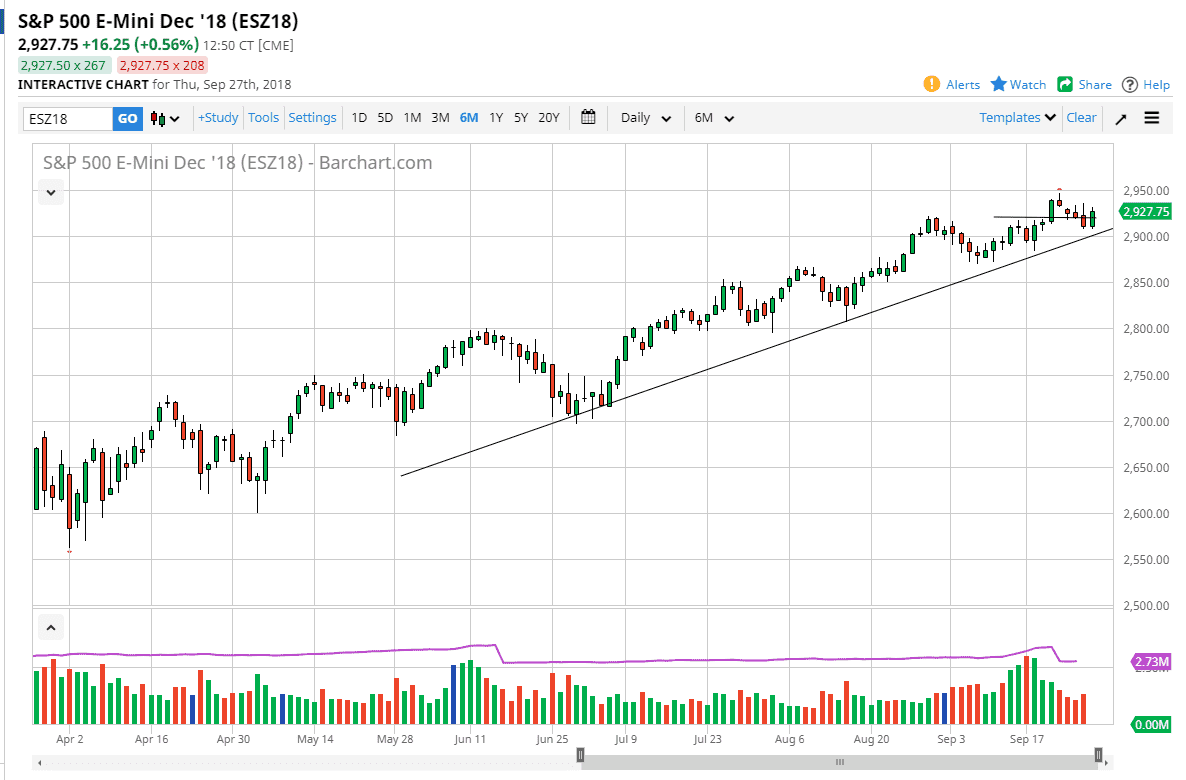

S&P 500

The S&P 500 rallied during trading on Thursday, wiping out the losses from the Wednesday session after the Federal Reserve released its statement. We continue to respect the uptrend line, and the 2900 level also offers plenty of support. Ultimately, I believe that this market does go much higher, and short-term pullbacks are looked at as value. It’s not until we close below the 2900 level on a daily chart that I would be concerned about this market, and therefore I am a buyer of value. Ultimately, this is a market that has been grinding higher for quite some time, and there’s no reason to think it’s going to change anytime soon. Ultimately, I think that the market could go as high as 3000, and many of the Wall Street pundits are out there saying the same thing. However, I recognize that there are the occasional hiccups that we need to deal with.

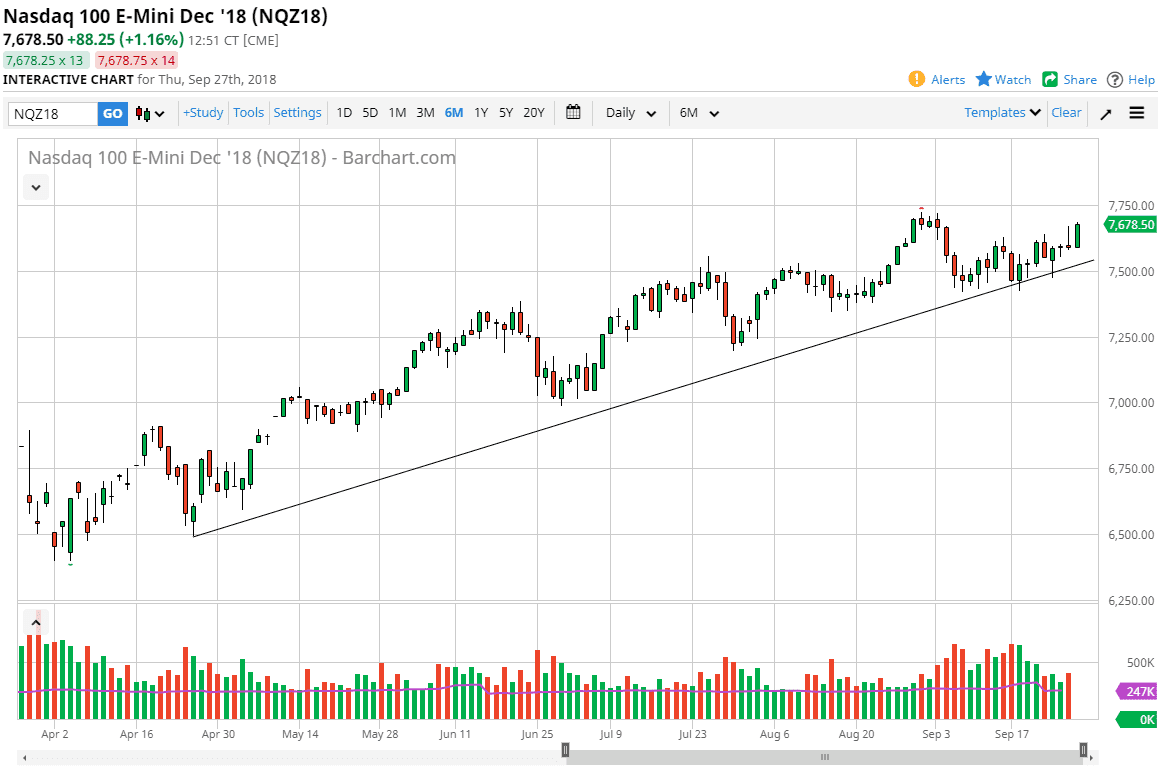

NASDAQ 100

The NASDAQ 100 has also rallied during the day, and even broke above the top of the shooting star from the previous session. That’s a very bullish sign, and I think it’s only a matter time before we break out to the upside and continue to go much higher. The 7750 level will obviously be resistance, and I think that if we can break above there the market probably heads to the 8000 handle of the longer-term. The nice uptrend line continues to keep this market higher, and as a result I think that pullbacks will be looked at with suspicion and they should be opportunities in the future. It’s not until we break down below the 7400 level that I would be concerned with the NASDAQ 100.