Today’s NZD/USD Signals

Risk 0.50%.

Trades may only be entered from 8am New York time until 5pm Tokyo time, over the next 24-hour period.

Short Trades

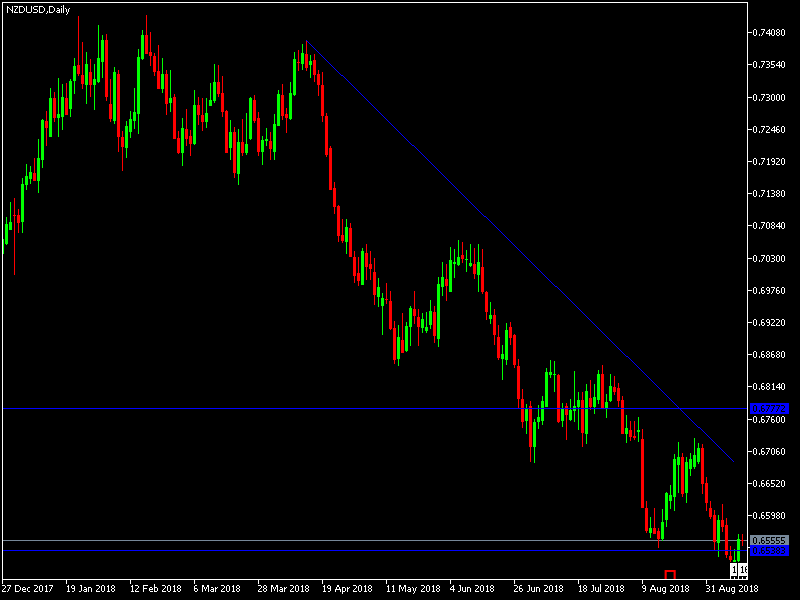

Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.6565 or 0.6610.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trades

Long entry following bullish price action on the H1 time frame immediately upon the next touch of 0.6490 or 0.6400.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

NZD/USD Analysis

Correction attempts for the pair remain weak and the general trend is still bearish. The price couldn’t break the 0.6565 level, and selling extended the support level at 0.6500, the lowest since January 2016. The New Zealand dollar is a risk currency while markets seek now more safety in safe haven currencies like the US, especially since the outbreak of the US-China trade war.

There is nothing important due today concerning the NZD. Regarding the USD, here will be the release of consumer price index and jobless claims data.