Gold prices ended Monday’s session up $7.11 an ounce, helped by a weaker dollar, but the precious metal turned negative early on Tuesday after U.S. President Donald Trump announced a new round of tariffs on about $200 billion worth of Chinese imports. Trump also warned that the administration will pursue more tariffs if China takes retaliatory action against U.S. farmers and industries.

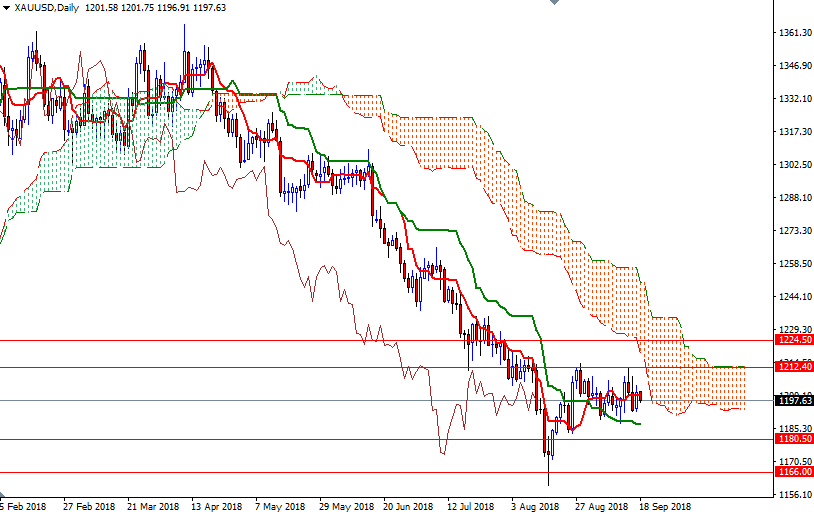

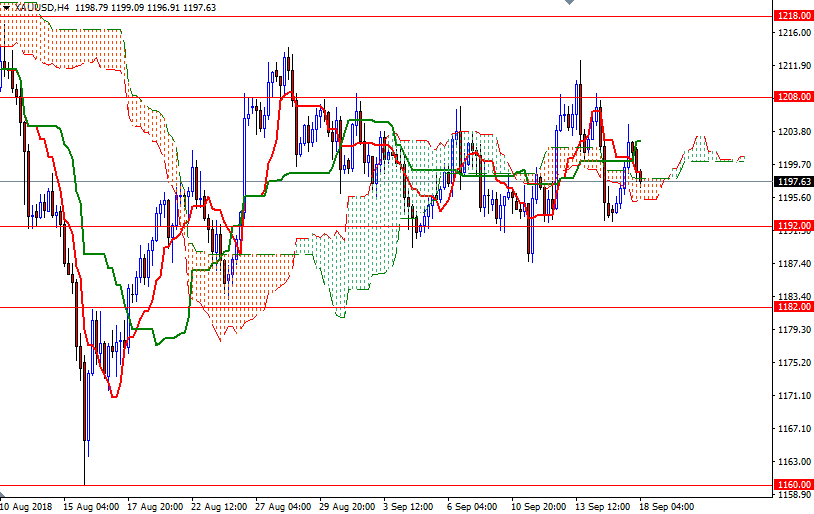

XAU/USD pulled back to the Ichimoku cloud on the H4 chart after prices failed to breach the resistance in the 1204/3 area. The market is trading below the weekly and the daily Ichimoku clouds, suggesting that the bears have the overall technical advantage. However, prices have been trading sideways for nearly three weeks.

The bottom of the 4-hourly cloud currently sits at 1195 so a break below there is essential for a test of 1192/0. The bears have to push prices below 1190 to put more pressure and revisit 1188/7, where the daily the Kijun-sen (twenty six-period moving average, green line) resides. If this support is broken, I think XAU/USD will return to 1182-1180.50. The bulls, on the other hand, have to pass through the 1204/3 area to tackle the next barrier at 1208, the 23.6% retracement of the bearish run from 1365.10 to 1160.05. If the bulls capture this strategic camp, they will be targeting 1214-1212.40 next. A successful break above 1214 would open the door for a move to 1218.