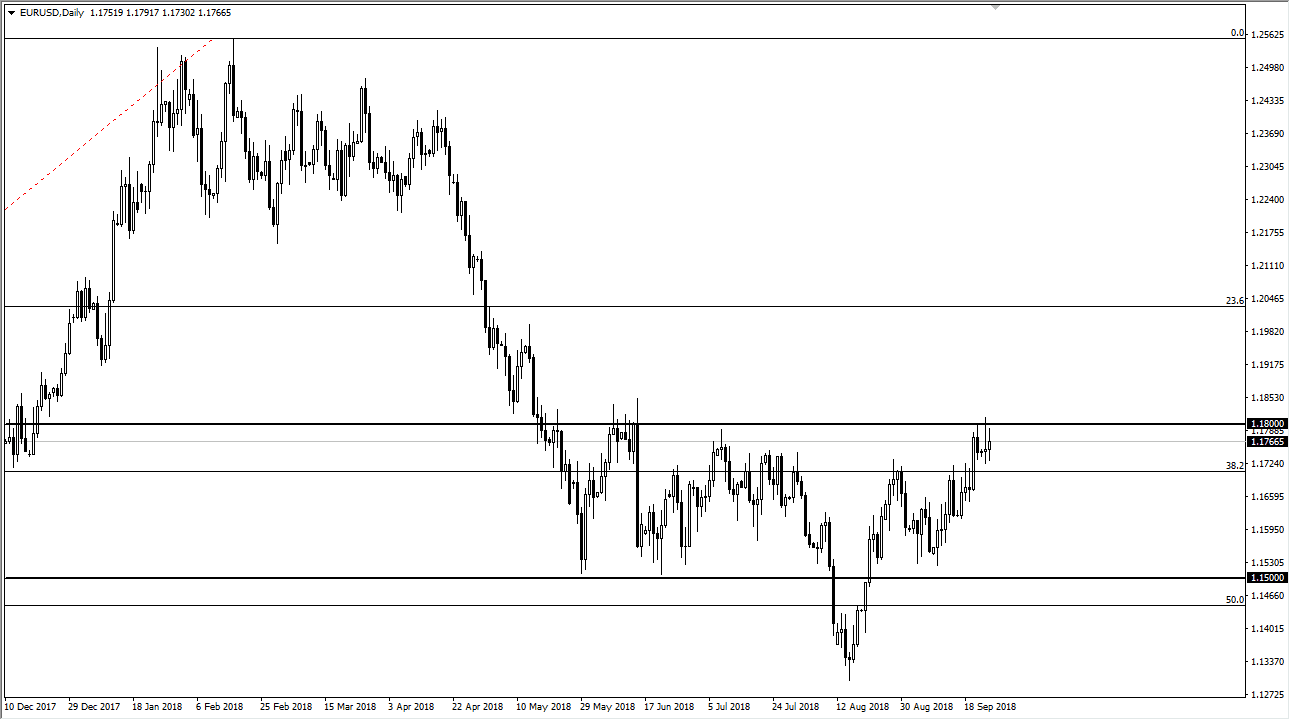

EUR/USD

The Euro rallied again during the day on Wednesday but found enough resistance just below the 1.18 level to show just how difficult this place is going to be to break above. If we do, that should send this market looking towards 1.20 level rather quickly, and I think at this point we been waiting on the FOMC Statemen to make our next move. I think that ultimately it’s going to be very choppy, because I see a lot of support below at the 1.1725 handle. It won’t be until after the statement that we make a decision in my estimation, so I would either be short below the 1.1725 level on a daily close, or long of this market above the 1.18 level on a daily close. Anything between here and there is going to be simple noise.

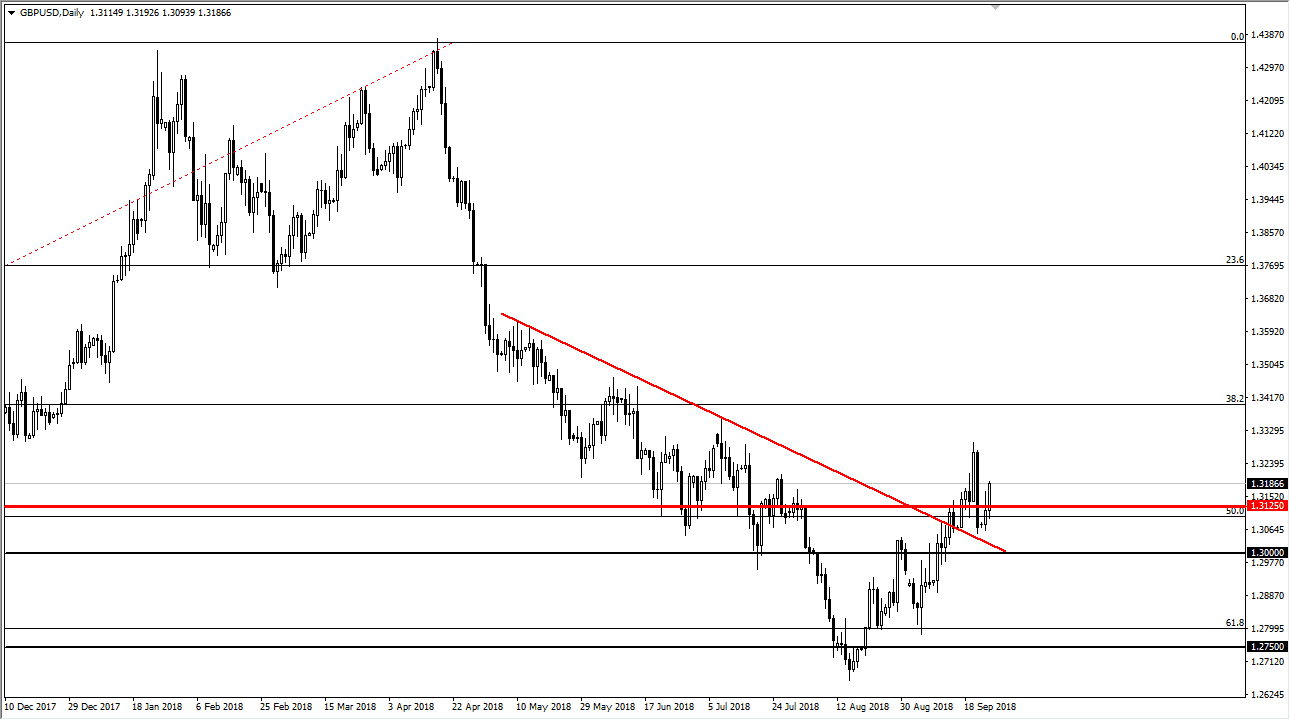

GBP/USD

The British pound initially fell during the day but found enough support underneath the turn around and rally again. We have wiped out the losses that we incurred from the highs of Monday, and now it looks like we are ready to go much higher. However, I’m not foolish enough to think that it’s going to be easy, as most trend changes aren’t. I am a buyer of dips in the British pound, but I also recognize that the FOMC Statement will have the ability to add a lot of volatility in this market. Nonetheless, I do think that unless something drastic happens, this pair should continue to be a “by on the dips” opportunity just waiting to happen. In fact, it’s not until we break below the 1.30 level that I would consider shorting. I recognize the 1.33 level above as the initial target.