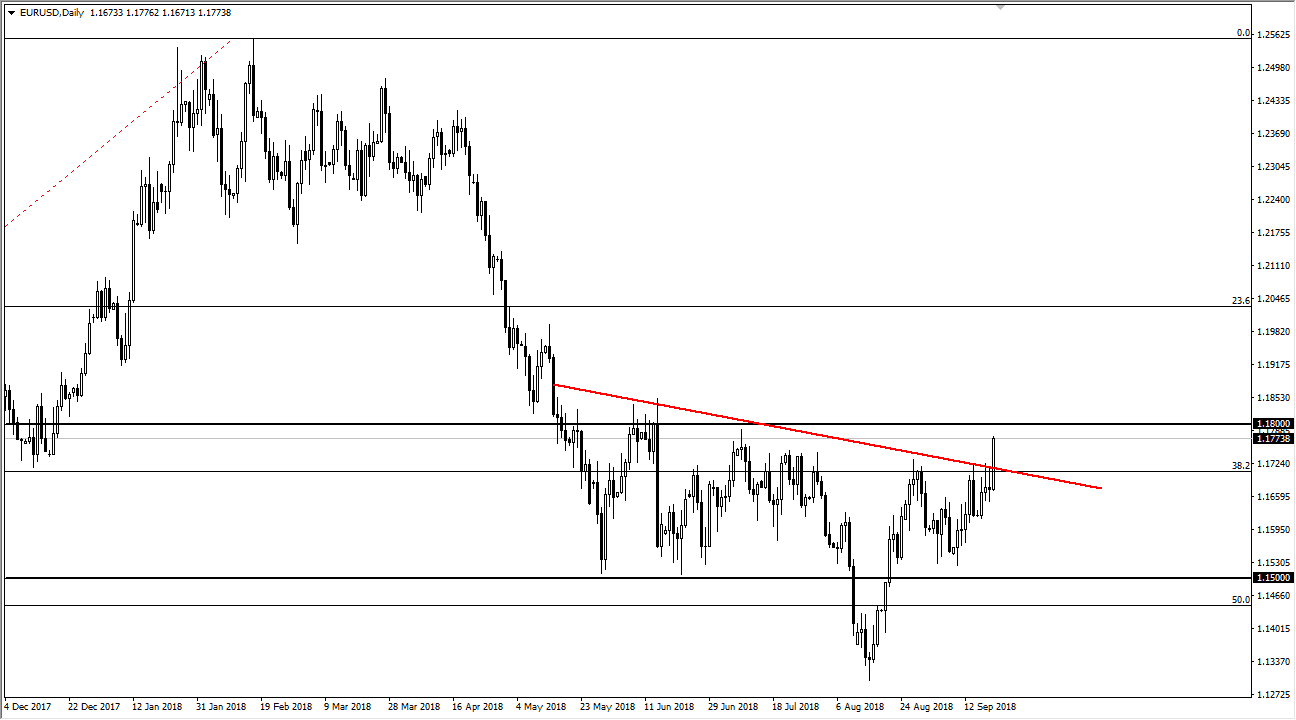

EUR/USD

The Euro has exploded to the upside during the day on Thursday, clearing the neck line that I had talked about in the complex inverse head and shoulders. Either way, it looks as if we are going to go looking towards the 1.18 level initially, which was major resistance. If we can clear that level, I think we will continue to go higher, perhaps reaching towards the 1.20 level after that. Short-term pullbacks will be buying opportunities, especially near the 1.1725 level below, which of course is previous resistance. Overall, this pair looks as if it is changing its attitude to the upside again. If we did break down below the massive candle for the trading session on Thursday, that would be a horrific sign for the Euro.

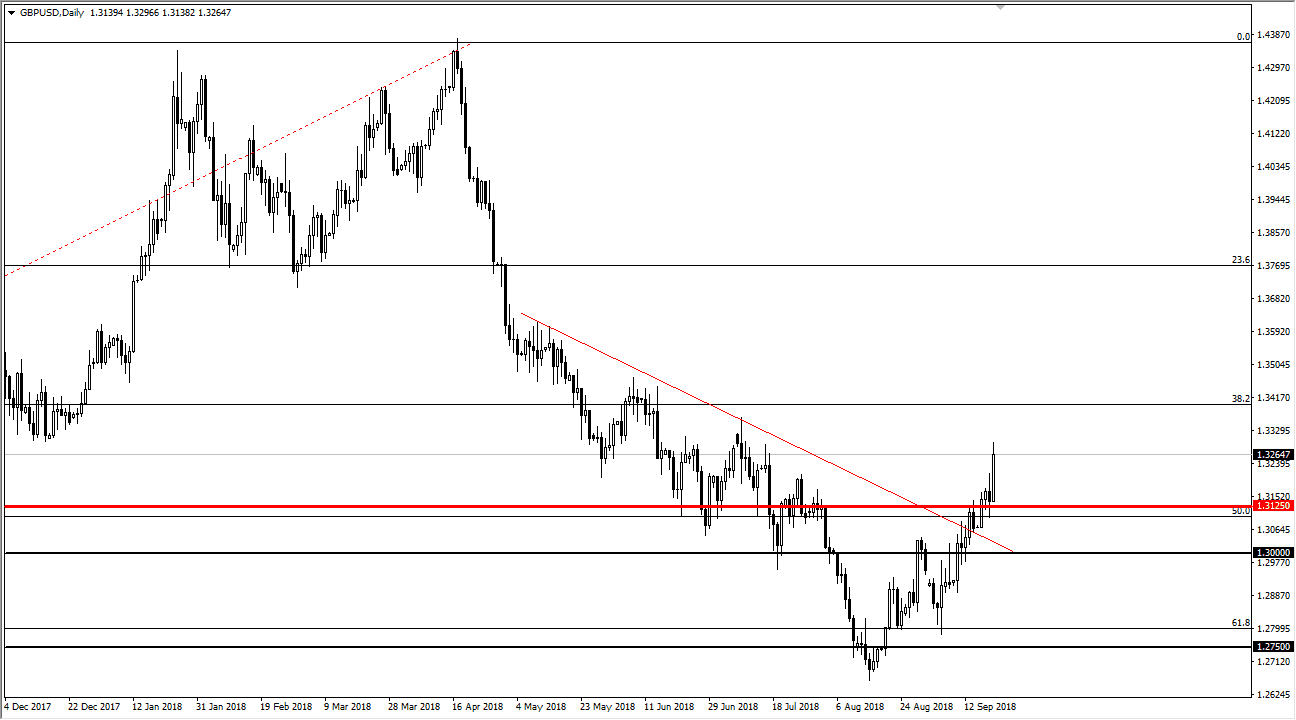

GBP/USD

The British pound broke higher during the trading session on Thursday as well, as US dollar got hammered. The 1.3125 level had previously been resistance, and it now shows signs of support. The support of course should hold any pullback as it will offer value from what I see. I think that the market has changed its trend completely, and now that this is a “by on the dips” type of situation. The British pound will get an extra boost as soon as we get some type of clarity when it comes to the Brexit, as the market is continuing to price in the inevitable resolution, even if it is no solution at all. I’m buying the dips, and I think we are going to go much, much higher over the longer-term. I have no interest in selling until we would break down below the 1.30 level, which looks very unlikely at this point.