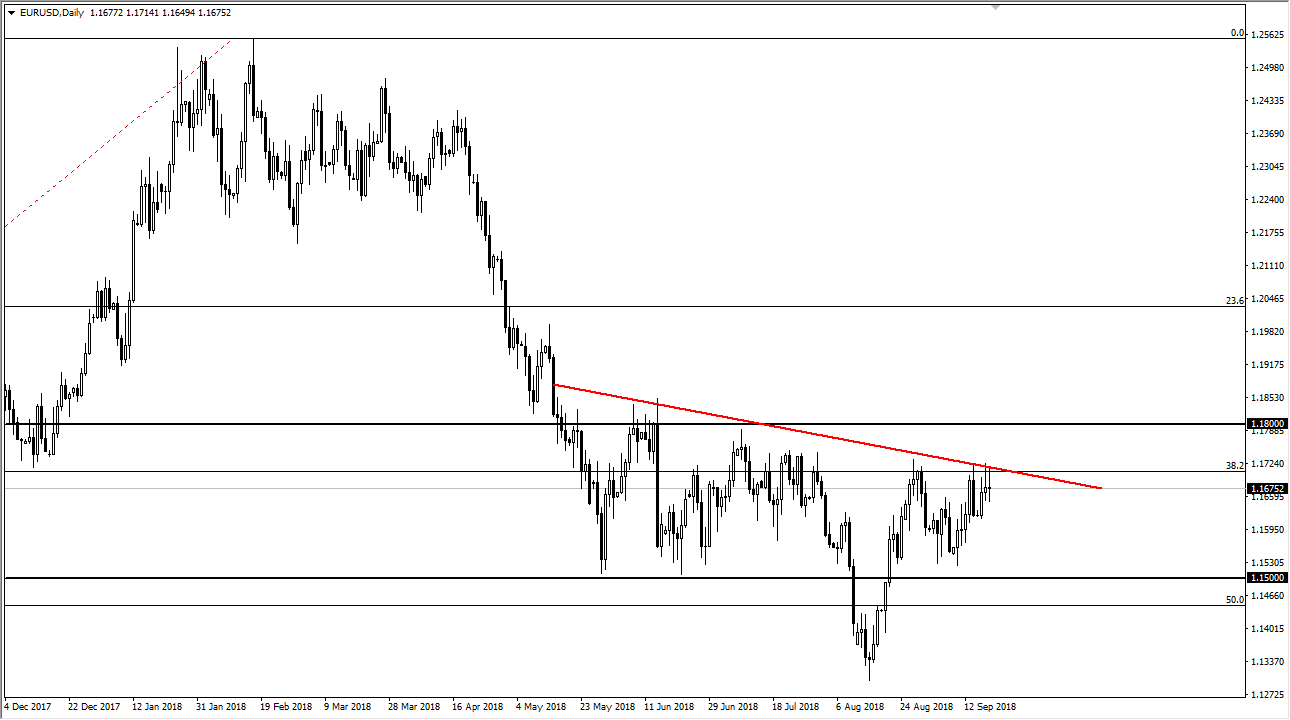

EUR/USD

The Euro rallied a bit during the trading session on Wednesday but continues to find trouble at the downtrend line I have marked on the chart. Because of this, we could make an argument for a bit of a complex inverted head and shoulders, but quite frankly I think the theme here is going to be consolidation anyway. There are a lot of moving pieces out there, and of course a lot of uncertainty when it comes to the Brexit, which of course plays out in the Euro as uncertainty is never a good thing for financial markets. If we break down below the daily candle for both Tuesday and Wednesday, that’s a negative sign and I think we will go looking towards the 1.16 level initially, possibly even the 1.15 handle. Otherwise, if we break to the upside I think that there is a shot at 1.18 and breaking there could open the door to 1.20.

GBP/USD

The British pound went back and forth during the trading session on Wednesday but mainly based on twitter news and other nonsense like that. Because of this, lot of the weak players will have certainly gotten shaken out. However, the buyers have come back to push the market back above the 1.3125 handle. Because of this, I think that it’s only a matter time before these markets continue to try to grind to the upside as we have broken above major resistance barriers. This big neutral candle for the Wednesday session does set up a nice binary trade though, because we can break above the top of the candle stick, that’s a very bullish sign and should send this market towards the 1.35 handle over the longer-term. If we get any good news about the Brexit or all, this pair continues to rally significantly. One thing that I would point out: the bad headlines that come out are having less and less of an effect on this market.