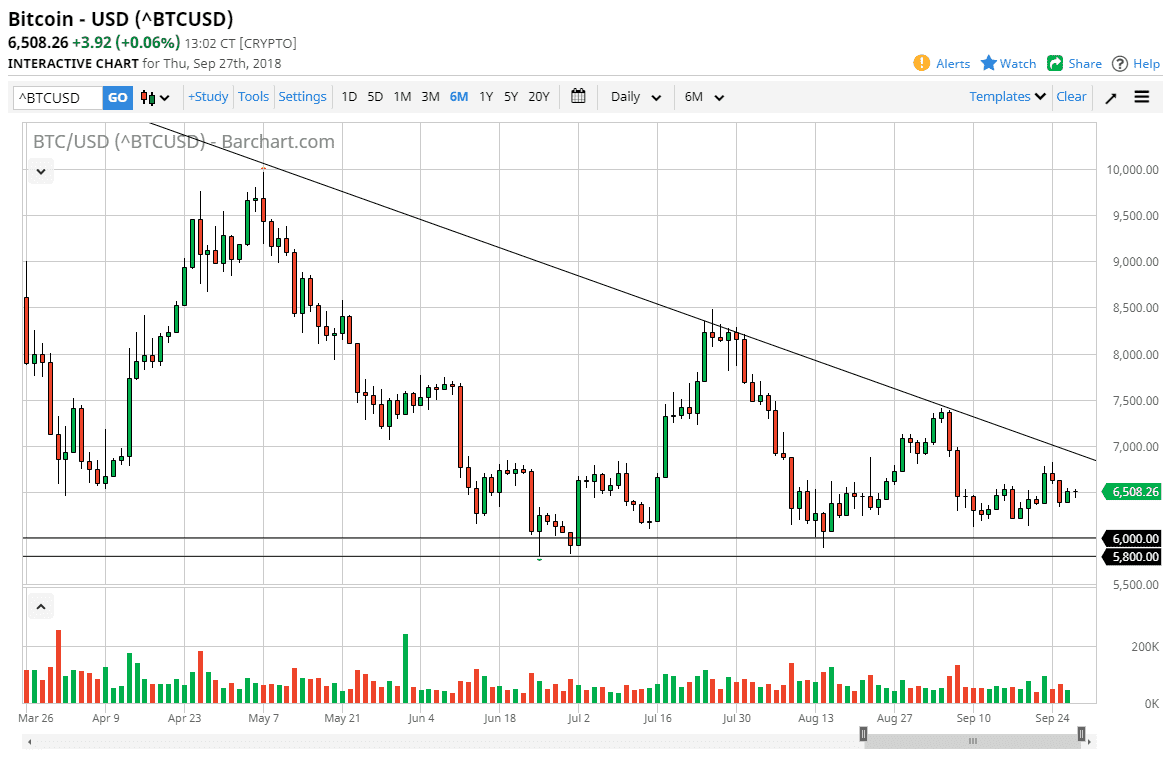

Bitcoin markets did very little during the day on Thursday, dancing around the $6500 level. The analysis has been the same for the entirety of 2018, every time we get closer that downtrend line sellers come back in. Having said that, if the analysis changes it will be the first time since late January. I think that the downtrend line being broken to the upside would signify a move towards the $7500 level, and then possibly the $8250 level.

The technical analysis for this pair remains bearish, but the area between $5800 and $6000 has offered a massive amount of support. It’s likely that if we break down below here, the market will unwind quite drastically. That being the case, I would expect that the bitcoin value to drop down to &5000 almost immediately. That certainly is what the descending triangle would suggest, but that hasn’t been confirmed quite yet. I think at this point, if we rally from here it’s likely to see more selling pressure above, but that trend line is such an obvious place on the chart that I think that if we get the close above there on the daily chart it will bring in a lot of fresh money.

The third scenario is one that very few people were talking about. It’s the market is simply drifting through the apex of the triangle, which negates the entire pattern. I suspect that that point we would go into some type of large consolidation, the could extend years. I do recognize that although crypto caught a lot of headlines last year, the reality is that adoption is still far from being mainstream. I think that will continue to be the biggest problem that bitcoin faces overall.