BTC/USD

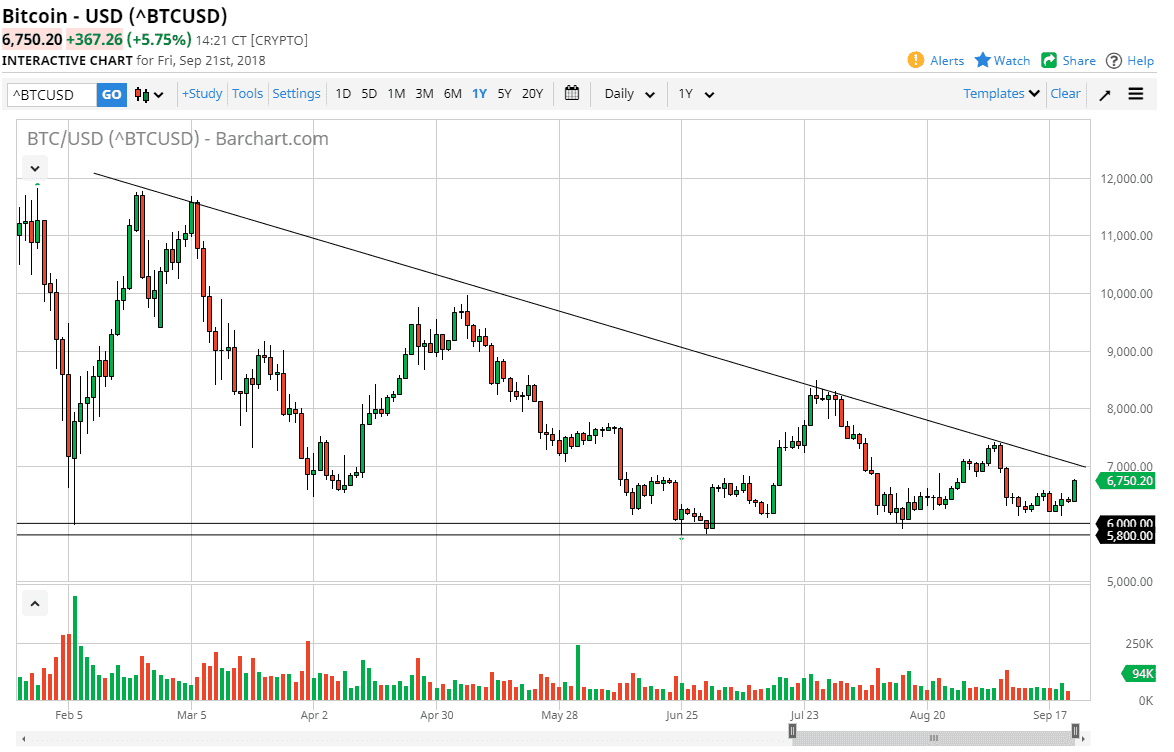

Bitcoin markets rallied over 5% during the day on Friday, in a sign of significant strength. Cryptocurrency gained as precious metals got pummeled, but at the end of the day we are still well below the major downtrend line. The market continues to be in a downtrend, regardless of the strength that we have seen during the day. At this point, it’s likely that we will continue to see a lot of volatility but given enough time it’s likely that the downtrend line will offer a lot of resistance. This is very interesting to me right now, because we are looking at an area in the form 7000 that could be where we start selling off. Ultimately, this is a market that breaking above the downtrend line would be a good sign for the buyers finely. However, so far we’ve only seen “lower highs”, which is classic bearish pressure.

The bullish case can be made that the $6000 level has yet to be broken to the downside, but right now that’s about it. If we do break above the downtrend line, the market will then go to the $7500 level, and then possibly the $8250 level. Overall, the markets look very volatile to say the least, but as we roll into the weekend it’s likely that the lack of volume will possibly work against the buyers. We will have to see how things shake out on Monday, because I believe Monday will be a very important day. On a daily close above that downtrend line, it will be the first time we broke above that downtrend line since January. However, if we do not break above there then I believe the market will simply roll over yet again and try to break down below the $6000 level.