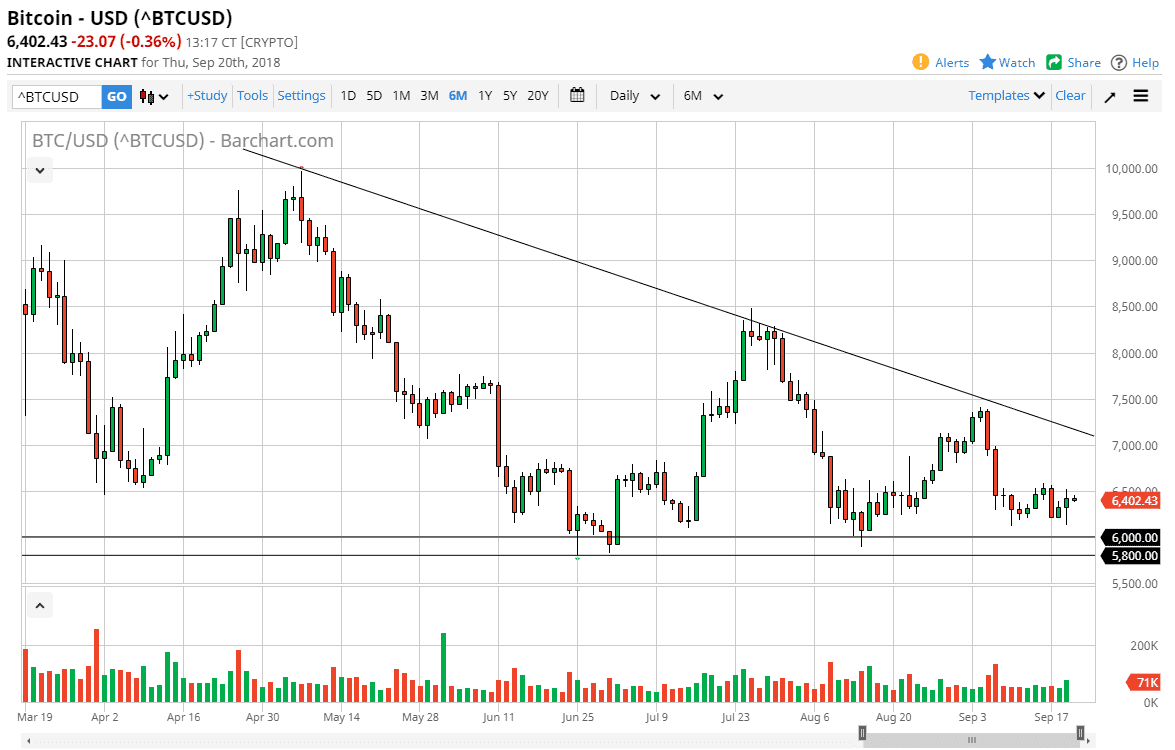

Bitcoin did very little during the day on Thursday again, as we continue to grind sideways in a very tight range. I think that the market will continue to sell off rallies at this point, because quite frankly we just don’t have enough interest in the market as the market continues to shrug off news, be it good or bad. This is a market that just has no reason to move in one direction or the other. It’s almost as if we are in a major “holding pattern”, but the technical outlook really isn’t that good right now. I do see a massive amount of support underneath, and that is the one thing that probably holds out hope, because quite frankly we have not been able to break down below the $5800 level, no matter how bearish the market is overall. Looking at the chart though, you can see that there is a significant downtrend line above that should continue to put bearish pressure on this market. It’s not until we break above there that buyers can get involved.

Any rally between now and then that show signs of exhaustion should give us an opportunity to start shorting yet again. If we were to turn around and break down below the $5800 level, I think that the market should then goes down to the $5000 handle. The alternate scenario of course is that if we break above the downtrend line, I think that the market will then go to the $7500 level, and then possibly the $8250 level after that. After that, we would be looking at the $10,000 level. I believe that there’s no reason to be buying bitcoin at this point. However, if we do slice through the downtrend line, things could change.