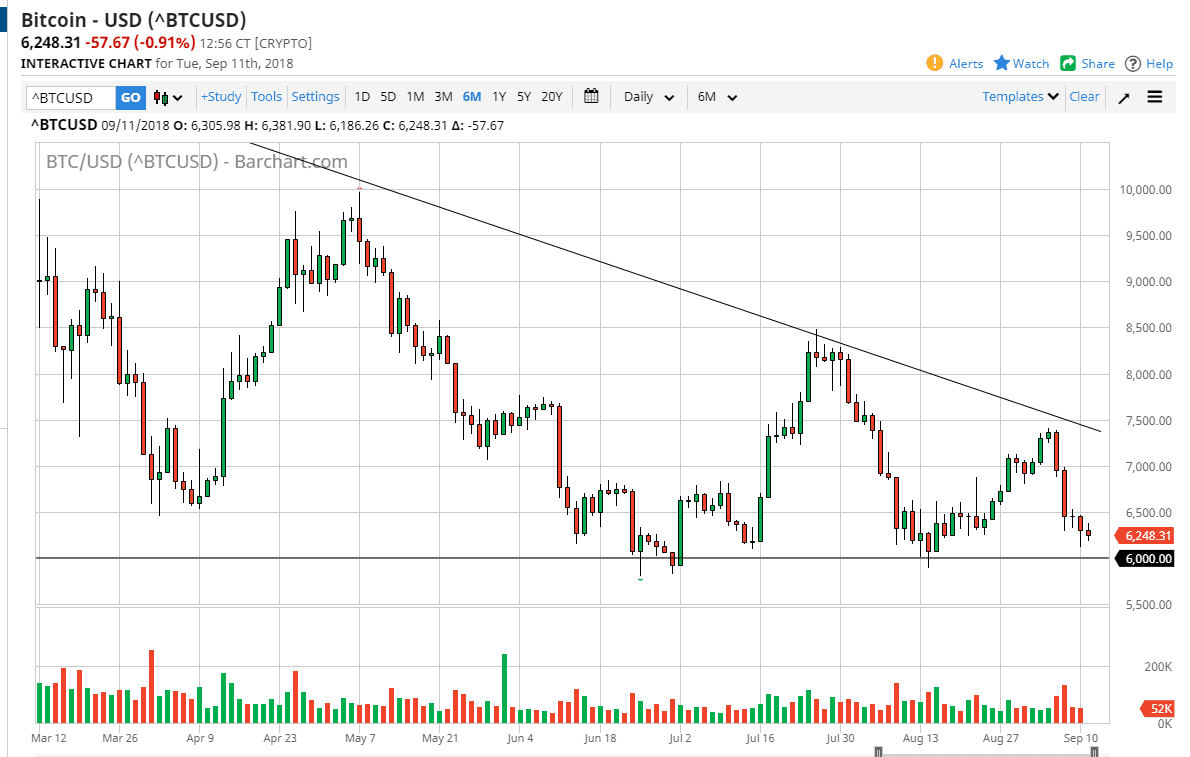

Bitcoin continues to fall as Tuesday was also negative. However, the $6000 level underneath continues to loom large. The $6000 level should be an area that the market will pay attention to going forward, and the candle stick from the Monday session did show that there seem to be buyers underneath. However, by the time the session rolled over to start the Tuesday trading, sellers came back in. I think at the moment; a lot of people are cautious around the $6000 handle as it has been so reliable. I anticipate that eventually we will need to make a decision, and once we do we should get a rather significant move. If we can break down below the $6000 handle I think that the market will then go looking towards the $5000 level. Overall, I do think that the sellers are very much in control this market as there is a significant downtrend line that has been respected multiple times over the last year.

With the US dollar showing signs of resiliency, that also doesn’t help bitcoin either, and therefore I think it’s going to continue to struggle to hang onto gains at this point. In the short term, it would not surprise me to see a small bounce, but I think the sellers will come back in near the $7000 handle again. Ultimately, this is a “sell on the rallies” type of situation, which has been most of what we’ve seen this year.

With that being the case, it’s likely that we will continue to see a lot of volatility but with a negative slant. If we did break above the downtrend line, then we will go hunting the area between $8000 and $8250 above. A break above that level should send this market looking for $10,000 after that.