Today’s AUD/USD Signals

Risk 0.50%.

Trades may only be taken from 8am New York time until 5pm Tokyo time, during the next 24-hour period.

Long Trades

Go long following some bullish price action on the H1 time frame immediately upon the next touch of 0.7060 or 0.7110.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short following some bearish price action on the H1 time frame immediately upon the next touch of 0.7245.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

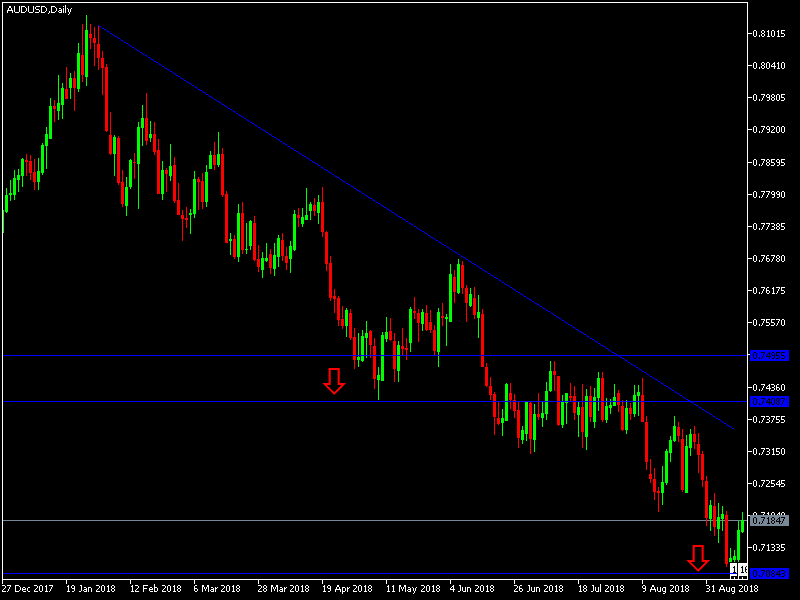

AUD/USD Analysis

The setback in US Dollar gains gave this pair an opportunity to correct to the upside reaching the 0.7199 level. Recent sell-off pushed the pair to move downward towards the 0.7084 support level, the lowest since December 2016. Trump's threat to impose $200 billion in new tariffs on Chinese products threatens any future attempts for the Australian dollar's attempts to correct to the upside. The US dollar will remain the primary beneficiary if Trump formally approves those tariffs. Therefore, I prefer to sell the pair at retracements.

Regarding the AUD, there will be the release of Australian unemployment rate and the change in the number of new jobs. Regarding the USD, there will be the release of consumer price index and jobless claims data.