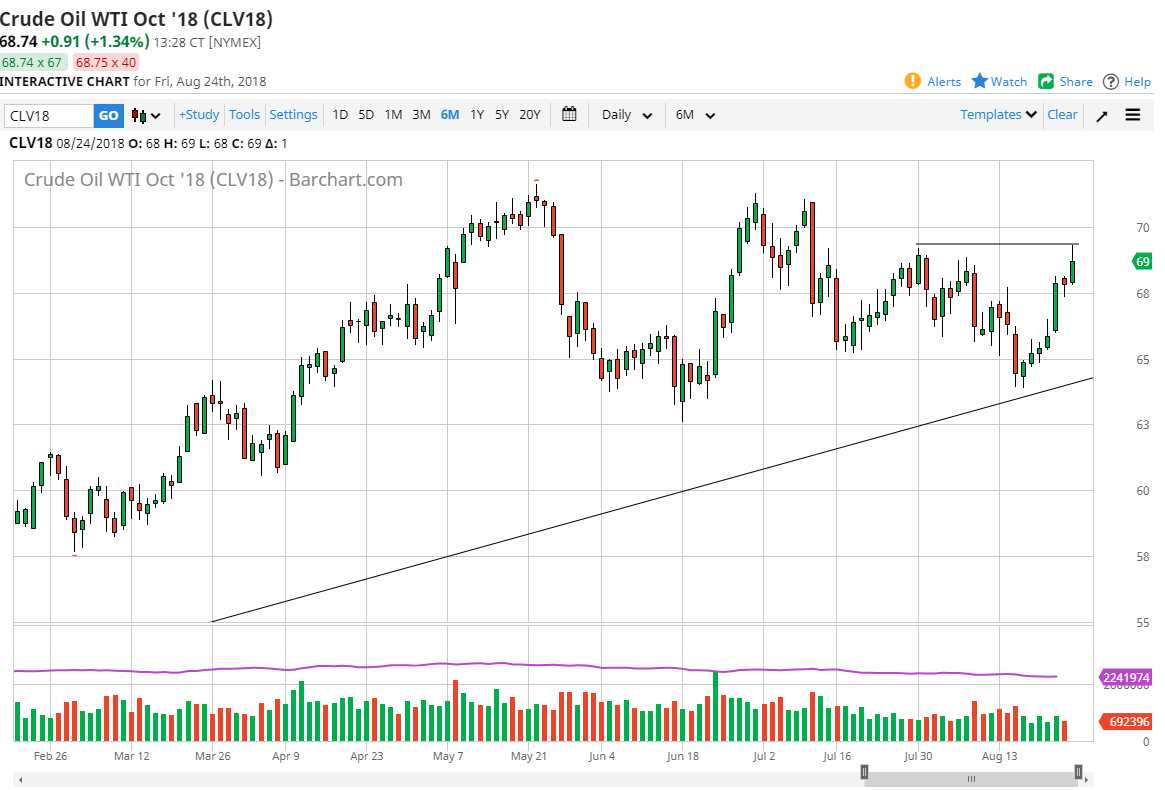

WTI Crude Oil

The WTI Crude Oil market had a strong session on Friday, reaching towards the $69.50 level before pulling back a bit. I think one of the main reasons we did pull back is that it was Friday, and people were probably willing to take profit. At this point, it’s obvious that the uptrend line has held from the weekly timeframe, and now I think that pullbacks are to be bought. 68 should be rather supportive, based upon the hammer that form there for Thursday. We will have to wait and see what happens, but I think that might be a nice entry point. Beyond that, if we break above the highs from the Friday session I think that sends this market looking towards the $70 level, and then an even more important level, the $71 level which has seen a lot of selling.

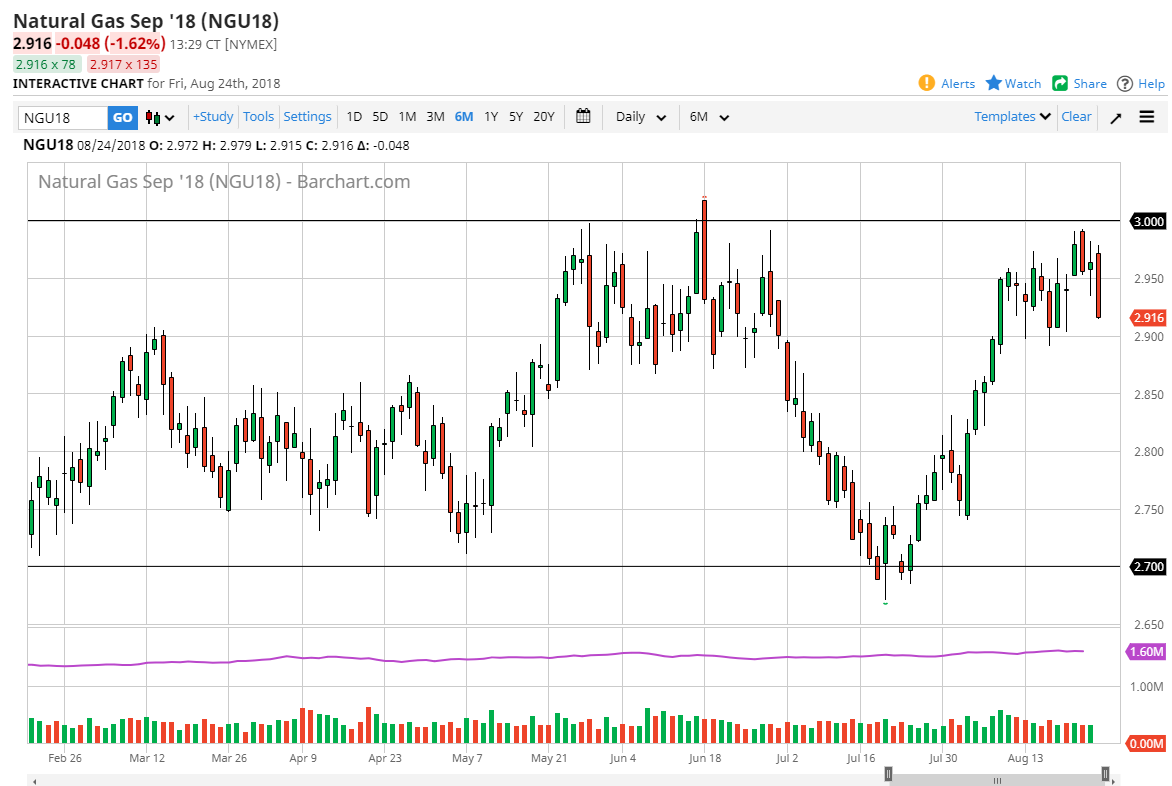

Natural Gas

Natural gas markets have consolidated for what seems like half my life. We continue to bounce around between $2.70 on the bottom and $3.00 on the top. Currently, we find ourselves just above the $2.90 level, and sold off rather viciously on Friday as traders do not wish to hold this contract through the weekend. Beyond that, we are at the top of a very obvious range so I think that at this point in going long is playing a dangerous game. On short-term rallies though, I am more than willing to continue selling this market, especially as we get close to the $3.00 level. That area is probably one of the most obvious support or resistance areas on any of the markets I follow, and this has been a very good trade. The alternate scenario is that we break down below the $2.90 level, which I think would send the market back down towards the $2.70 level.