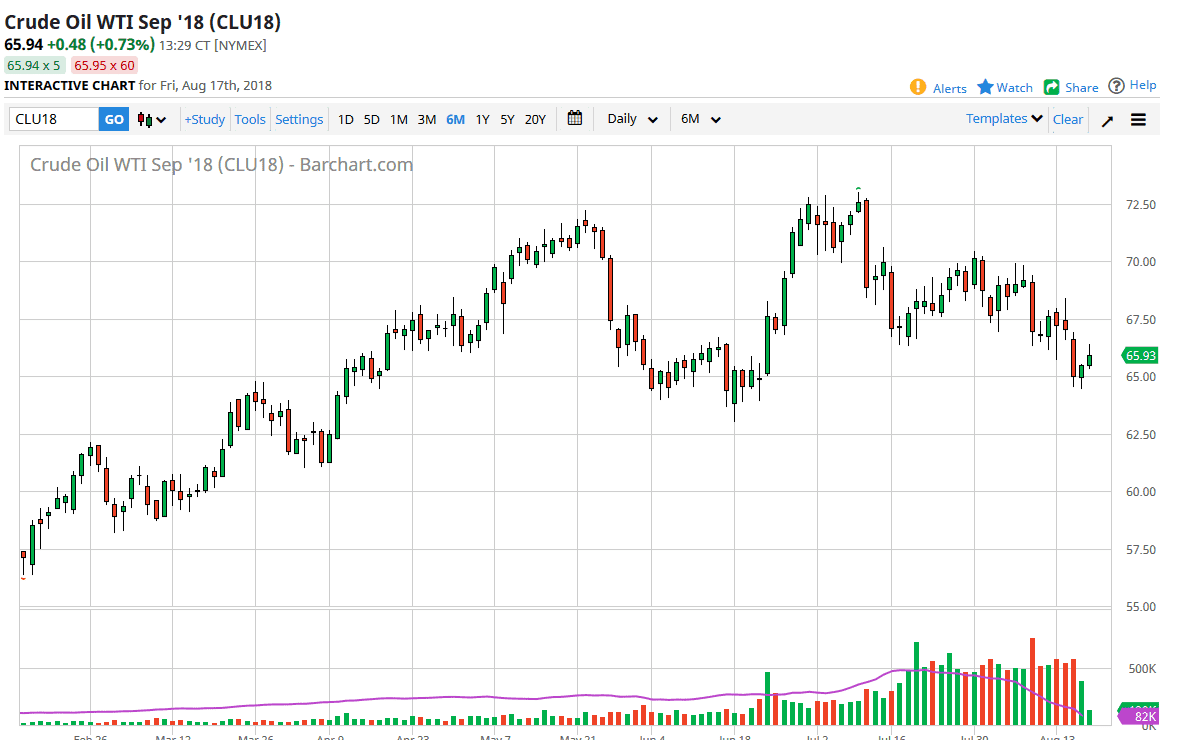

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Friday, reaching towards the $66 level before pulling back. As we pulled back, it should be noted that we were heading into the weekend so there could’ve been some position squaring causing this. The market seems to have a significant amount of support underneath at the $65 level. The market continues to be very volatile, and with poor inventory numbers during the week, we still have a lot to worry about. However, it looks as if the US dollar is trying to soften a bit, and that could help lift this market as well. Tensions with the Iranians could also help this market, so at this point I think value hunters are starting to come back in. $67 above should be a target for buyers, while $65 should offer some support.

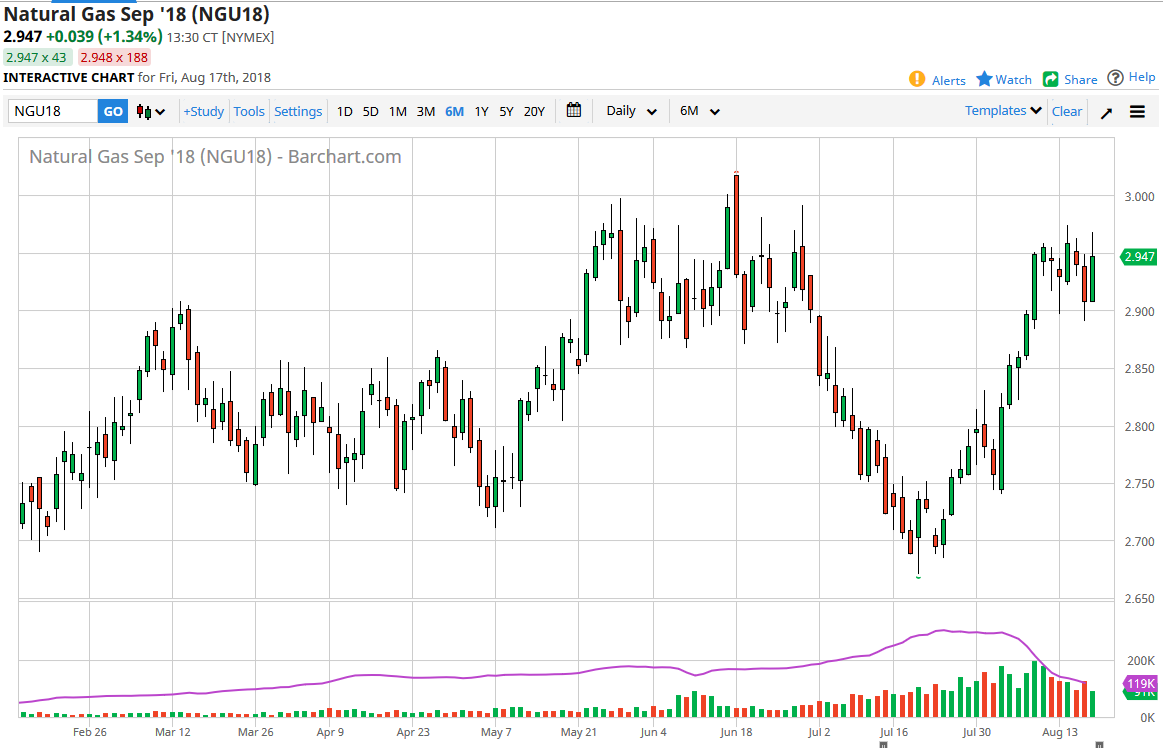

Natural Gas

The natural gas markets rallied significantly during the trading session on Friday, crashing into the $2.95 level. That is the beginning of significant resistance extending to the $3.00 level, so I think at this point we will probably see sellers coming in on rallies from short-term charts. If we roll over from here, we will probably go looking towards the $2.90 level. If we can break down below there, then we could drop much more significantly. The alternate scenario of course is that we managed to break above the $3.00 level, something that would be a bit surprising considering that volume is starting to drop off a little bit at these lofty levels. I expect this market will probably roll over eventually. In the meantime, expect a lot of back and forth trading.