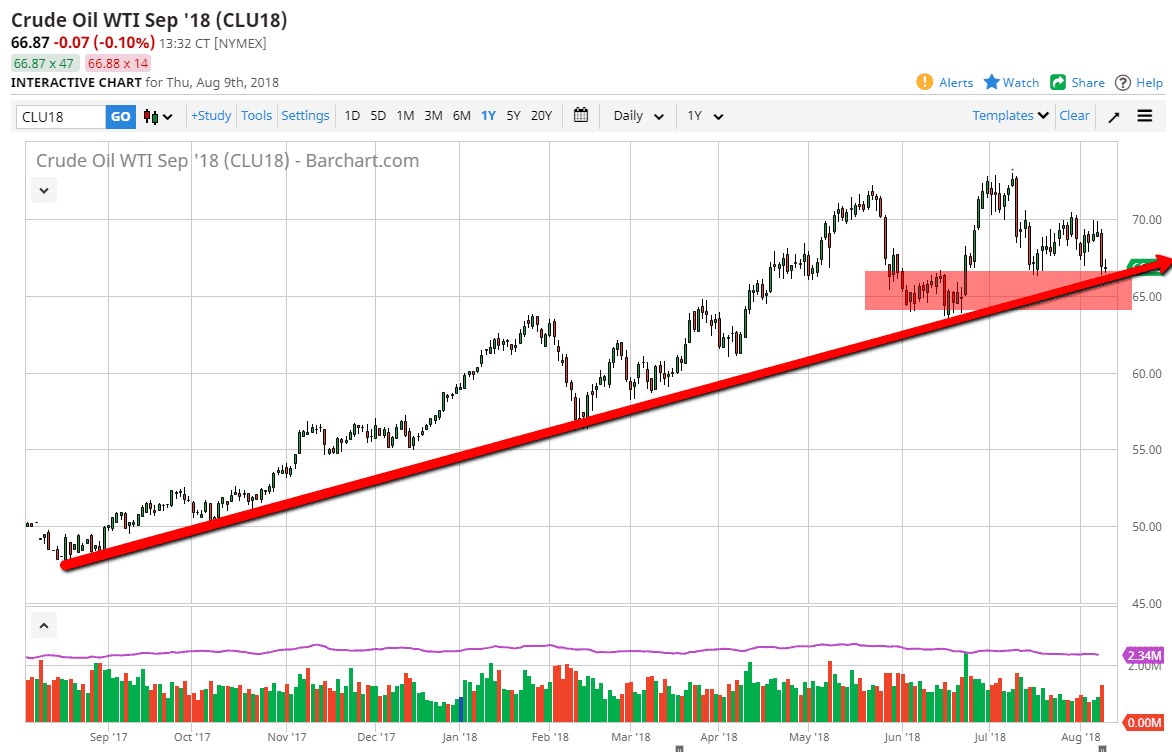

WTI Crude Oil

The WTI Crude Oil market was very noisy during trading on Thursday but did offer a bit of stability coming in at support. This is something that the market desperately needed, after getting slammed the previous day. I believe that there is an uptrend line underneath that should also support this market, and although there was not much going on during the day for Thursday, it was encouraging in the sense that we stopped the bleeding. I was in the futures market scalping all day, showing quite well from bouncing at the $66.80 level. At this point, I think the uptrend line is the most important thing to pay attention to on this chart, and on a daily close below that level I think we would enter a bear market. Overall though, I think this far too much in the way of instability to think that the oil markets are going to be susceptible to headlines. There is the concern of global trade slowing down, but there’s also a lot of geopolitical noise out there as well.

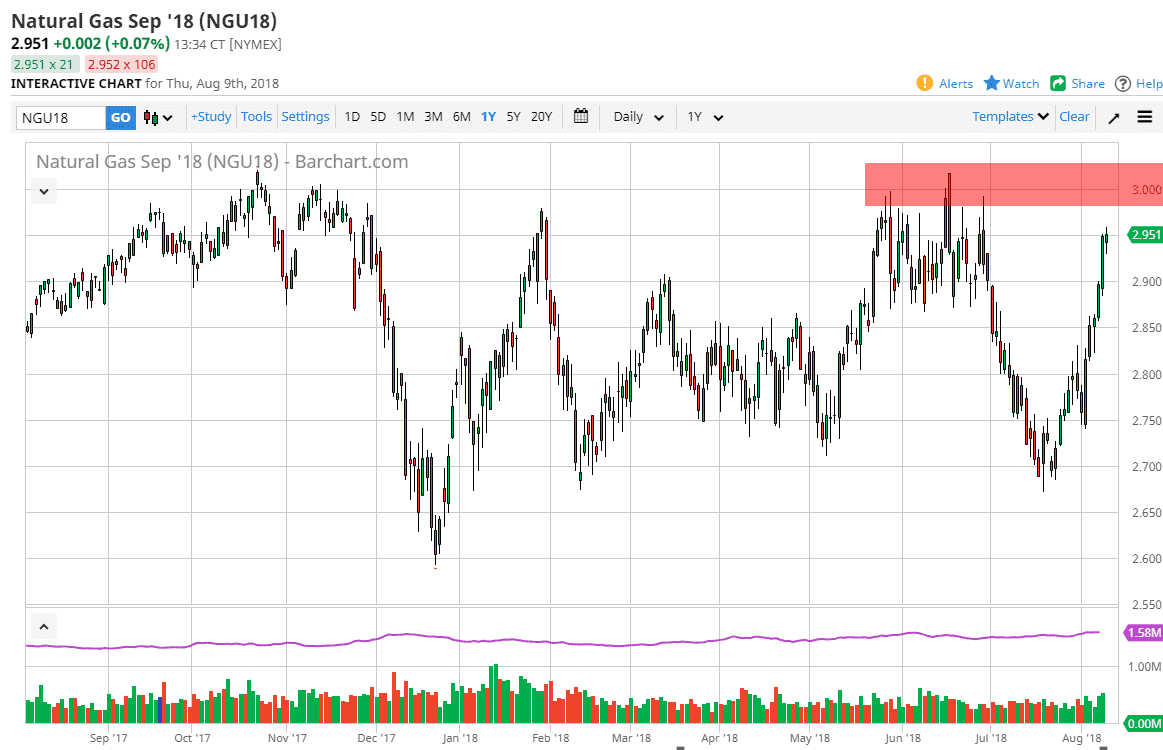

Natural Gas

Natural gas markets initially fell during the day on Thursday, but then turned around to rally a bit. However, I would point out that the market is starting to slow down after a parabolic move to the upside, and at this point I’m looking for some type of exhaustive candle to start selling. I believe that the $3.00 level will be an excellent shorting opportunity on signs of exhaustion, but that’s assuming that we even get to that point. Otherwise, if we can break down below the bottom of the range for the Thursday session, I would then start shorting this market at that point. This is a longer-term consolidation area that we are testing the top of, and at extreme velocity. To me, that’s a pretty good opportunity to start selling. Look for failed short-term rallies or break down below the Thursday session.