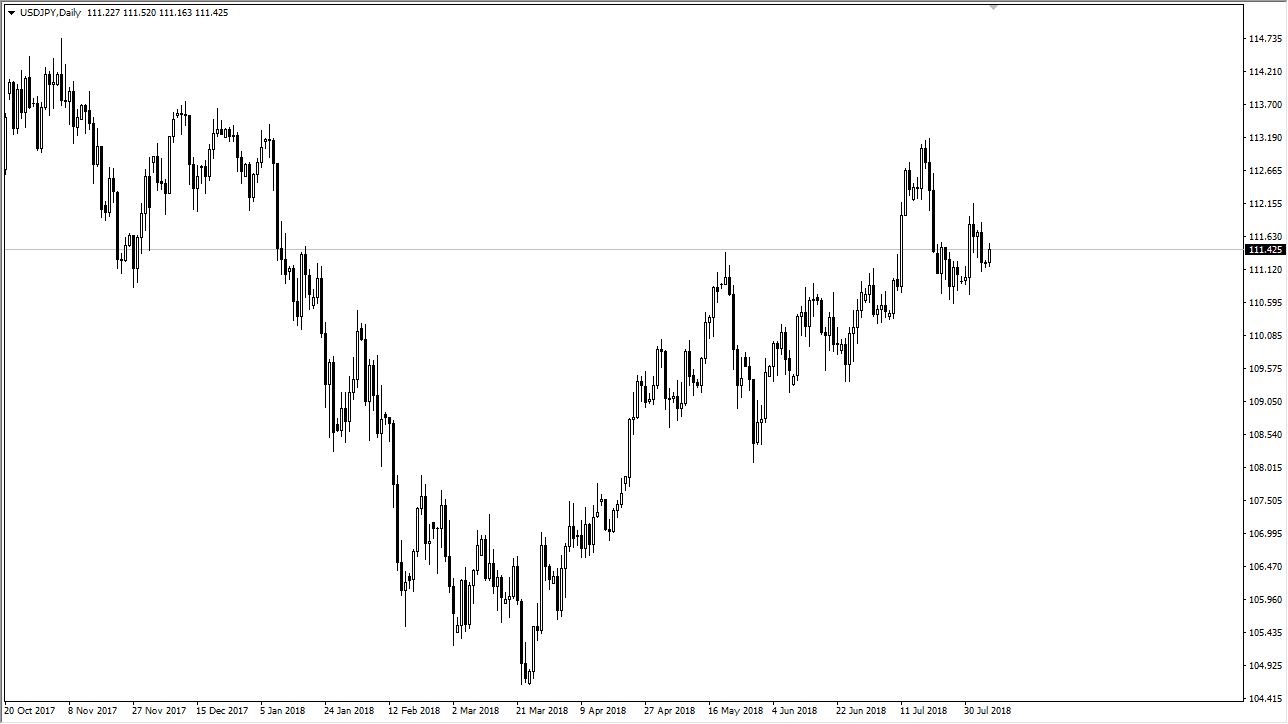

USD/JPY

The US dollar has rallied a bit during the day on Monday, as the US dollar has strengthened overall in the Forex markets. The ¥111 level has offered a significant amount of support, and I think it will continue to. The ¥112 level above is resistance, so I think at this point we are going back and forth more than anything else. I believe that the market will continue to chop around, so therefore I would keep my position size small but we most certainly have seen a proclivity to the upside as of late. It’s probably going to be easier to buy dips as they occur, but I wouldn’t put too much in the way of size into your trades right now. If we do break down below the ¥111 level, then there is support at both the ¥110.50 level and the ¥110 level.

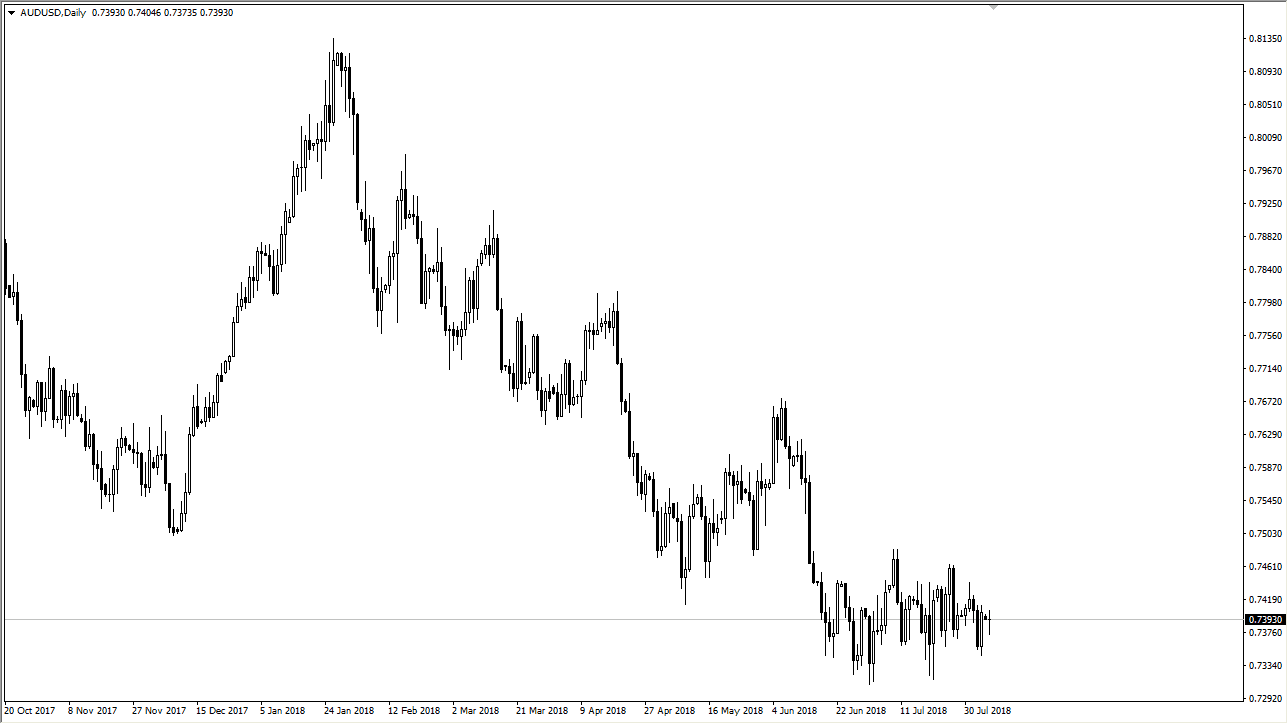

AUD/USD

The Australian dollar has been choppy to start the week, as we continue to consolidate in this market as well. I see the 0.7350 level underneath as being supportive, while the 0.75 level above is resistance. I don’t see anything breaking this out of this range, but I do recognize that longer-term charts show a massive amount of support underneath, so I think there’s probably more risk to the upside then down longer-term. Nonetheless, August is a very quiet trading month, at least under normal circumstances. This pair is sensitive to the trade war between the United States and China, so if headlight start to heat up again, that could put a little bit of bearish pressure on the Australian dollar, but in the meantime I think it’s a simple back-and-forth type of range bound trade you should be looking at.