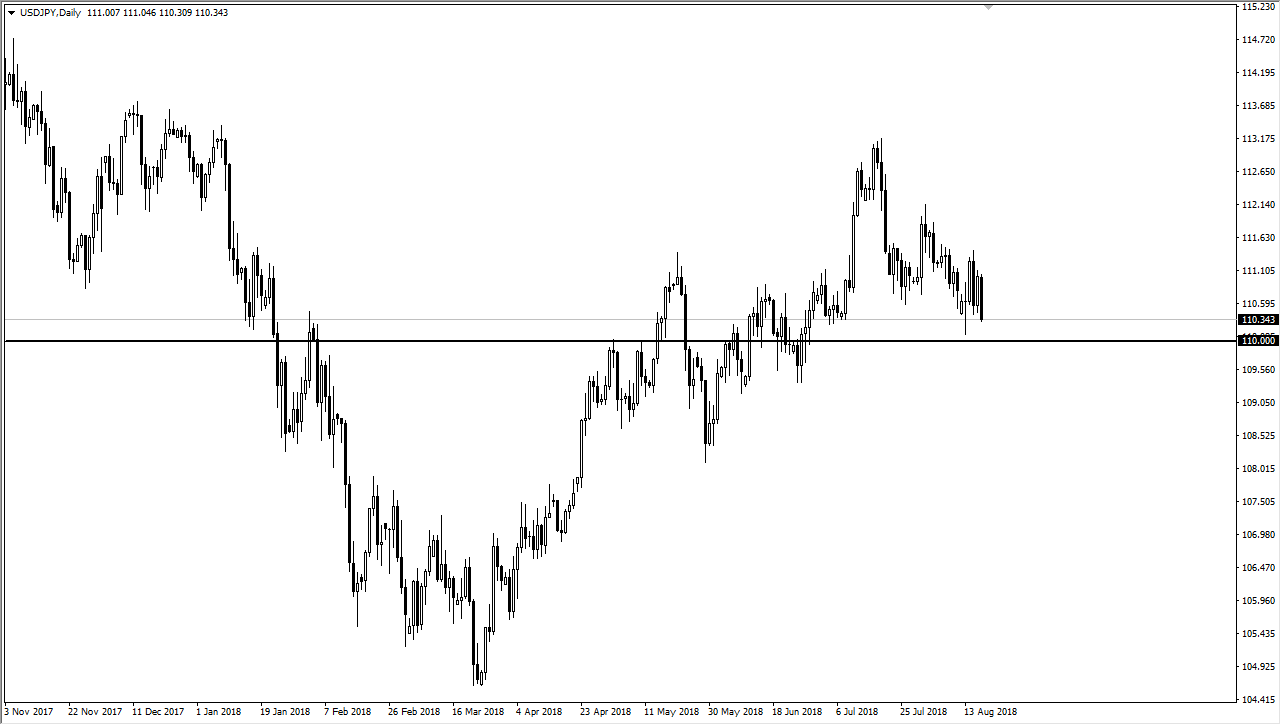

USD/JPY

The US dollar has broken down a bit during the trading session on Friday, as we continue to dance just above the ¥110 level. That’s an area that should cause a bit of support, but quite frankly I think at this point we are more or less in consolidation. The ¥109 level underneath should be support, while the ¥111 level above should be resistance. I think that short-term back and forth trading is probably going to be the order of the day, with the ¥110 level being essentially what I would consider to be “fair value.” Ultimately, this is a market that will continue to struggle but I think that clarity could come in September when senior traders come back from holiday. At most firms currently, we have Junior traders pushing buttons to keep larger positions from falling apart.

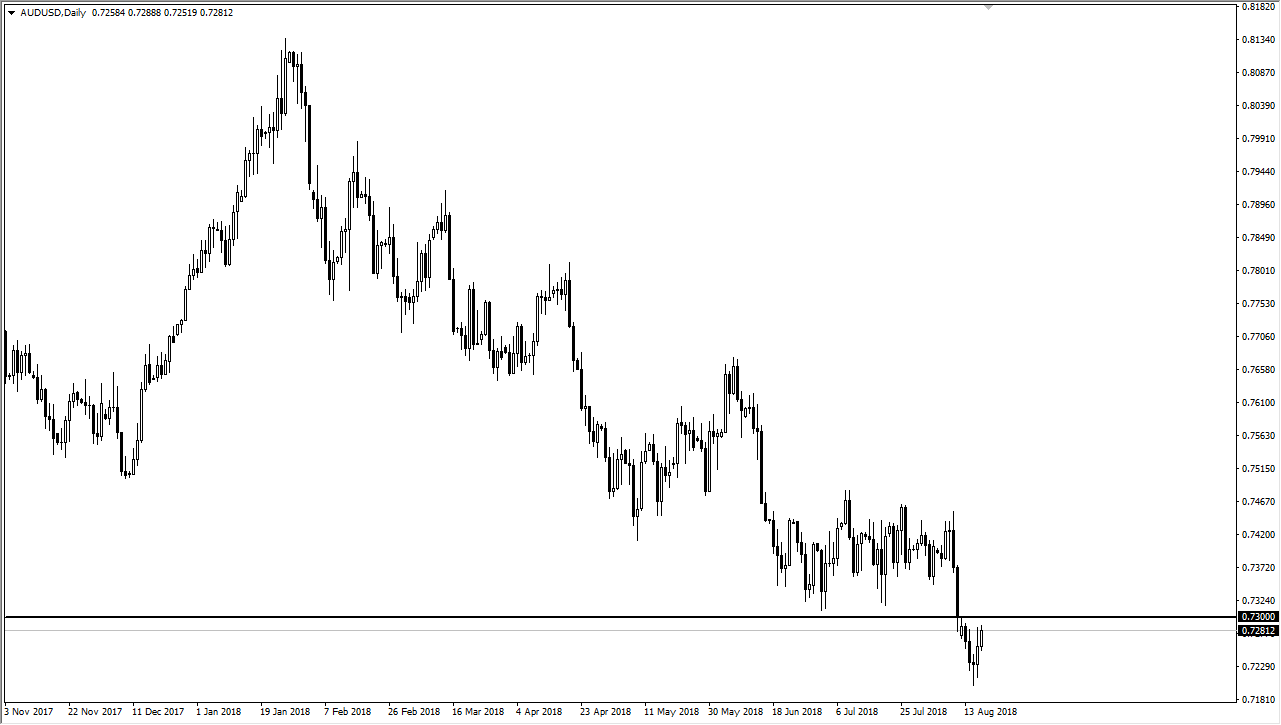

AUD/USD

The Australian dollar rallied significantly during the trading session on Friday, as we continue to see a bit of a “risk on” move. If we can break above the 0.73 level, it’s likely that we could go towards the 0.7450 level. Ultimately though, I think that rallies will probably prove to be selling opportunities as we are far from safety. The Australian dollar looks strong at the moment, but longer-term we certainly have a lot of noise. If we broke above the 0.75 level, then the market should go much higher, perhaps starting a new trend to the upside.

The Australian dollar will need the Sino-American relations to work out favorably in order to continue going higher. It is a proxy for the Chinese economy, so keep that in mind.