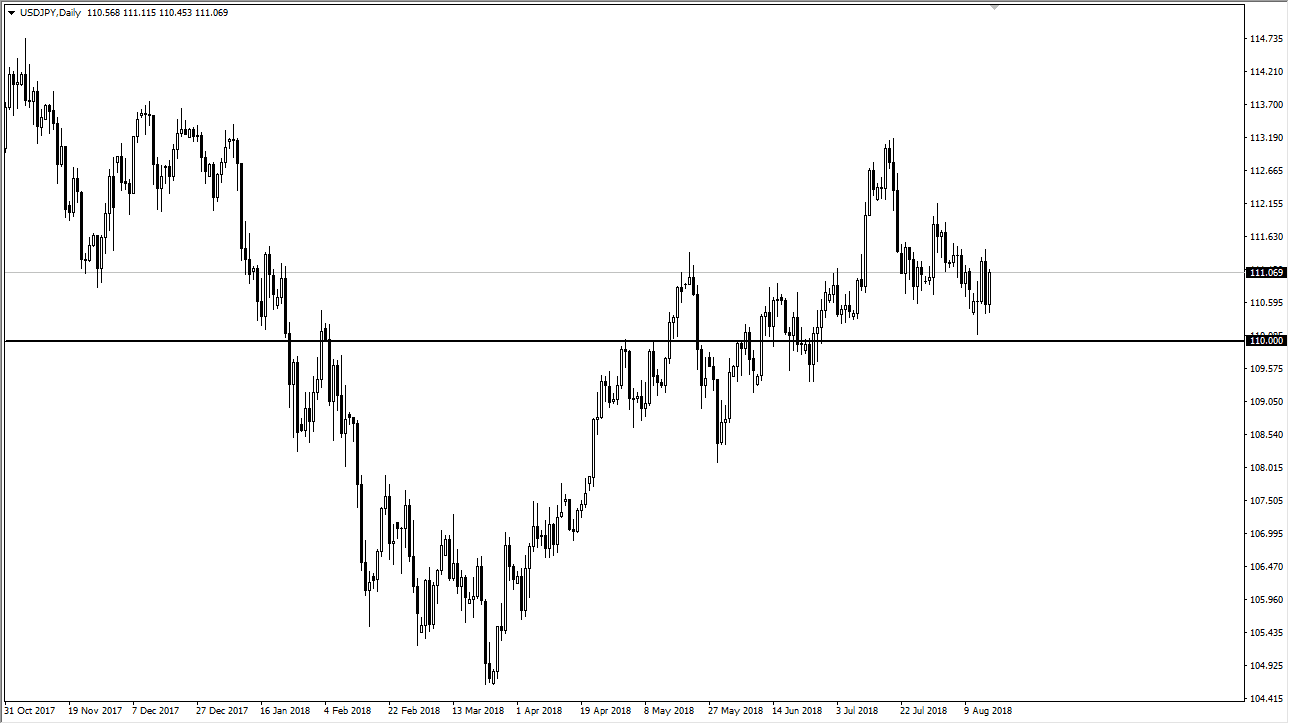

USD/JPY

The US dollar has skyrocketed against the Japanese yen during trading on Thursday, as word came out that the Chinese are coming to the United States to talk about trade. Because of this, there is a lot of optimism on Wall Street, which went roughly parabolic during the day. However, there is resistance above that could cause issues, so I would be cautious about trying to hang onto that trade. I think that the ¥111 level causing a bit of resistance is telling, showing us that the market cannot quite take off. I believe we continue to chop around regardless of these headlines, simply because there’s a lot of uncertainty out there beyond trade wars. However, I do believe that eventually we rally. I just don’t think it’s going to be some type of massive move. Currently, I have the ¥110 level as a bit of a floor.

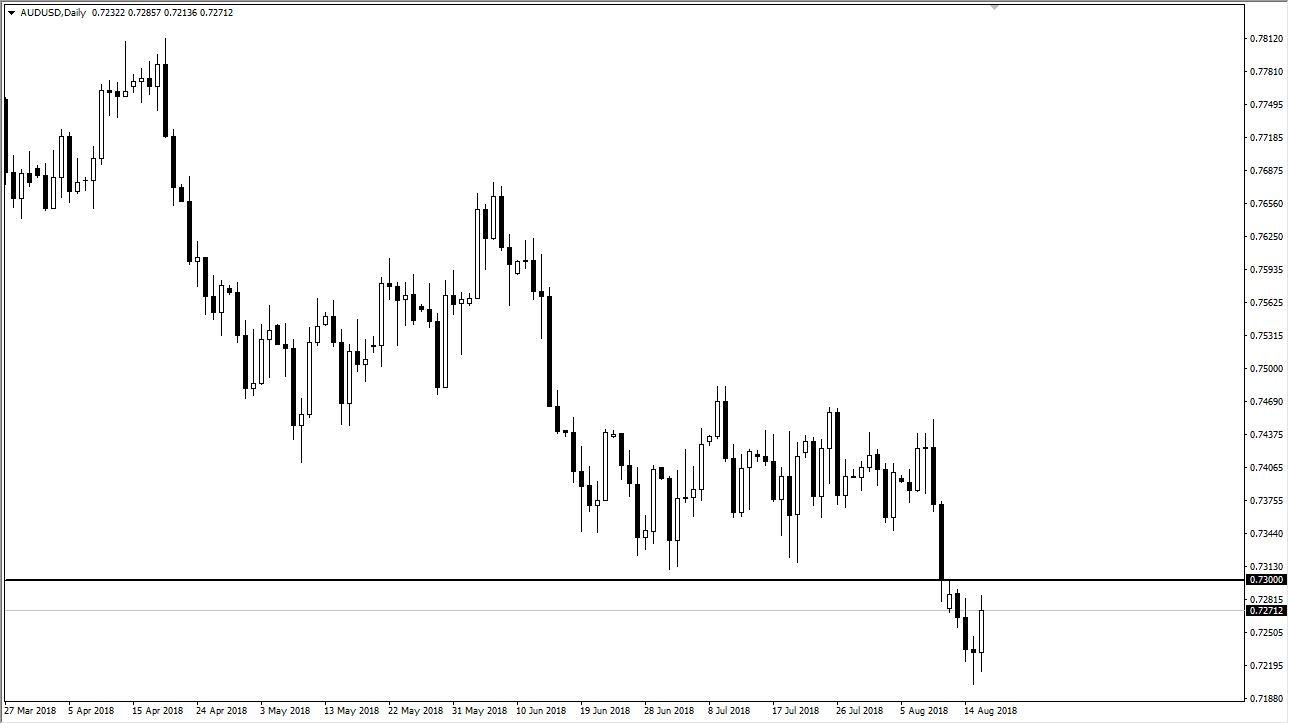

AUD/USD

The Australian dollar also rallied in a “risk on” bid but failed to break above the important 0.73 handle. Because of this, I think that the market will probably pull back again, as we have so much concern out there. It’s not until we clear the 0.73 level on a daily close that I would be convinced it’s time to start buying, and even then I would feel much better above 0.75. In other words, even though we got a bit of a reprieve against the brutality of the selloff, the reality is that we could not clear the first significant resistance barrier. I believe that the sellers are going to return, and that the Australian dollar will continue to suffer at the hands of those who worry about Sino-American relations.