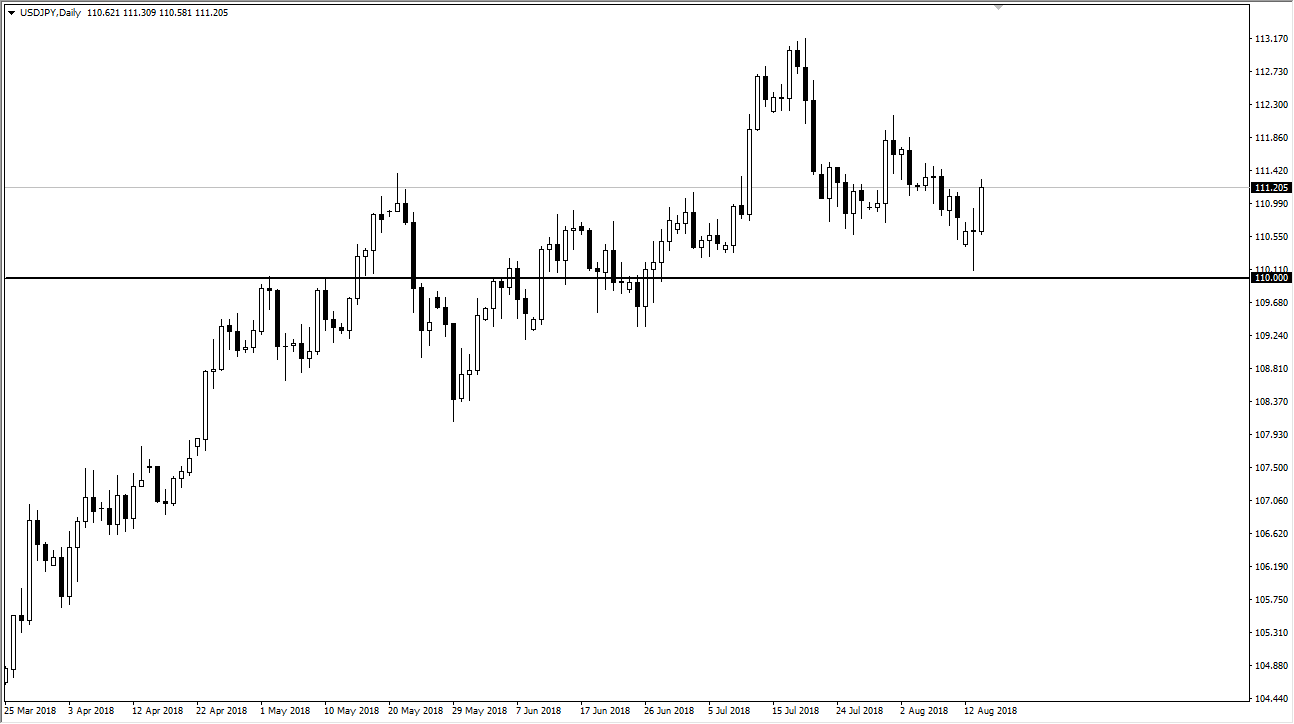

USD/JPY

The US dollar rallied significantly during the day on Tuesday again, not just against the Yen but pretty much everything else it touched. We broke above the top of the hammer from the previous session, which is always a bullish sign, but I think there is enough noise just above that we may get a bit of a pushback. While I do believe that it makes sense the US dollar continues to rally from here overall, the Japanese yen will be a bit of an exception in the sense that it may slow things down as it is a safety currency. If we finally get away from the overall concerns of the market though, then we could be looking at a situation where we rally a bit stronger, because interest rate differentials and outlook basically demand it. If we do break down below the ¥110 level, then I think the market may drop to the ¥109 level. Until then, I suspect that it’s probably a “buy on the dips” situation for short-term traders more than anything else.

AUD/USD

The Aussie broke down again during the day on Tuesday, reaching towards the 0.72 handle. Once the market broke down below the 0.73 level, it was time to start shorting again as it looks like we will probably go looking towards the 0.70 level underneath, a large, round, psychologically important number as well as an area that we should see a lot of structural importance placed upon it. If we do rally from here, I would look to sell closer to the 0.73 handle, because there should be a significant amount of resistance between there and the highs from the Wednesday of last week. I have no interest in buying the Australian dollar currently.