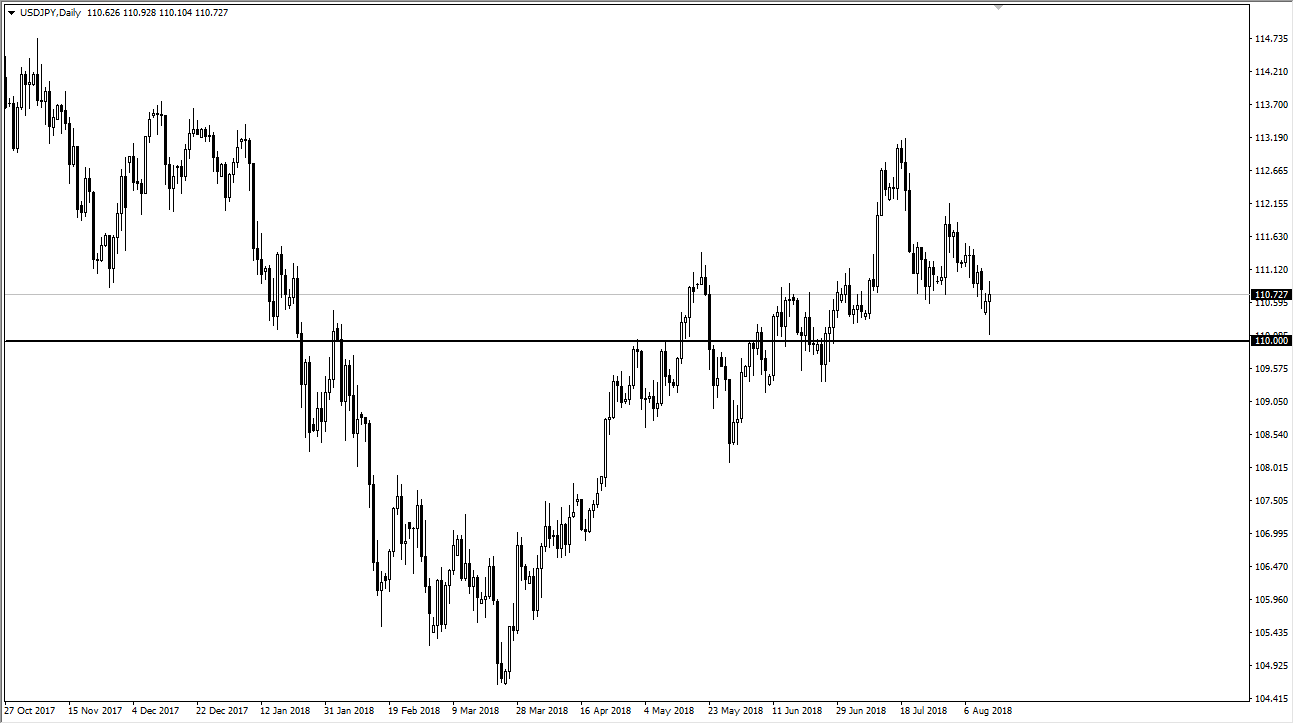

USD/JPY

The US dollar has been very volatile against the Japanese yen as the market to spend continue to weigh the contagion risk of the Turkish currency crisis. From a technical analysis standpoint, the market has tested the ¥110 level and bounce quite significantly. After initially gapping lower at the open in Asia, we have filled that gap is now the question is whether we can hold above the ¥110 handle? I believe that if we can break above the range of the candle for the Monday session, the market could recover towards the ¥112 level, perhaps even ¥113. However, if we break down below the ¥110 level, it’s possible that we could go down to the ¥109 level, an area that had been supportive in the past. I think the one thing you can probably count on here is a lot of volatility.

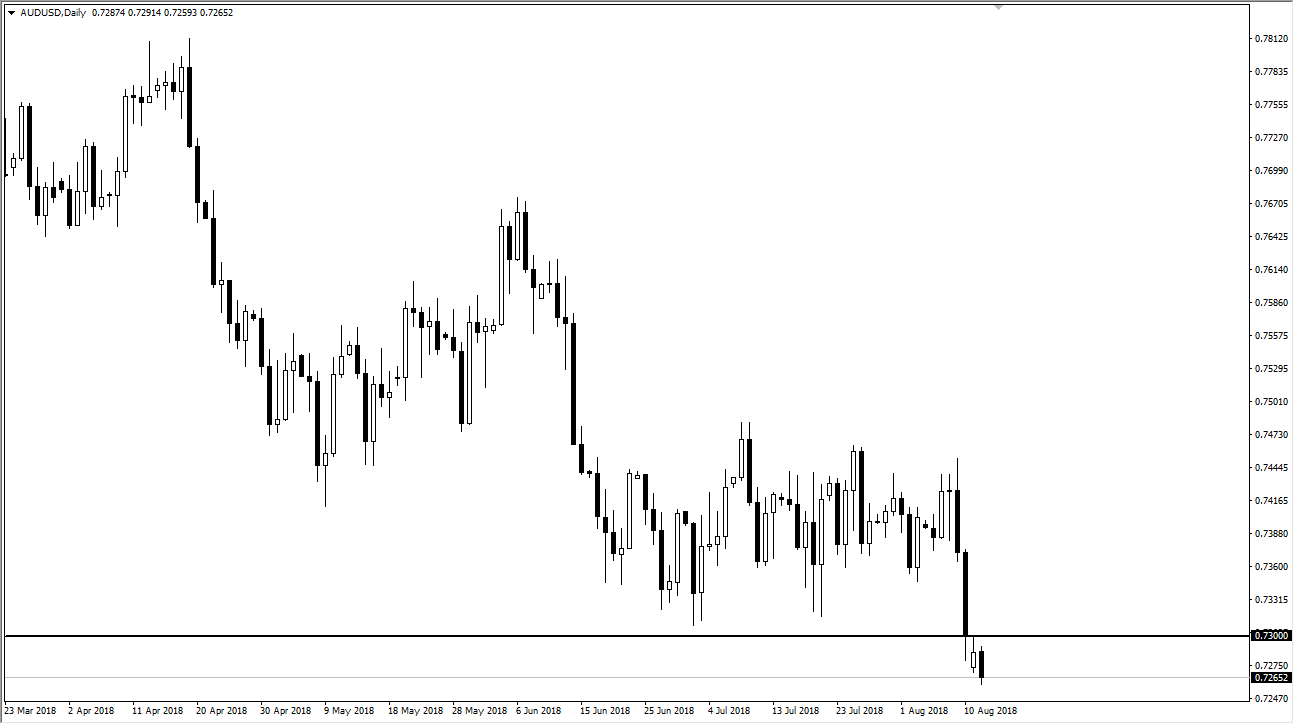

AUD/USD

The Australian dollar has drifted a bit lower during trading on Monday, as we continue to see a lot of noise overall. Now that we are below the important 0.73 handle, it’s likely that we will continue to go lower from here. I believe that the market will target the 0.70 level, especially if we continue to get some type of negativity coming out of the headlines. I think we probably will, because even if it’s not Turkey that’s causing noise, it will be the trade war concerns that continue to brew. I believe that the Chinese stock market is going to continue to break down, and that should continue to weigh upon the Australian dollar as a proxy. I do believe that we will have a significant fight at the 0.70 level.