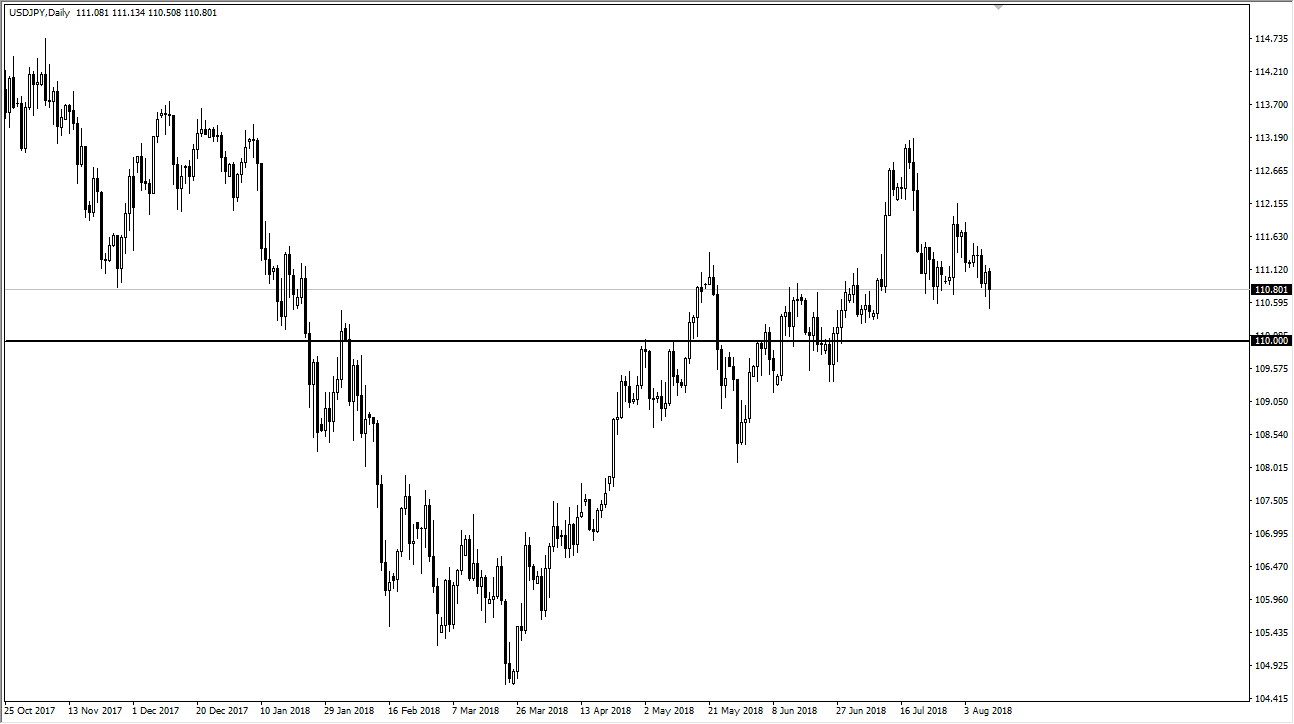

USD/JPY

The US dollar fell against the Japanese yen during trading on Friday but found a little bit of support underneath by the end of the day, forming a bit of a hammer. I think there is a lot of support underneath here as well, extending down to at least the ¥110 level, if not the ¥109 level. This market is of course very sensitive to global trade concerns, and of course that has been front and center. All things being equal, I think this pair is going to continue to move on those headlines. ¥110 should bring in some interest, just as ¥113 above would be massively resistive. I think the buyers are going to come in sooner rather than later, but we may get a little bit better entry price underneath. Regardless I would keep my position size small to say the least.

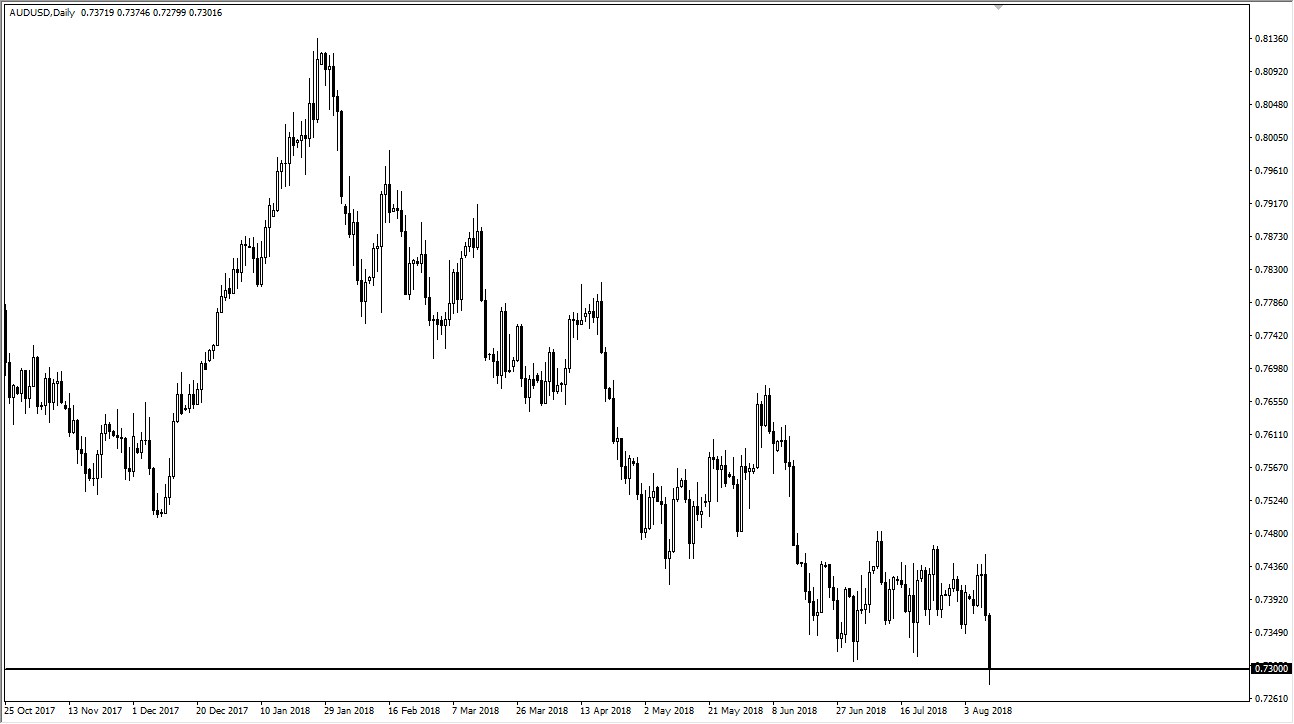

AUD/USD

The Australian dollar plummeted during trading on Friday as the US dollar strengthened against almost everything. I believe that this market will continue to suffer, and if we break down below the lows of the session for the Friday candle, then I think we continue to unwind towards the 0.70 level. However, if we get a gap higher, perhaps on some type of good trade news over the weekend, then we will probably turn around and go looking towards the 0.75 level above. Overall, the US dollar has strengthened due to concerns in Turkey, and of course the trade war fears which has a direct effect on the Australian economy. It also say there’s a bit of a knock on effect here as the New Zealand dollar has broken through major support as well. I suspect that we may finally be seeing the mass of support at the 0.7 3 level giving way.