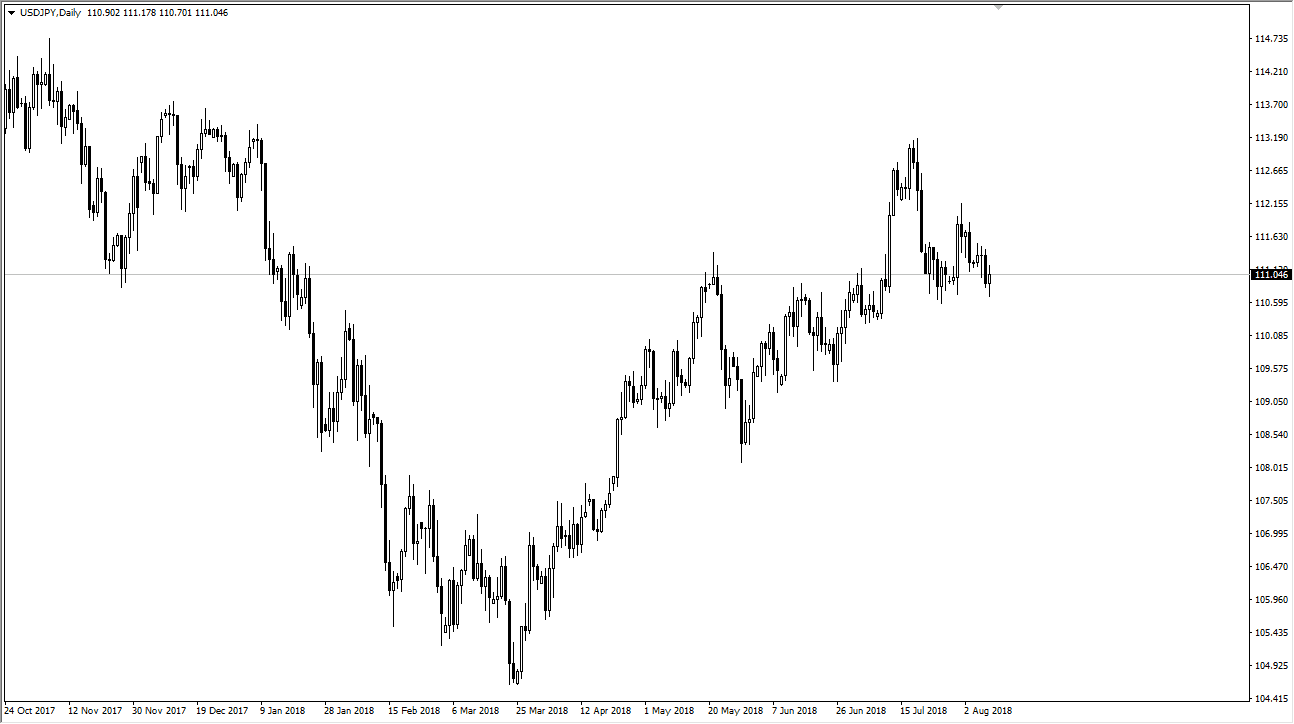

USD/JPY

The US dollar has been very noisy during Thursday trading session against the Japanese yen as we tested the ¥111 level. This area was previous resistance, and I think now should offer plenty of support. In fact, I believe that there is support here, the ¥110.50 level, and then the ¥110 level after that. Longer-term, I think that we will turn around and try to reach towards the ¥113 level again. That doesn’t mean that I’m ready to start buying quite yet, but I do recognize that this pair certainly has more upward momentum longer-term than downward, as we have been in and uptrend for over six months. We have course need some type of resolution to the trade war to allow the Japanese yen to soften, which it will rapidly at that point because then we will focus on interest rate differential which most certainly favor the higher currency exchange rate.

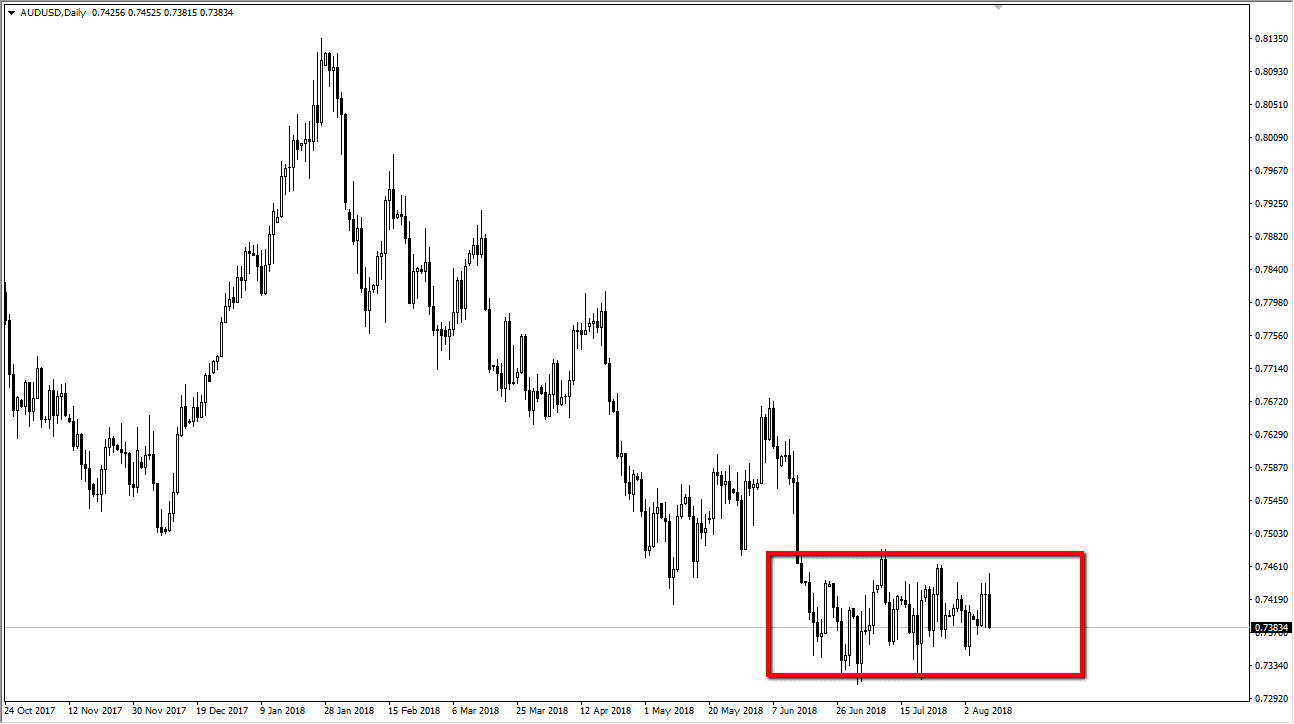

AUD/USD

The Australian dollar initially tried to rally during the trading session on Thursday, but then rolled over to stay within the consolidation that we have been in for some time. As we approach these low levels, I’m looking for buying opportunities, be it a short-term supportive candle or some type of bounce that I can take advantage of. I believe that there is significant support at the 0.7350 level, and below there at the 0.73 handle. If we can break down below that level, the market is likely to drop to the 0.70 level, offering a fresh new selling opportunity. However, the weekly chart continues to form hammers from these levels, and at this point I don’t see anything to change the attitude of this market overall.