USD/CHF

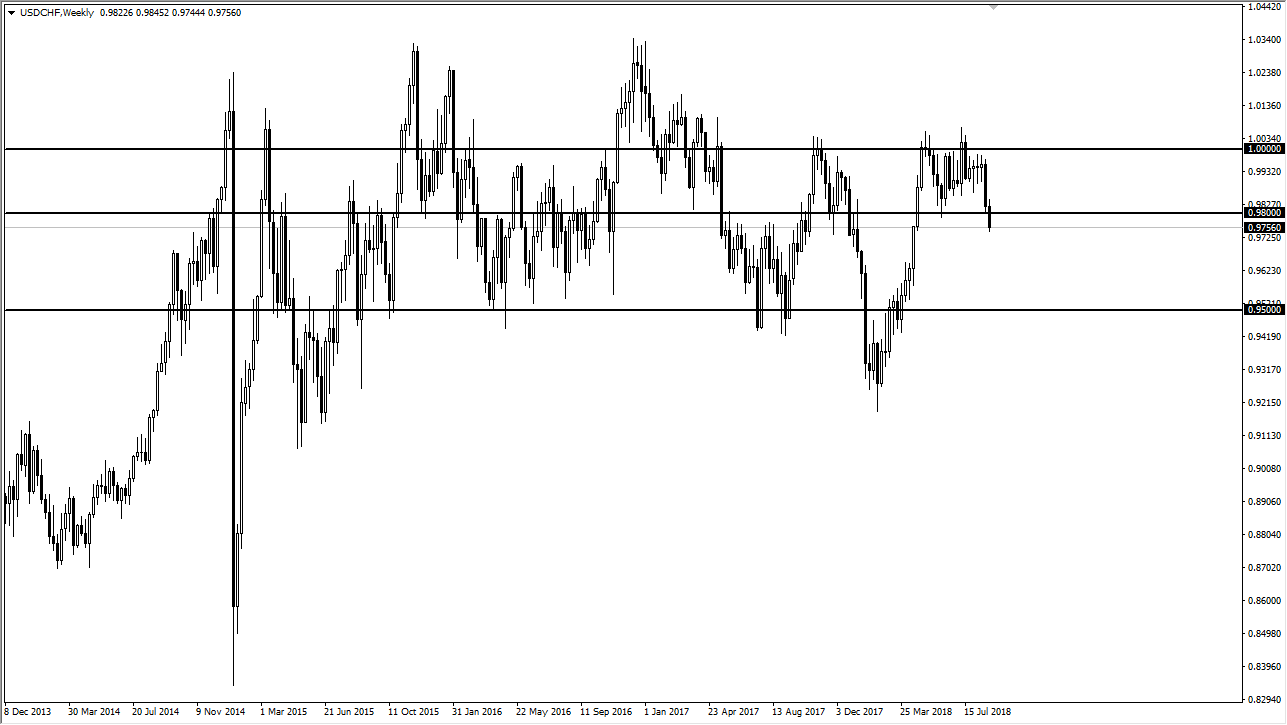

The US dollar ended the month of August on the back foot, breaking through the 0.98 level against the Swiss franc. If the US dollar can’t hold gains against the Swiss franc, it doesn’t stand much in the way of hope when it comes to other currencies, because when it comes to interest rates, the Swiss are the worst save the Japanese. Ultimately, this should release the US dollar to continue falling, perhaps looking for more significant support. At this point, it looks very likely that we could go down to test the 0.96 level, possibly even the 0.95 level after that.

Ultimately, I think the US dollar has been overbought for some time, and that should show up in this pair like many others. There are signs that the EUR/USD pair is trying to turn things around and continue going higher as a write this article, which typically moves inversely to this pair. There are enough “old-school traders” out there that will follow this long-held truism.

The question now is whether this is going to be a safety move, or simply a correction? I suspect the latter of the two to be the correct answer, so I think that we may see some softness early in September, but I would anticipate that the 0.96 level, and possibly the 0.95 level would offer buying opportunities. I anticipate that we will continue to see a lot of volatility, and I also believe that the first two weeks of the month will be soft. However, I find it a bit unlikely that we would break down below the 0.95 level. If we did, then the dollar will wind down to the 0.93 handle next. Overall though, this looks like a typical range bound type of play, so playing this range will probably be the way to go.