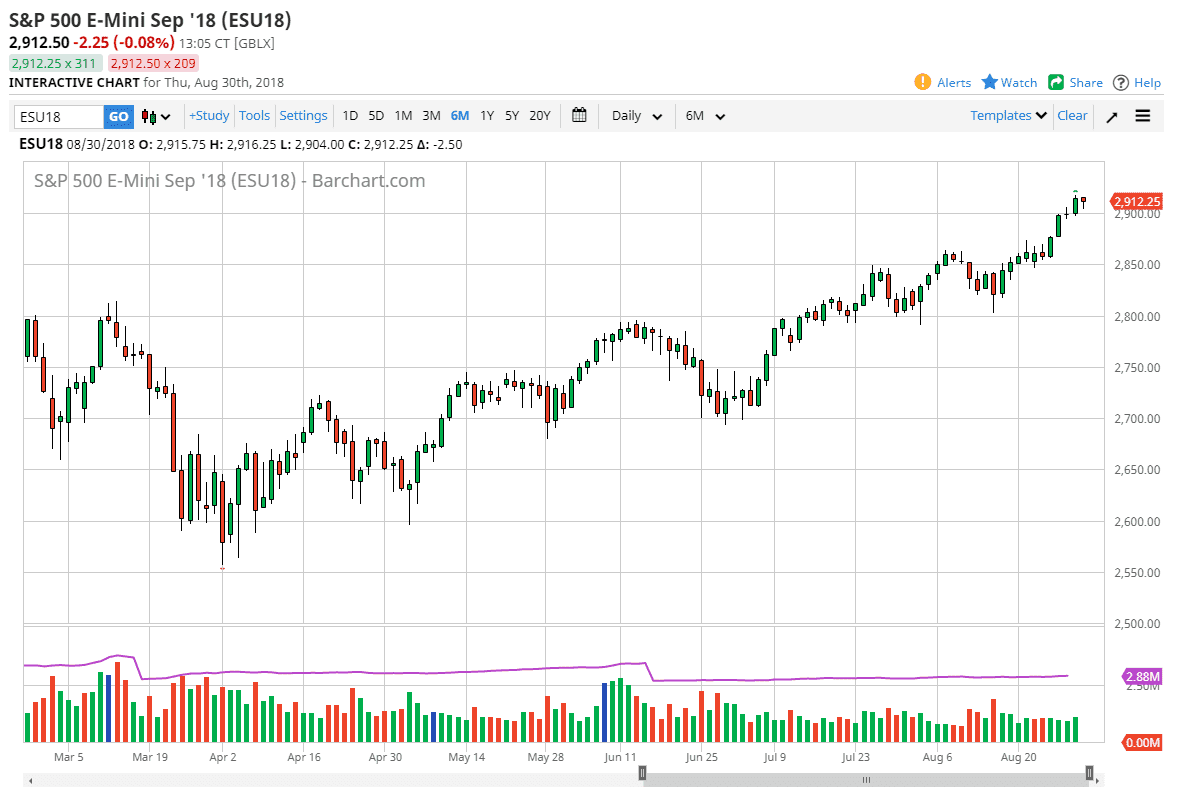

S&P 500

The S&P 500 fell during trading on Thursday, as traders collected profit. It does look as if the 2900 level is going to offer support though, so I think buying on the dips will probably continue to be the way most traders approach this market. The market participants continue to see value in the United States, especially in comparison to other economies. I think that the 2900 level will see a huge fight from the buying side, but even if we break down below there I think there’s plenty of support at the 2875 level, and then the 2850 level. I have no interest in shorting this market, I believe it will eventually go looking towards the 3000 level given enough time. That level will of course be a major Keystone price to pay attention to, and it will be easy to clear.

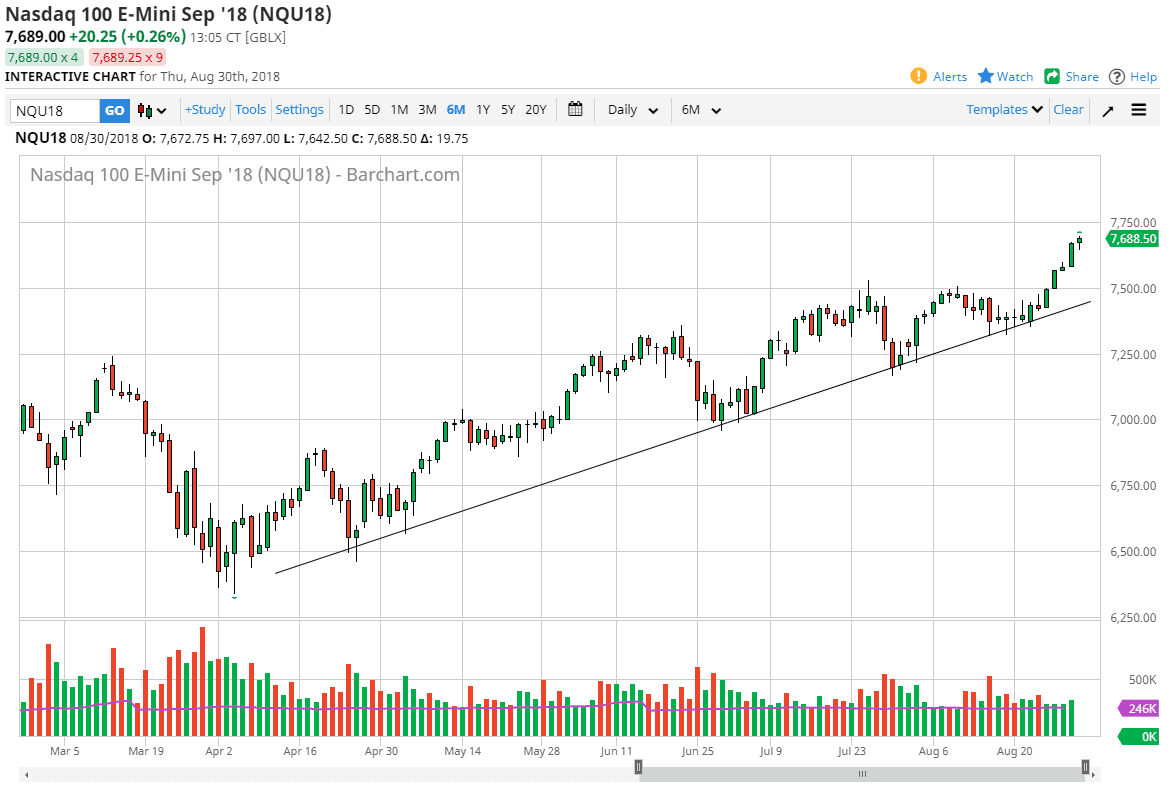

NASDAQ 100

The NASDAQ 100 was chaotic during trading on Thursday, as the market pulled back initially but then turned around the show signs of life again. Ultimately, this is a market that I think that is very likely to continue to attract buyers. Word got out that the negotiations between the Americans and Canadians were going fairly well, and that sent a bit of a charge into the market late. Nonetheless, I think this is a market that you need to buy on dips, there’s far too much bullishness out there to think that anything else will happen. Beyond that, there’s a nice uptrend line underneath, and of course the psychologically important 7500 level that will both create buyers. Although we are getting a bit extended, I think selling is probably very difficult to do at this point in time.