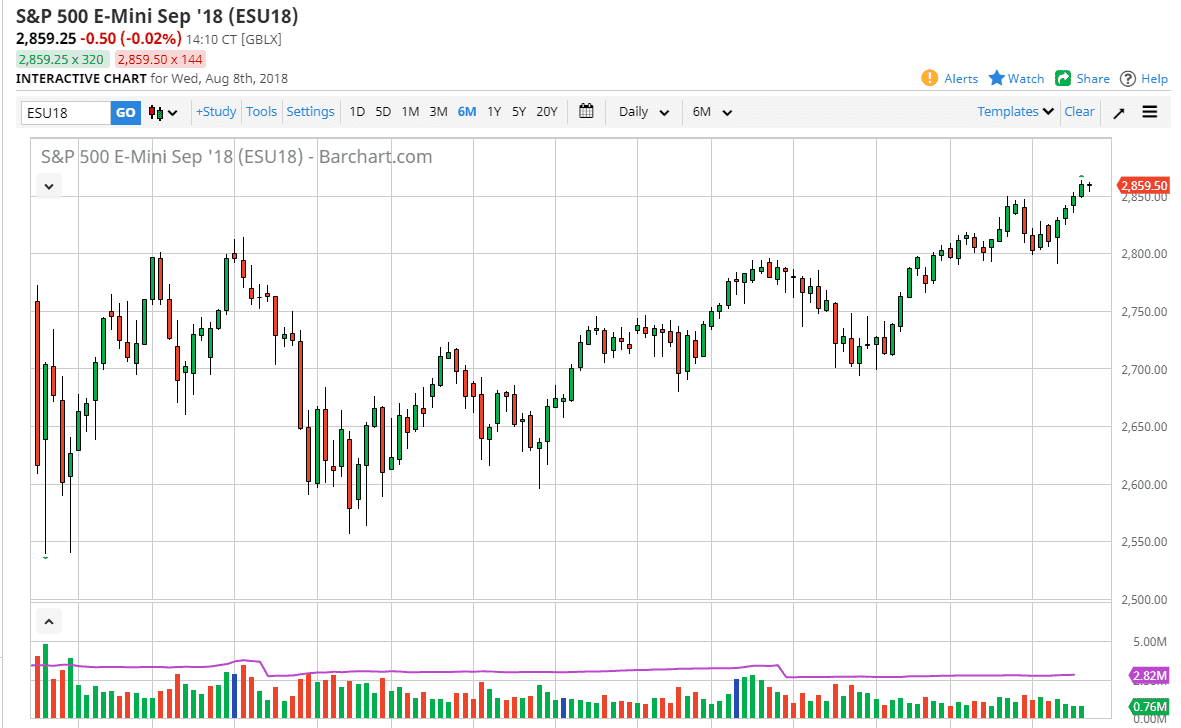

S&P 500

The S&P 500 was a bit choppy during trading on Wednesday but ended up relatively unchanged. While not again, was a nice turnaround after what had been an initial selloff to kick off the US session. Because of this, it appears that there is a certain amount of interest near the 2850 level, and I think that the buyers will continue to push towards the upside, testing the 2880 area that had been so resistive in the past. I believe there is a significant amount of support underneath at the 2800 level as I have been saying, and I think that continues to be a “buy on the dips” type of scenario. Trade war fears seem to be on the sidelines currently, and quite frankly I think we are starting to see a strange correlation with fear. I think money is starting to run towards the United States from overseas, driving up some of the pricing of assets. A decent earnings season hasn’t exactly hurt either.

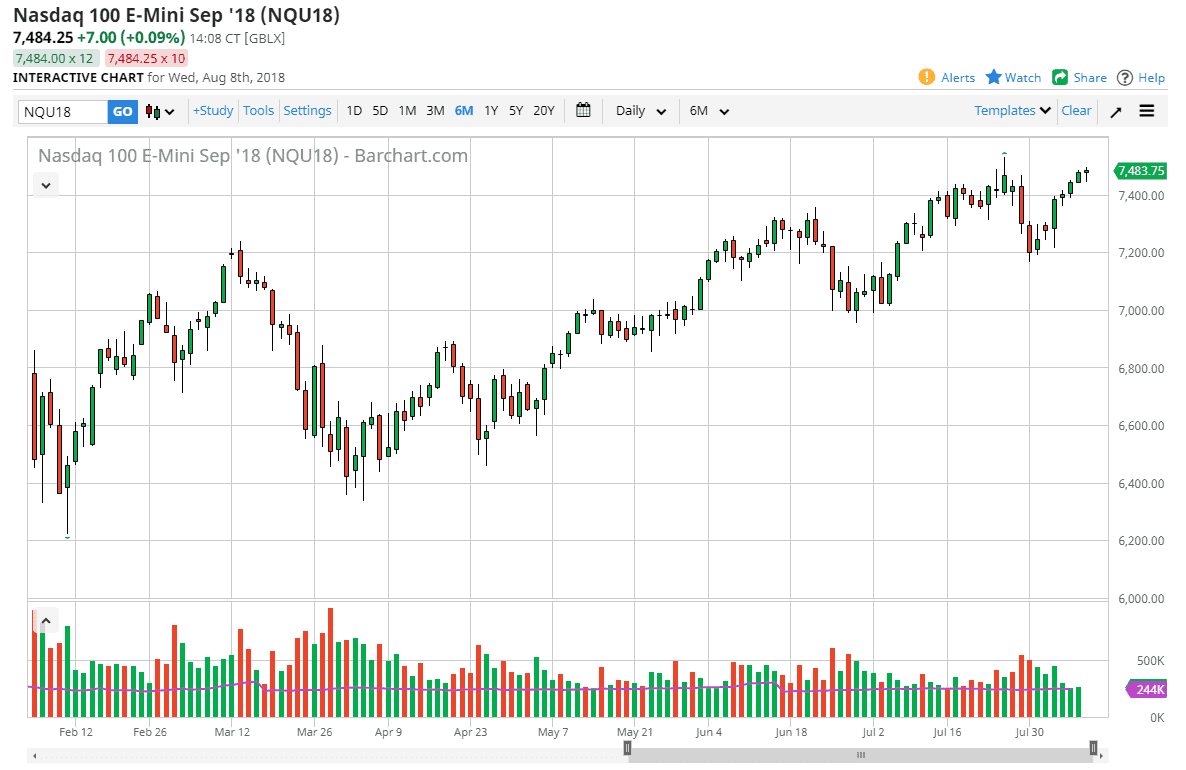

NASDAQ 100

The NASDAQ 100 initially sold off as well, but as you can see turned around of form a bit of a hammer. The market looks as if it is going to continue to try to reach towards the 7500 level, and when we break above there I think that the market continues to go much higher. I believe that the market breaking above there probably sends participants looking for the 7750 level longer-term. Currently, I see the 7400 level as support, as well as the 7200 level. I have no interest in shorting the NASDAQ 100, it is simply far too bullish over the last several months. That’s not to say I don’t expect the occasional short-term pullback, but it should be looked at as value.