S&P 500

The S&P 500 has been very noisy during trading on Monday, as traders came back from the weekend. It has been very difficult to get a handle on the trading during the day, as we gapped lower but then rumors came out that perhaps the Turkish were going to release the pastor that had started the whole mess to begin with. However, there seems to be a lot of speculation that perhaps it isn’t going to happen, and of course the Turkish government has shown no signs of letting go, so I think at this point we are more than likely going to see this market continue to go down to the 2800 level, an area that I think will offer a lot of support. I anticipate that the market may continue the upward channel that is prevalent on this daily chart.

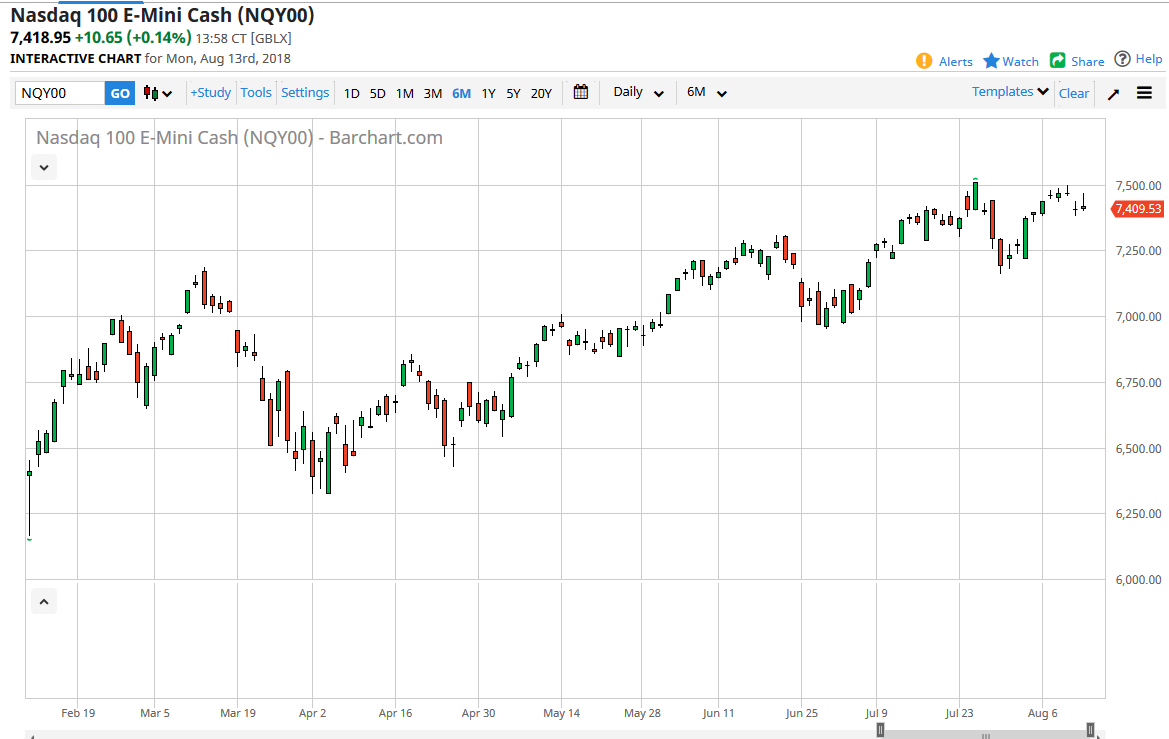

NASDAQ 100

The NASDAQ 100 clearly struggles with the idea of breaking above the 7500 level. We did turn around during the day on Monday, after gapping lower. However, we turned right back around from there and ended up forming a bit of a shooting star. The market continues to struggle with the idea of a longer-term rally, and I think that perhaps we may have to churn a bit in this region before we can build up enough momentum to go higher. I anticipate that the 7250 level underneath will be supportive, and I would anticipate a certain amount of value investing down there. If we break down below that level, then we could be looking at 7100 next, followed very quickly by the 7000 level which I think is crucial.