Gold prices fell $10.82 an ounce on Thursday, weighed down by a stronger dollar. The greenback was boosted by the FOMC minutes which said the Federal Reserve will likely hike interest rates next month. Investors are awaiting Fed Chairman Jerome Powell’s speech at an annual gathering of central bankers in Jackson Hole.

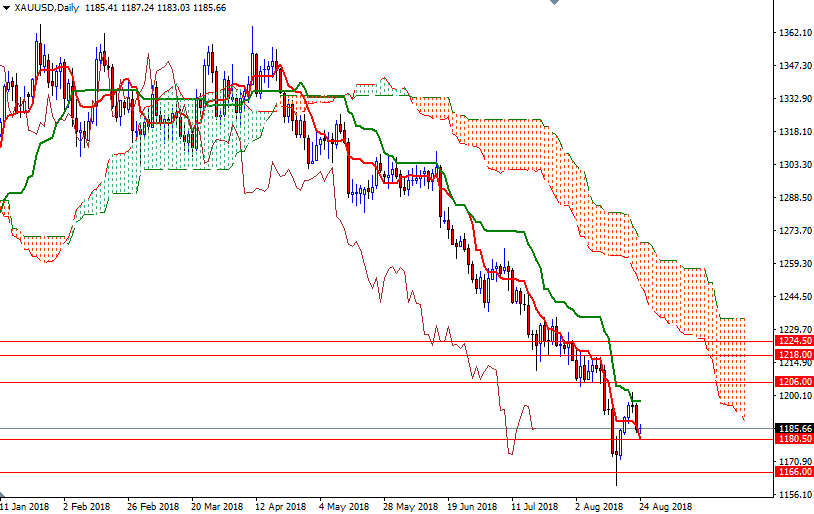

From a chart perspective, the bears still have the overall technical advantage. XAU/USD is trading below the Ichimoku clouds on the weekly and the daily charts. Shorter term charts, on the other hand, point to a sideways price action.

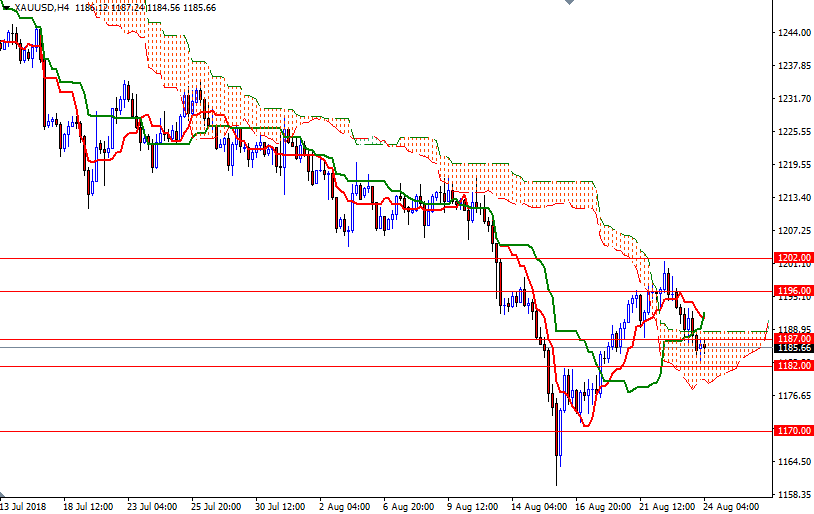

To the upside, the initial resistance sits at 1193, the bottom of the hourly cloud. That is followed by 1193, the top of the hourly cloud. If the bulls can lift prices above 1193, they may have another change to revisit 1197.58-1196. A break above 1197.58 implies that the market is about to challenge 1202/0. However, if XAU/USD drops below the 4-hourly Ichimoku cloud, the market will test the 1177/6 area. The bears have to capture this camp to tackle 1172/0.