The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 5th August 2018

In my previous piece last week, I forecasted that the best trade would be long of the S&P 500 Index above the previous week’s high price, as well as short EUR/USD and GBP/USD. These trades worked out well: the S&P 500 Index did not exceed the previous week’s high price, so there was no trade there, but EUR/USD fell by 0.75% and GBP/USD fell by 0.84%, producing an average profit of 0.80%.

Last week saw a rise in the relative value of the Swiss Franc, and a fall in the relative value of the Euro.

The major developments in the Forex market last week were in the disappointing Non-Farm Payrolls data, which had the effect of halting the Dollar’s advance at the end of the week, and in the continuing prospect of a “No Deal” Brexit plus the “hawkish” rate hike of 0.25% in the British Pound. There are also continuing developments on the tariff dispute between the U.S.A. and China.

Sentiment on the British Pound is quite weak, and the Euro is also negatively impacted by the prospect of a “No Deal” Brexit. Sentiment on the U.S. Dollar is more uncertain.

Fundamental Analysis & Market Sentiment

Fundamental analysis tends to support the U.S. Dollar, as American economic fundamentals continue to look relatively strong. However, last week’ Non-Farm Payrolls came in below expectations, despite the other related metrics looking OK. The Dollar rose slightly but significantly, finally breaking above the resistance at 12085 and making its highest weekly close of the last year, which is a bullish sign.

The week ahead will probably be dominated by central bank input from Australia and New Zealand, as well as U.S. inflation data and GDP data from the U.K. The coming week is likely to be a little less busy and less volatile than the past week.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that after five consecutive weeks of being stuck, the U.S. Dollar Index has finally made a bullish breakout above 12085, suggesting a further rise after a bullish candlestick. The Index is clearly in a long-term bullish trend, however there is another resistance level not far above. This suggests that the outlook for the U.S. Dollar is bullish, especially above 12158.

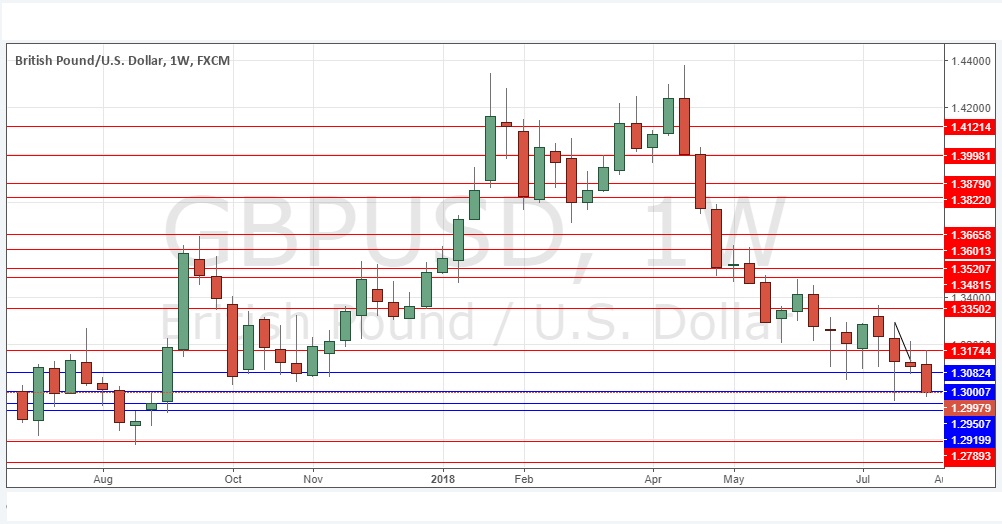

GBP/USD

This pair is technically in a long-term downwards trend, as is shown clearly by the bearish action over the past 16 weeks or so. Although we saw seeing long lower wicks over recent weeks, suggestive of long-term buying close to 1.3000, we now see the price close just below that level with a strongly bearish candlestick. This suggests that the price is now ready to fall further to still lower prices after its lowest weekly close in approximately 11 months.

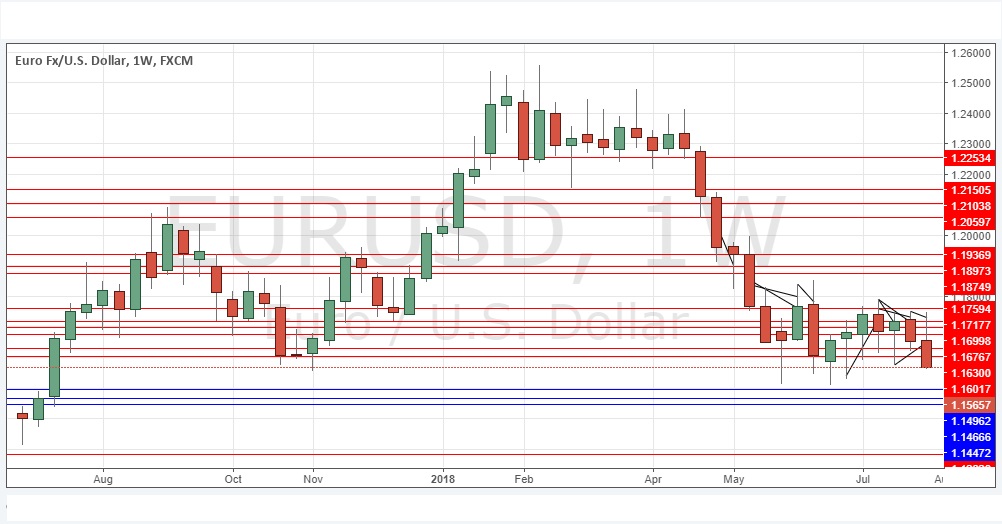

EUR/USD

Although we have seen a consolidation here over the past ten weeks, which suggested a long-term trend change to bullish is increasingly becoming a possibility, we now have more decisively bearish price action, with a very bearish candlestick making the lowest weekly close in over a year, which is a bearish sign. The pair is in a long-term bearish trend. All signs look bearish.

S&P 500 Index

The past six months have been choppy for the U.S. stock market, but the 200-day moving average has held even when the market was beginning to look very bearish. After last week’s rise to new highs, we again saw the price make a healthy rise over the week, closing right on its high, which is a bullish sign. This is a bull market, and the bullish case has been strengthened by the price getting established above the new level flipped from resistance to support at 2803. However, any bad news on trade or tariffs can sink the market in an instant, so it is important to either be very careful, or to take a long-term investment approach.

Conclusion

Bullish on the S&P 500 Index above the high price of two weeks ago; bearish on GBP/USD and on EUR/USD.