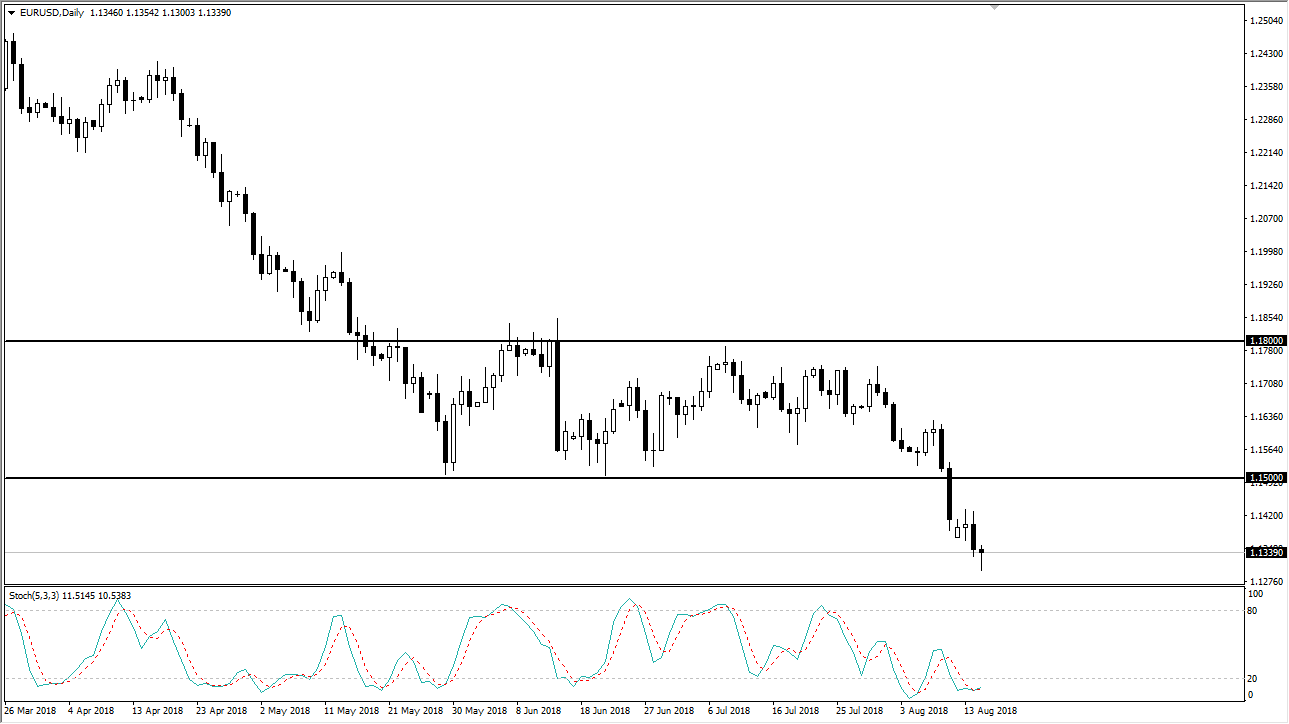

EUR/USD

The EUR/USD pair fell rather hard during trading on Wednesday, as we continue to worry about the Turkish lira. There’s a contagion risk with the European banks, so this has shown itself in the European Union’s currency. I think it’s only a matter of time before we rally though, because we are getting a bit overextended. That rally should be a nice selling opportunity, especially near the 1.14 handle, and most certainly the 1.15 level. I think we are going to go looking towards the 1.10 level given enough time, and it feels as if this market only needs a little bit more of a “push” to drop even further. Rallies are to be treated with suspicion, and I would be a seller at the first sign of trouble as we simply do not have a compelling reason to go long of the Euro at this point.

GBP/USD

The British pound has fallen rather hard during the day as well, but it did gain back some of its losses. As I record this, we are a little bit closer to the 1.27 level than anything else, but we have most certainly broken down through a major support. Because of this, I do think that we continue to go a bit lower, and I think the highs from the Tuesday session will offer a significant barrier for anybody trying to buy Sterling. I think that we probably go looking towards the 1.25 handle over the longer-term, but perhaps the market need to pullback to catch its breath if nothing else. I would not look at a bounce as anything more than that in this type of environment, simply an opportunity to sell from higher levels.