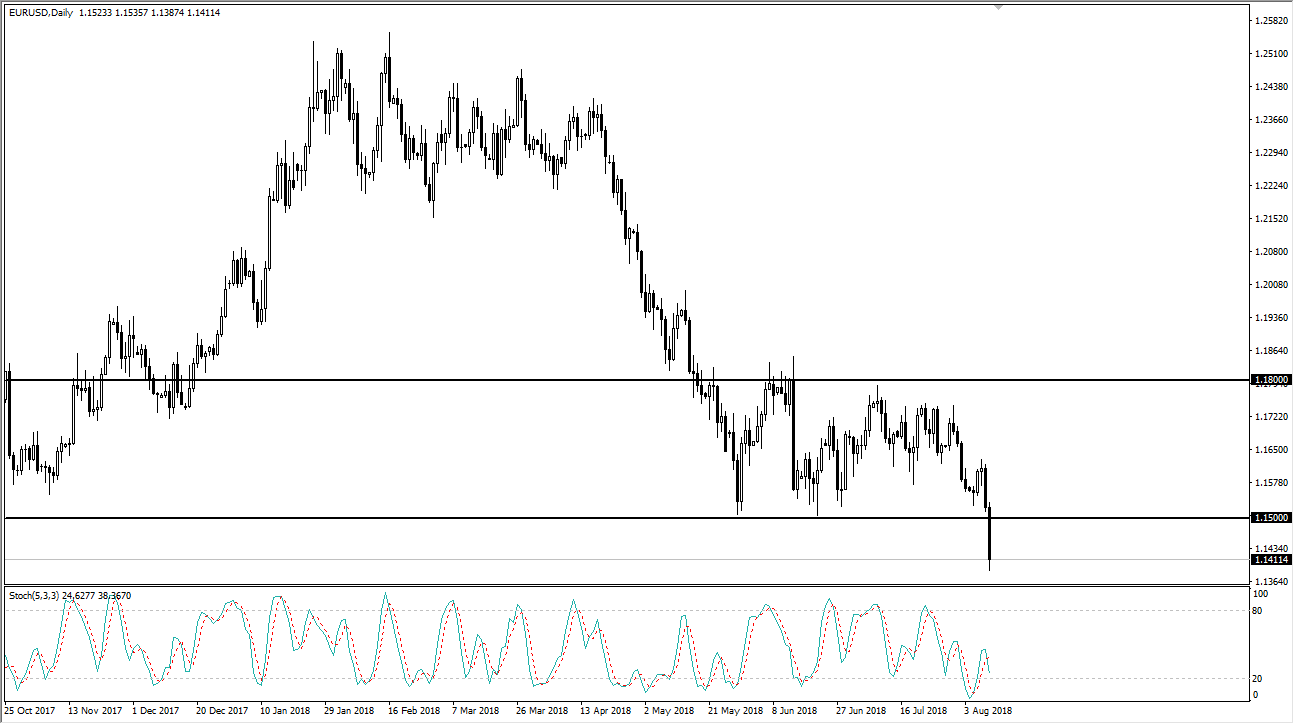

EUR/USD

The Euro broke down below the 1.15 level during the day on Friday, a major area that I have been watching for some time. Because of this, I think that we will continue to unwind, with the catalyst this time being Turkish debt. There are a lot of European banks that are exposed to Turkish debt, and that of course has a negative effect on the EU itself. People are starting to speculate that the ECB won’t be able to raise rates anytime soon, and therefore I think that we may have some legs in this trade. The 1.13 level will probably be targeted next, as it was an area of support in the past. Rallies at this point will probably find sellers at the 1.15 level. However, we could get a daily close above that level, it could breathe a little bit of life into the Euro.

GBP/USD

The British pound broke down rather significantly during the day on Friday, slicing through the 1.2750 level, an area that I said that we could hit if we broke down below the 1.30 level. We showed a little bit of support in that area by bouncing, and I believe that this will simply be an opportunity to sell for higher levels. I believe that the first signs of exhaustion will attract plenty of selling, and I think that we will probably drive down towards the 1.25 level over the longer-term. If we do rally from here, it’s likely to be a scenario where we can simply sell from higher levels. I think if we can break above the 1.30 level, then we can talk about possibly buying. However, a lot of what’s about to happen will come down to the headlines coming out of the Brexit deal, no Brexit deal, or the conservative party in the United Kingdom.