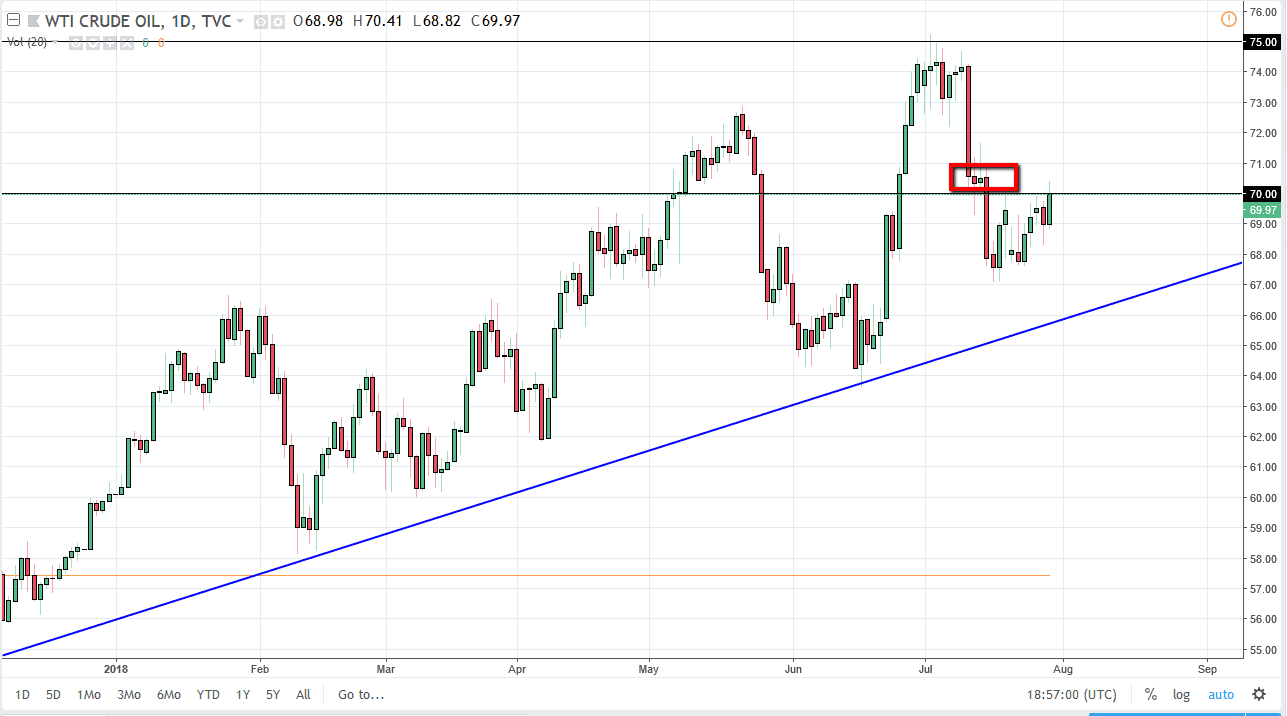

WTI Crude Oil

The WTI Crude Oil market rallied on Monday to kick off the week, breaking above the $70 handle. However, there is a significant amount of noise between here and the $71 level, so I would not be surprised at all to see a little bit of a pullback. The market breaking above the $71 level would be a bit more convincing, but right now I have to question whether we have that type of momentum. We’ve recently seen a lot of selling at $71, so it would be a major break of resistance. I suspect that it will be easier for the markets to consolidate ahead of so much noise in the central bank realm this week. Beyond that, we also have the jobs number coming and that of course will have a major influence on the US dollar.

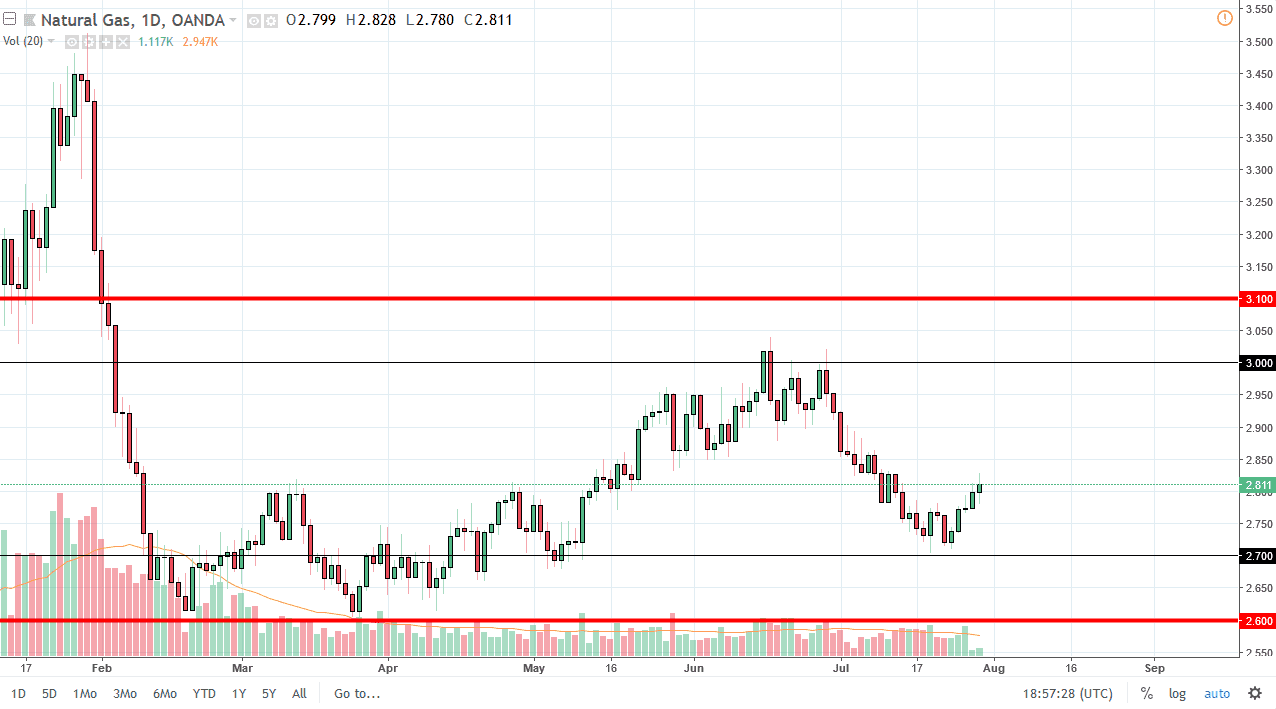

Natural Gas

Natural gas markets continue to rally during the day on Monday, breaking above the $2.80 level. The market continues to be very noisy in general, but it also is very consolidated. The $2.70 level underneath is a major support level that extends down to the $2.60 level, while the $3.00 level above is resistive to the $3.10 level. We are in the middle that, but closer to the bottom, which tells me that we will probably continue to see buyers come in on short-term dips, continuing the overall consolidation that we have seen. Natural gas markets of course are going to be noisy as per usual, but right now I think there is more risk to the upside than down. Longer-term I am a bit bearish, but I also recognize that we are at extremely low levels right now.