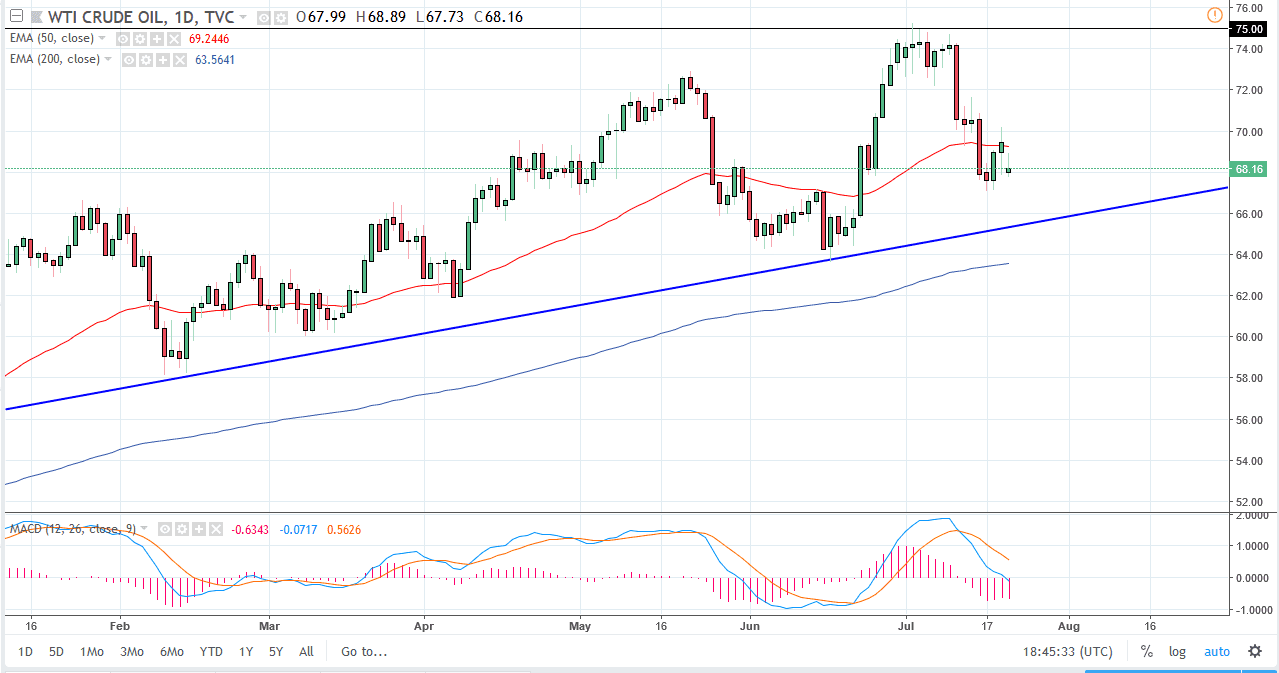

WTI Crude Oil

The WTI Crude Oil market gapped lower to start the day on Friday, but then rallied. The rally was a bit soft though, and it looks as if we are continuing to see bearish pressure. The gap of course is a sign of negativity, and it’s likely that we will go looking towards the uptrend line underneath. The $70 level above is massive resistance, and an area where there is a lot of supply. I think that it is likely to see a lot of trouble in this area, so therefore I think that it wouldn’t take much to push the market lower. If the US dollar continues to strengthen, that will also put a lot of downward pressure on this market. The uptrend line though should be rather supportive. If we were to break down below the $65 level, then the market could unwind quite drastically. Until then, I think it’s a “sell on the rallies” type situation.

Natural Gas

Natural gas markets initially tried to rally during the trading session on Friday but turned around to form a bit of a shooting star. The fact that we couldn’t even hang onto the short term gains after the massive bullish candle on Thursday tells me just how soft this market is. The $2.70 level is a significant support level, and of course a short-term target. Even if we do rally from here, I’m waiting to see selling pressure at $2.80 and $2.85 after that. I believe that the market will continue to be range bound longer-term, and we are towards the bottom of that range. However, we don’t see any real signs of recovery quite yet on the chart. At this point I think the $2.60 level is longer-term support to pay attention to.