WTI Crude Oil

The WTI Crude Oil market fell apart during trading on Monday, losing over 3% and breaking cleanly below the 50 EMA. We are still clearly above the uptrend line, so I don’t know that we are going to break down longer term, but it looks as if rallies are to be sold. I believe that the Saudi Arabian announcement to release more crude oil into the market, and the possible release of crude oil in the United States out of the SPR could be larger drivers of this market to the downside as well. I think that rallies that show signs of exhaustion continue to be selling opportunities, as we clearly have a lot of supply just below the $75 handle. If we were to break down below the uptrend line, then the market could go much lower, but as you can see the 200 day EMA is just below, so I think it’s going to be difficult to slice through there.

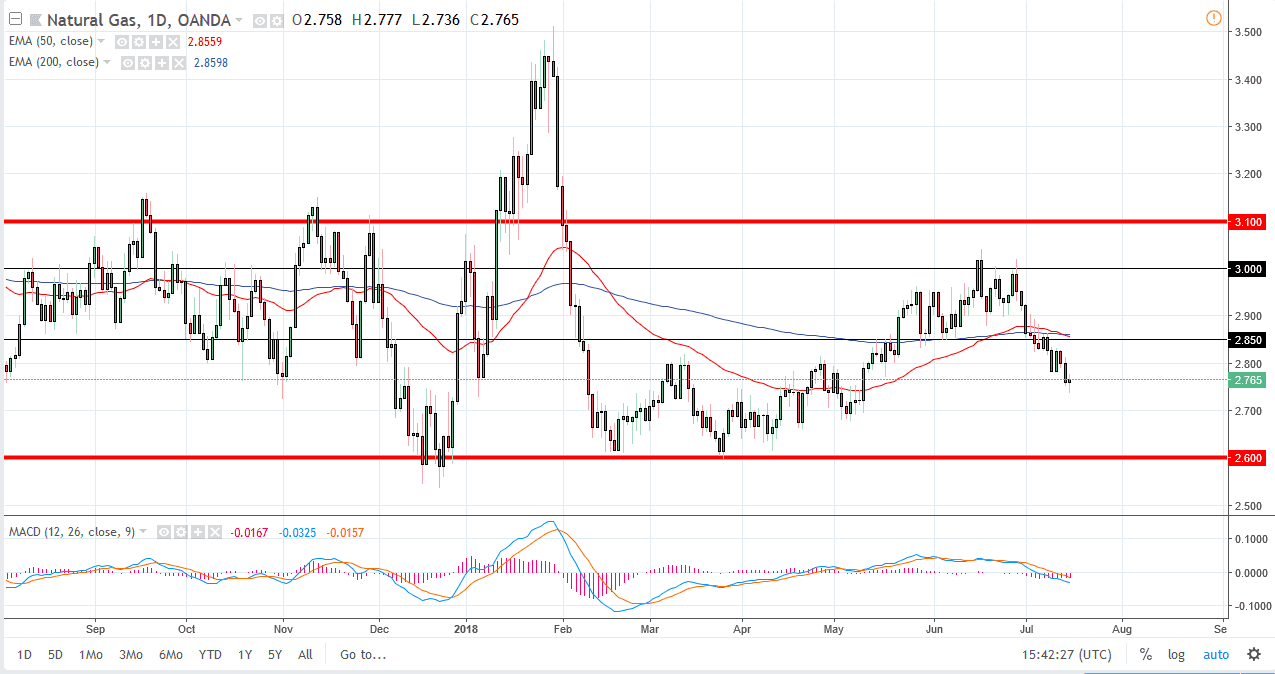

Natural Gas

The natural gas markets did very little during the day, bouncing around the $2.75 level. I think that the market has a significant amount of support underneath, so don’t be surprised if we get a bit of a bounce. The $2.85 level above is significant resistance, as it was previous support. The 50 day EMA just crossed below the 200 day EMA and is a longer-term sign of negativity. I think selling rallies continues to be the way forward, as we should go to the $2.60 level underneath, an area that has offered a significant amount of demand, and I don’t think that is going to change, meaning that we have a bit of a “floor” in place. I continue to short rallies.