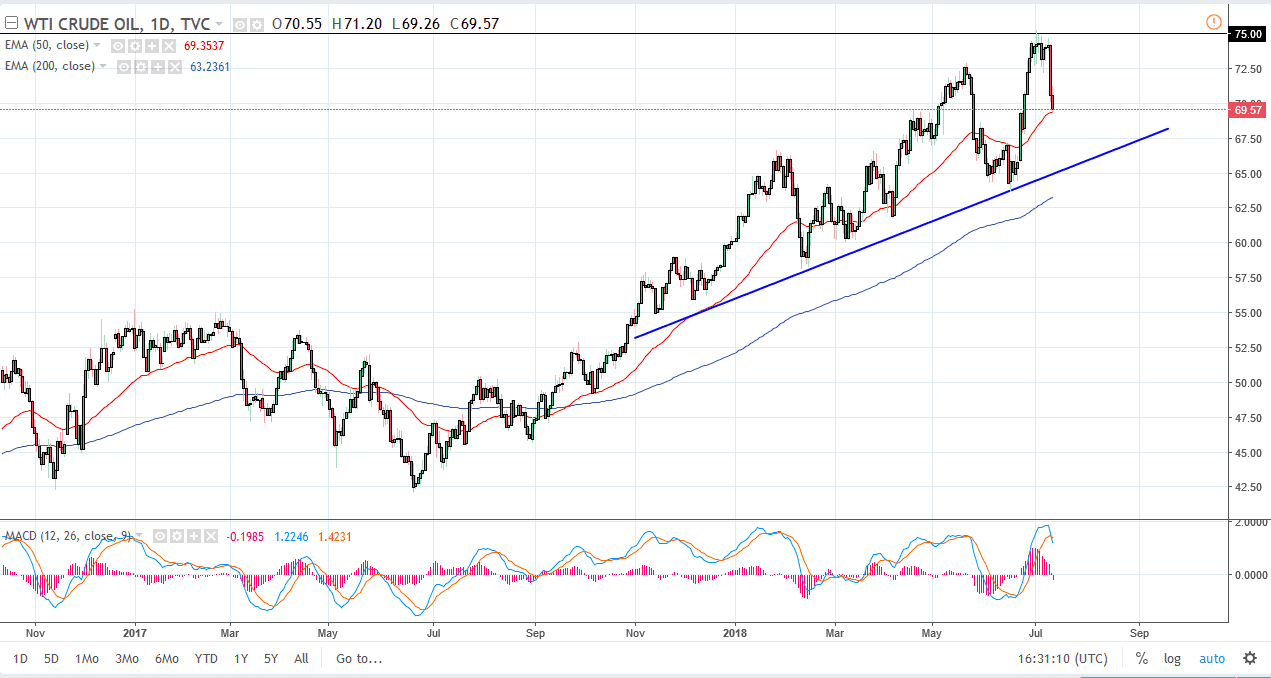

WTI Crude Oil

The WTI Crude Oil market fell again during the trading session on Thursday, losing 1.5% by the time I record this video. However, what’s rather interesting is that we managed to do this after losing almost 5% during the previous session. The market looks likely to see a lot of supply at the $75 level, and of course the opening of Libyan ports will continue to add more supply to the market overall. With this, it does not surprise me that we reached towards the 50 EMA. I think that the uptrend line below is probably where we could see the market go to, but a short-term bounce is not out of the question. Pay attention to the US dollar, because it is highly influential on this market as well.

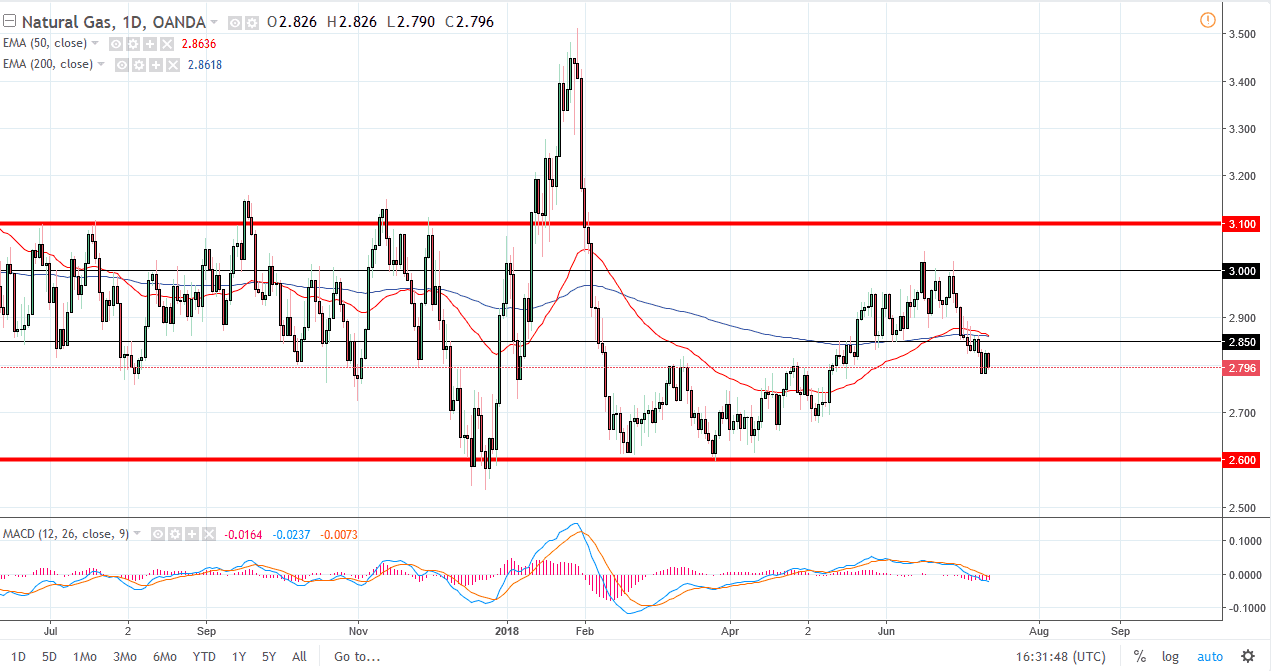

Natural Gas

Natural gas markets also fell during the day, losing almost 1% by the time I got to the desk today. However, I think that what we are looking at is the market catching its breath before the next move lower. Granted, I do recognize that there is support underneath, but when you look at the longer-term charts, the bottom of the consolidation area is still another $0.20 below where we find the market trading at right now. Short-term rally should be selling opportunities because of this, especially near the $2.85 level as we not only have structural support and resistance, but we also have the 50 and the 200 day EMAs converging.

I like selling rallies, and I like the idea of waiting for signs of exhaustion on shorter-term charts to take advantage of the longer-term move. I don’t have any interest in buying this market right now, it appears that the significant push higher is now over.