Gold ended the week up $3.02 at $1254.45 an ounce, breaking a three-week losing streak, as a correction in the U.S. dollar index triggered some short-side profit taking. Positive economic data out of Europe sent the euro lower against the dollar. U.S stocks posted weekly gains after upbeat U.S. employment data helped investors look past escalating trade tensions between the U.S. and China. The minutes of the Fed’s latest policy meeting released on Thursday showed that the economy that was evolving in line with policymakers’ expectations.

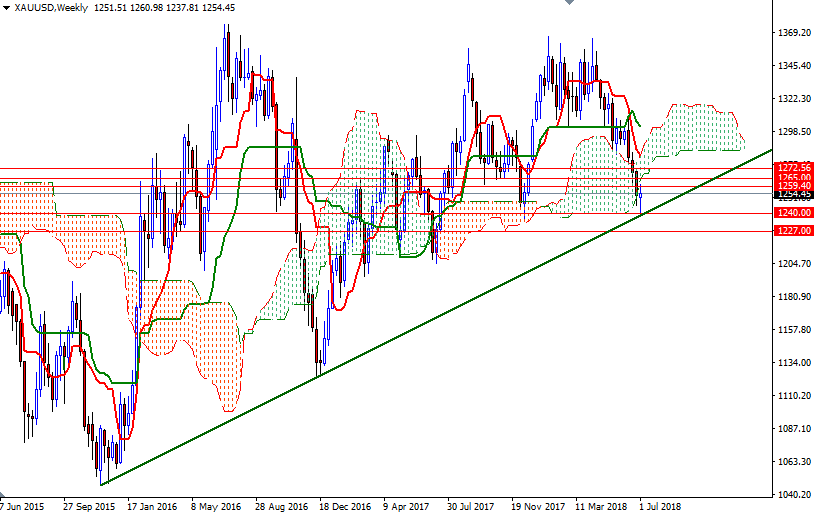

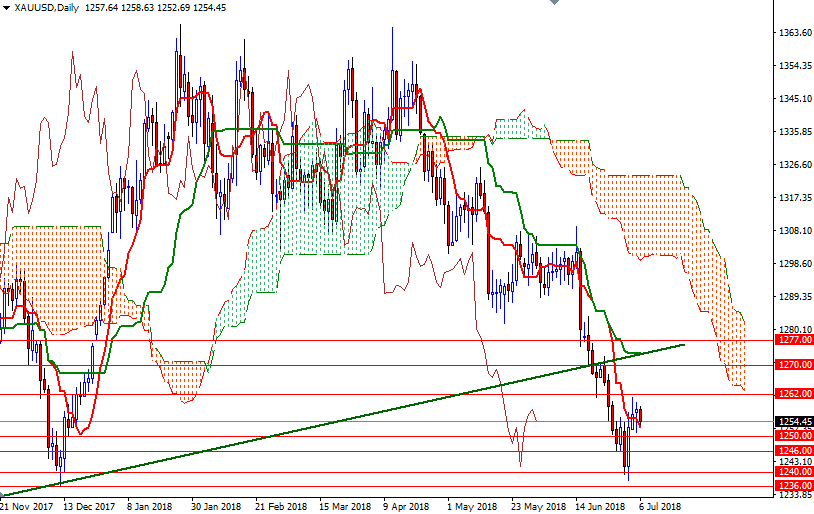

Gold continues to struggle with multiple headwinds, but the market has nevertheless managed to find some support in the 1240/36 zone. As I pointed out last week, the market was short-term oversold and I was expecting a bounce towards 1273.50-1270. XAU/USD is trading above the Ichimoku clouds on the H1 and the M30 charts. However, prices are still below the daily cloud, and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned, suggesting that the bears have the overall near-term technical advantage.

That said, I think the bulls have to lift prices above 1259.40-1262 so that they can gain momentum for 1273.50-1270. The bottom of the week cloud sits near there, and a sustained break above 1273.50 is needed to give the gold bulls short-term confidence. In that case, the 1277 level will be the next stop. Beyond there, the 1284/2 area stands out as a key technical resistance. To the downside, the initial support sits at 1250, followed by 1246. If XAU/USD gets back below 1246, we will probably pay another visit to 1240/36. The bears have to produce a daily close below there to put more pressure on the market and test 1230 or even 1227/5. A break below 1225 implies that the market is aiming for 1218/15.