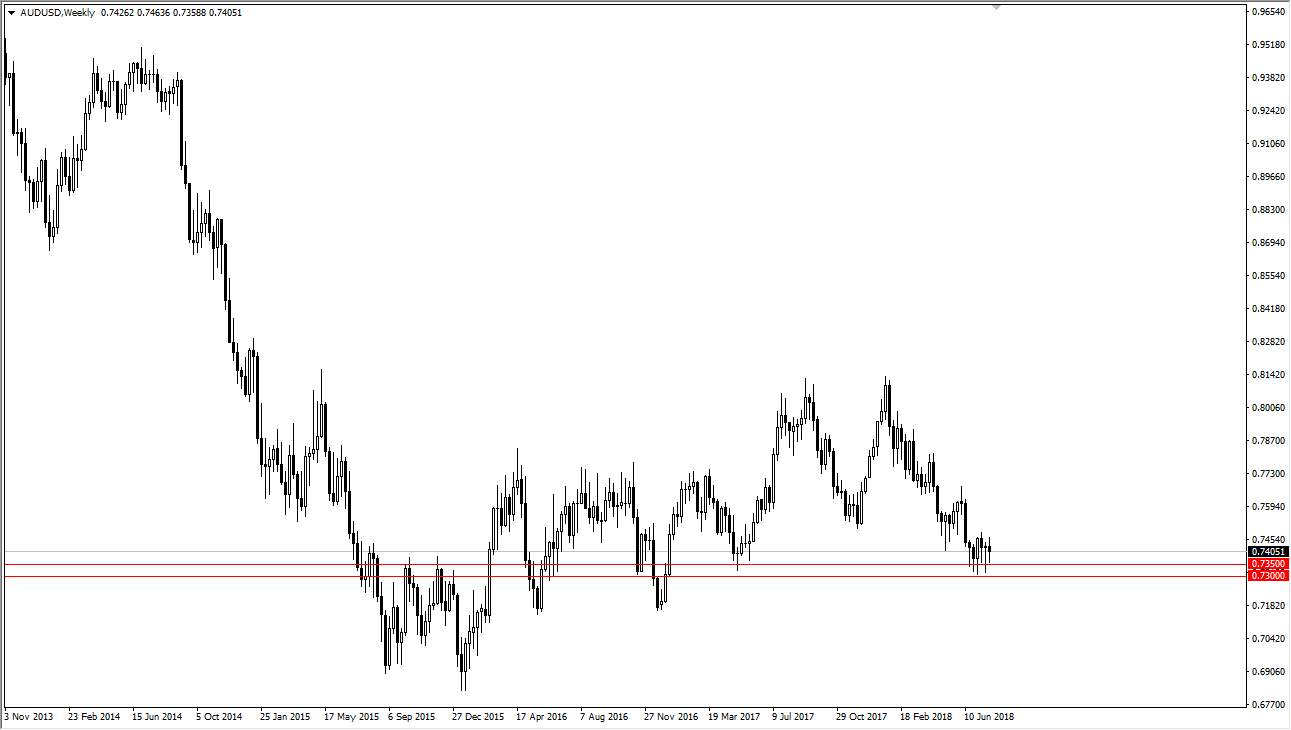

AUD/USD

The Australian dollar has fallen during most of the week but turned around to form a hammer. The hammer of course is a bullish sign, and beyond that we have formed hammers for several weeks in a row, and it now looks as if the 0.73 level underneath is massive support. I think if we break down below that level, then we could unwind. However, based upon recent price action I think that we will probably bounce from here and continue to go much higher. At that point, the 0.76 level would be targeted.

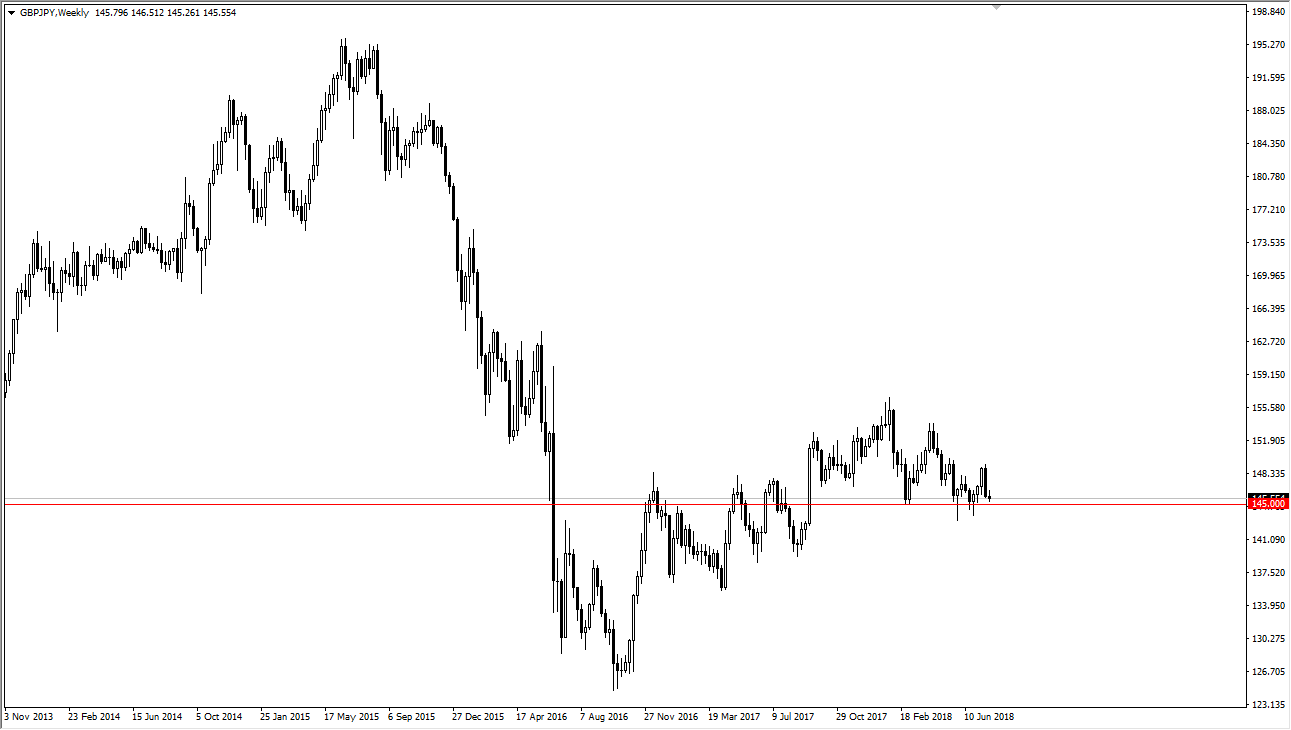

GBP/JPY

The British pound has done very little against the Japanese yen during the week but remains above the ¥145 level. I believe that the market continues to find buyers underneath, and I think at this point it’s likely that the market will turn around and reach towards the ¥150 level. That being said, keep in mind that the market is very sensitive to risk appetite, so obviously we will need to pay attention to headlines around the world. Overall, I do believe that we have more upward proclivity than down in the short term

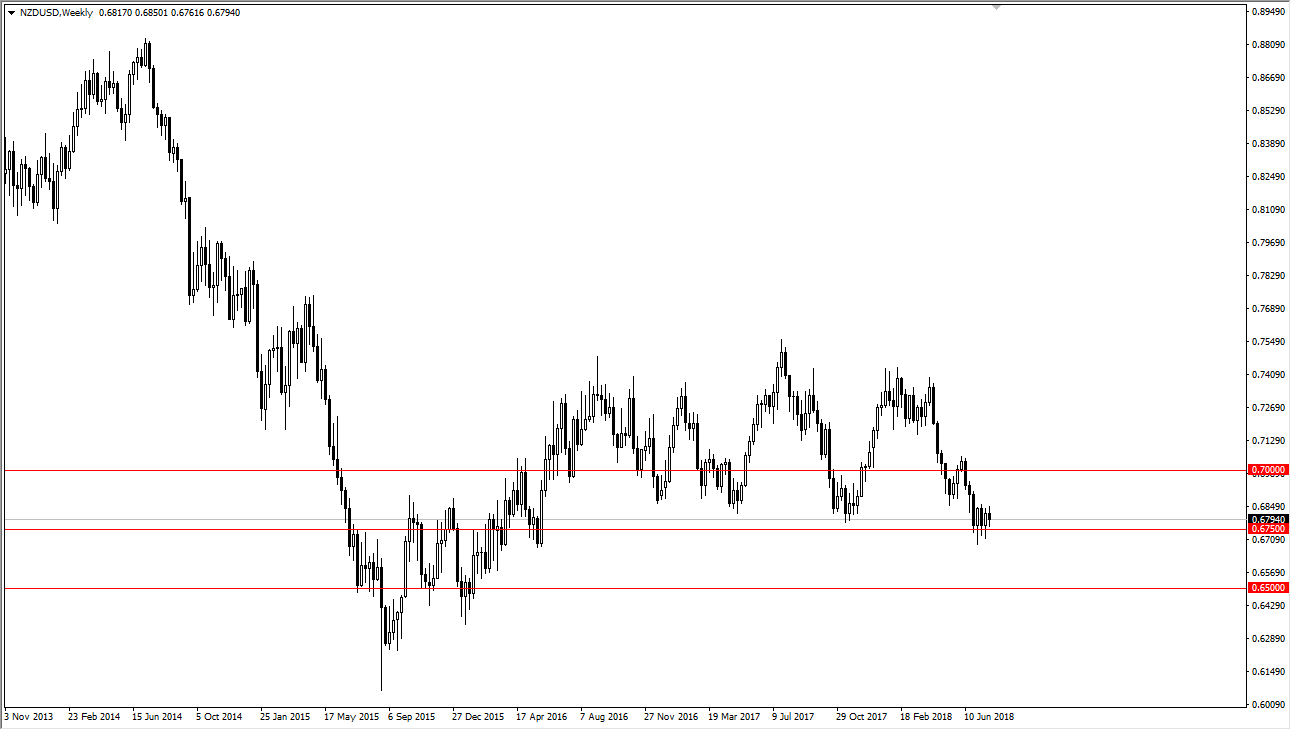

NZD/USD

The New Zealand dollar has gone back and forth during the course of the week again, testing the 0.6750 level. This is an area that is rather supportive, and as we continue to go sideways, it’s likely that we could bounce from here and reach towards the 0.70 level above. Alternately, if we were to break down below the hammer from a couple of weeks ago, making a fresh, new low, then the market could break down to the 0.65 level underneath that.

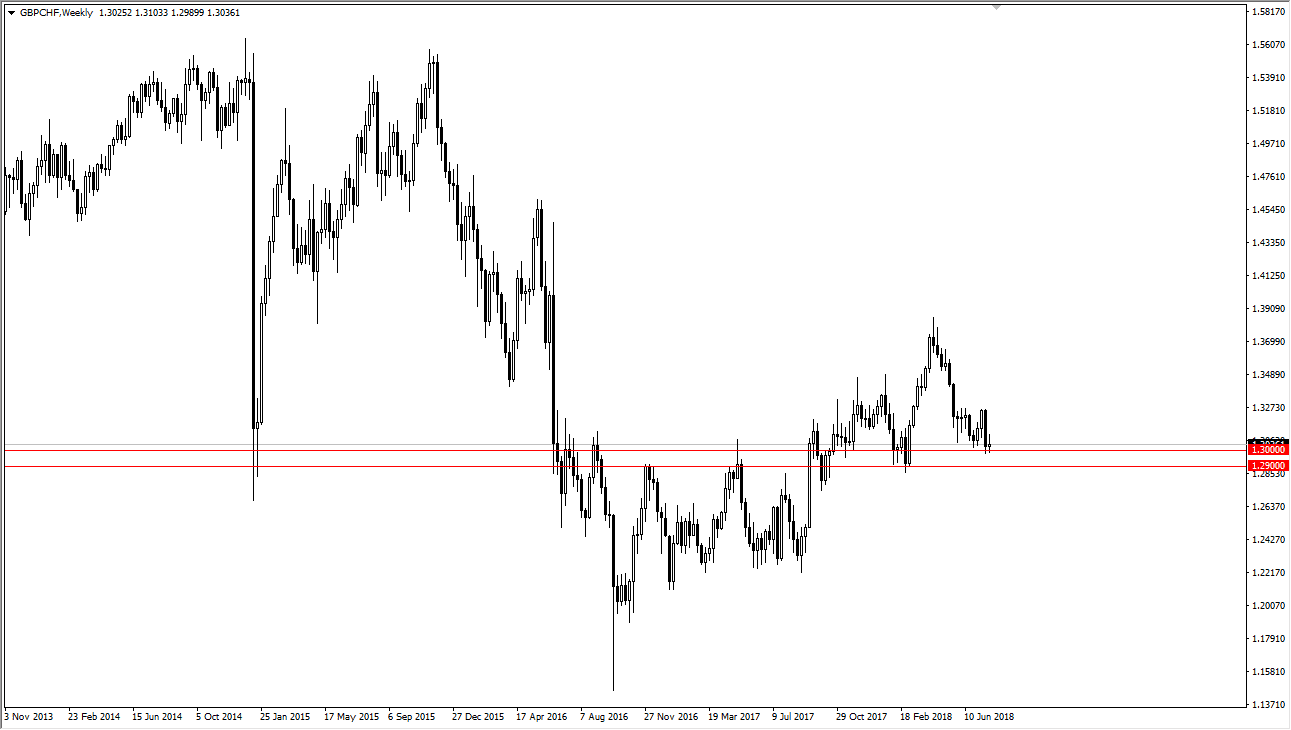

GBP/CHF

The British pound has done very little against the Swiss franc during the week, as we continue to hover above the 1.30 level. I believe that the market could bounce from here, as long as we can stay above the 1.29 handle. If we break down below the 1.29 level, then the market unwinds rather drastically. Otherwise, I would look at short-term pullbacks as a short-term buying opportunities.