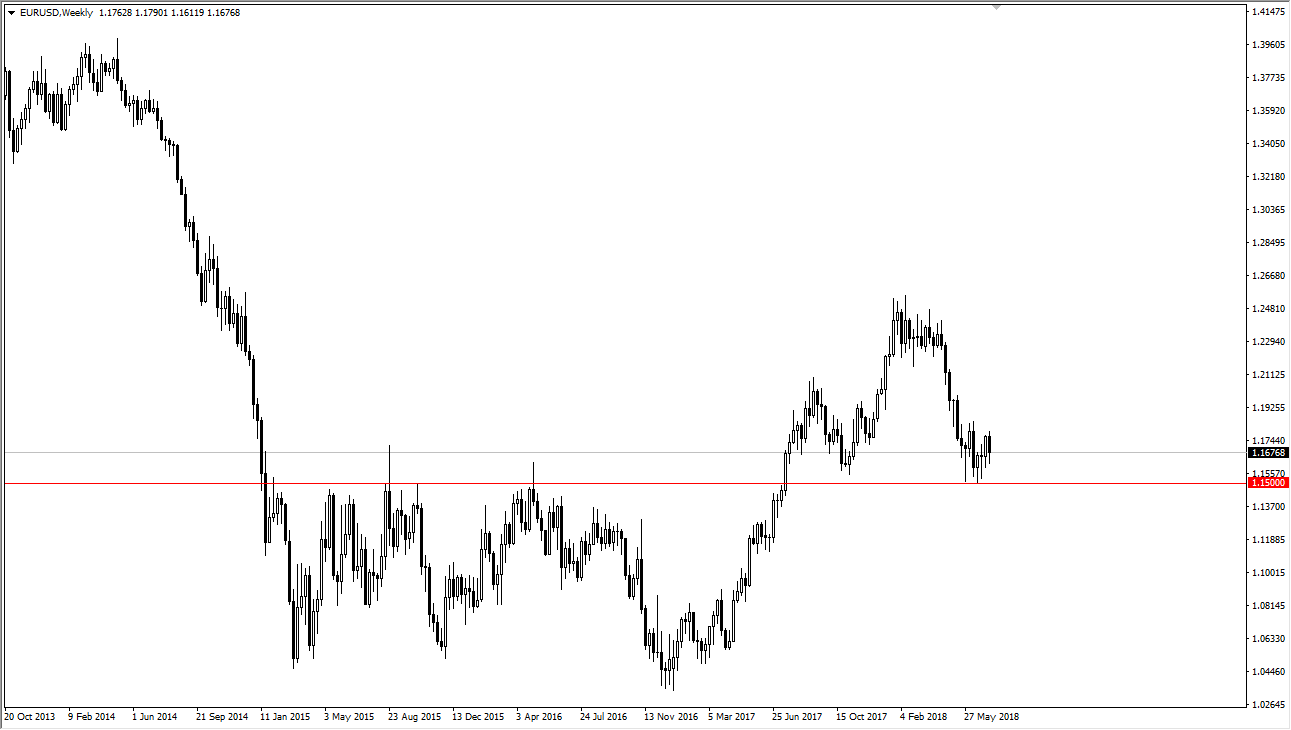

EUR/USD

The EUR/USD pair has been very noisy during the past week, as we continue to chop around. At this point, I believe that we are looking at more consolidation overall, with the 1.1850 level being resistance, and the 1.15 level being major support. Because of the hammer on Friday, I think that the market will more than likely look to reach towards the highs of this range.

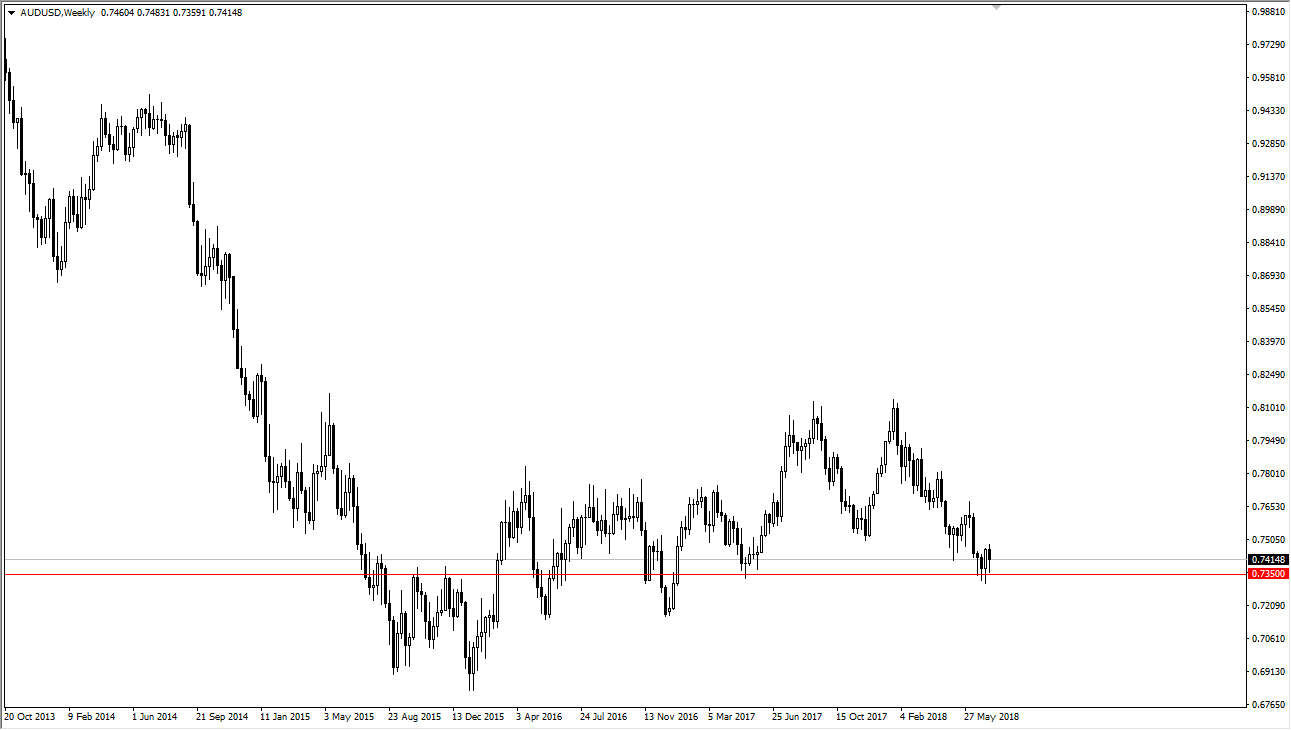

AUD/USD

The AUD/USD pair has formed yet another hammer for the week. This shows just how important the 0.7350 level is for support, and I think that the larger institutions are starting to show a lot of interest in that level – meaning that we should continue to see buyers on dips. Clearly, the level has held its own, and I see this market chopping around between the 0.7350 level and the psychologically important 0.75 level above.

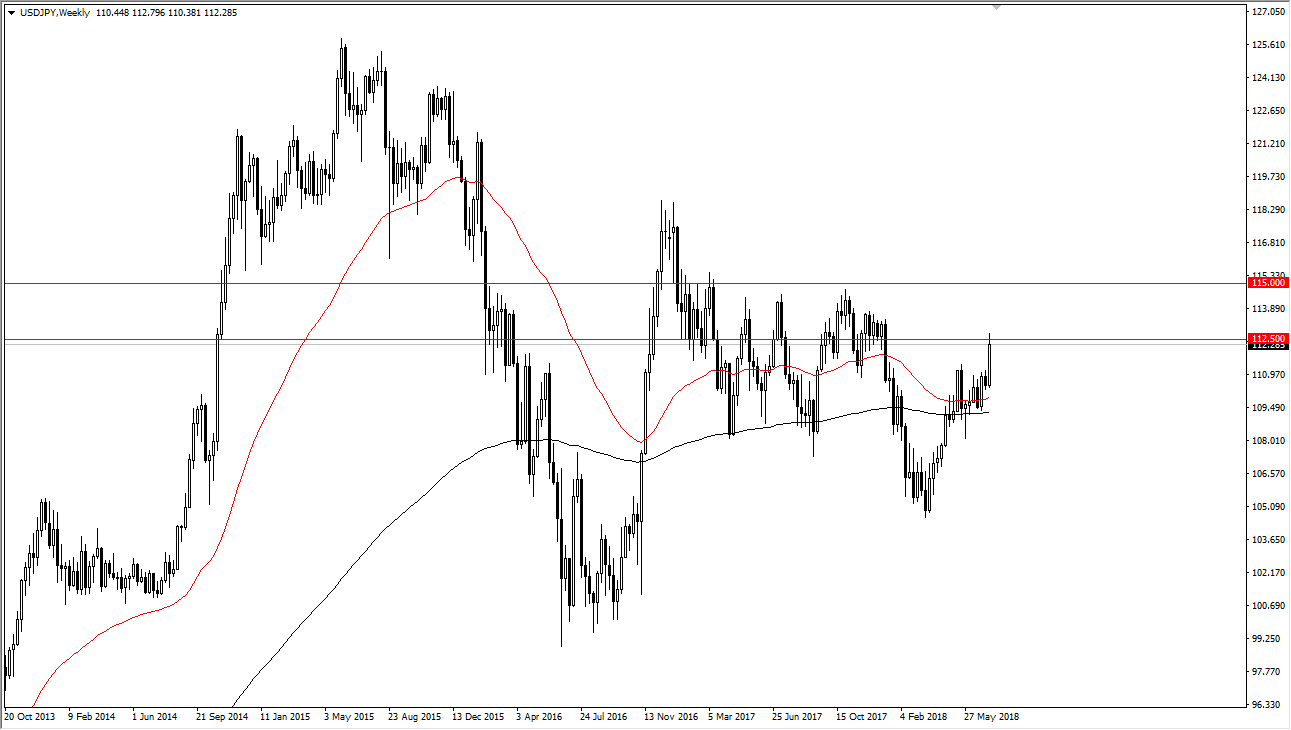

USD/JPY

The USD/JPY pair had a great week for the buyers, reaching towards the 112.50 region. This area has been important before, so it isn’t very surprising that it stopped the buyers. The market will more than likely pull back a little bit this week, but I think that the 112 level is a demand area, and the 111.25 level most certainly will be as well. The US dollar is enjoying a certain amount of bullish activity, due to the expected three or four interest rate hikes, while the Bank of Japan isn’t anywhere near tightening monetary policy. Because of this, it is likely that we will continue to see buyers.

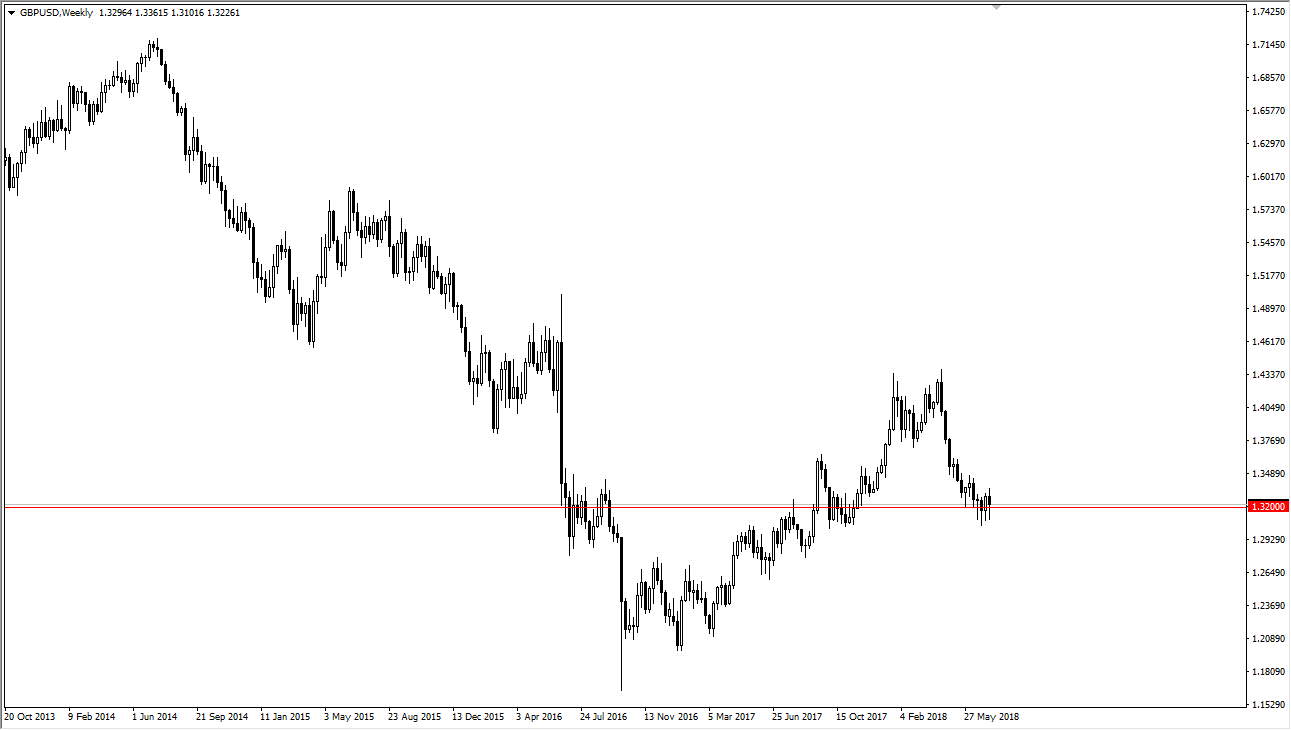

GBP/USD

The British pound pulled back initially but found buyers underneath to see the 1.32 level offer strength. This markets will probably eventually clear the 1.33 level above, to continue to the 1.35 level. That level would signal that even more bullish pressure is to be found. Alternately, if we break below the 1.31 level, this market unwinds to the 1.30 handle.