USD/JPY

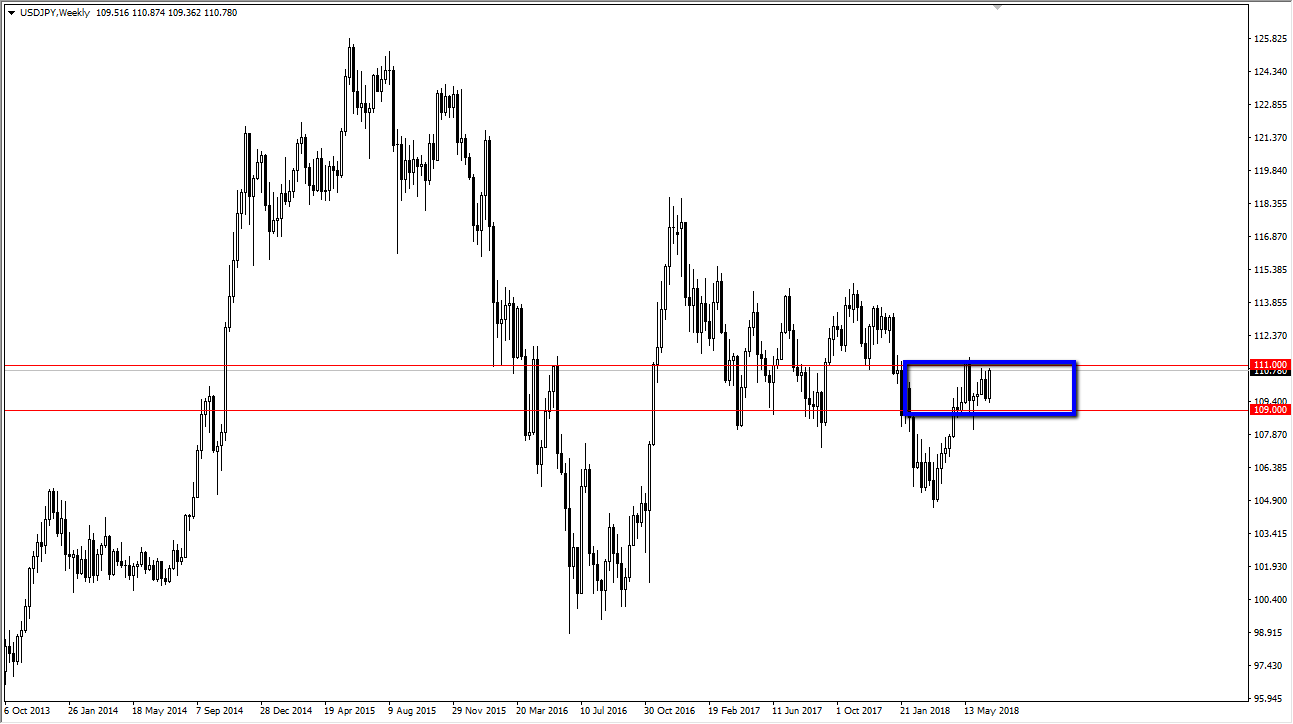

The US dollar has had a very active and busy month against the Japanese yen, essentially consolidating between the 109 young level on the bottom and the ¥111 level on the top. This makes sense if you think about it though, because there are talks about trade tariffs, and that of course has a massive influence on how the US deals with Asia, thereby potentially stifling currency flow. This is a very risk sensitive currency market, so as long as there are concerns about some type of trade war, it will only be able to rally so far. However, if left to its own devices, and other words the interest rate differential, it’s likely that this pair would rally significantly.

It is because of this that I believe that if we can get a dampening of the trade rhetoric, this pair will almost certainly rally and break above the ¥111 level, looking for the 114 million level over the longer-term. With the Federal Reserve looking to raise interest rates at least a couple of times this year, and the Bank of Japan being light years away from doing the same, it makes sense that the market would continue to do what it had done over the last few months. However, keep in mind that there are a potential minefield full of problems ahead, and that will continue to make this market erratic to say the least. Short term, I suspect that we should probably look at this as range bound, and therefore I would play the two previous mentioned levels back and forth in a range bound system until we get some type of confirmation. If we were to break down below the ¥109 level, the market could very well drop to the ¥107.5 level before finding support.