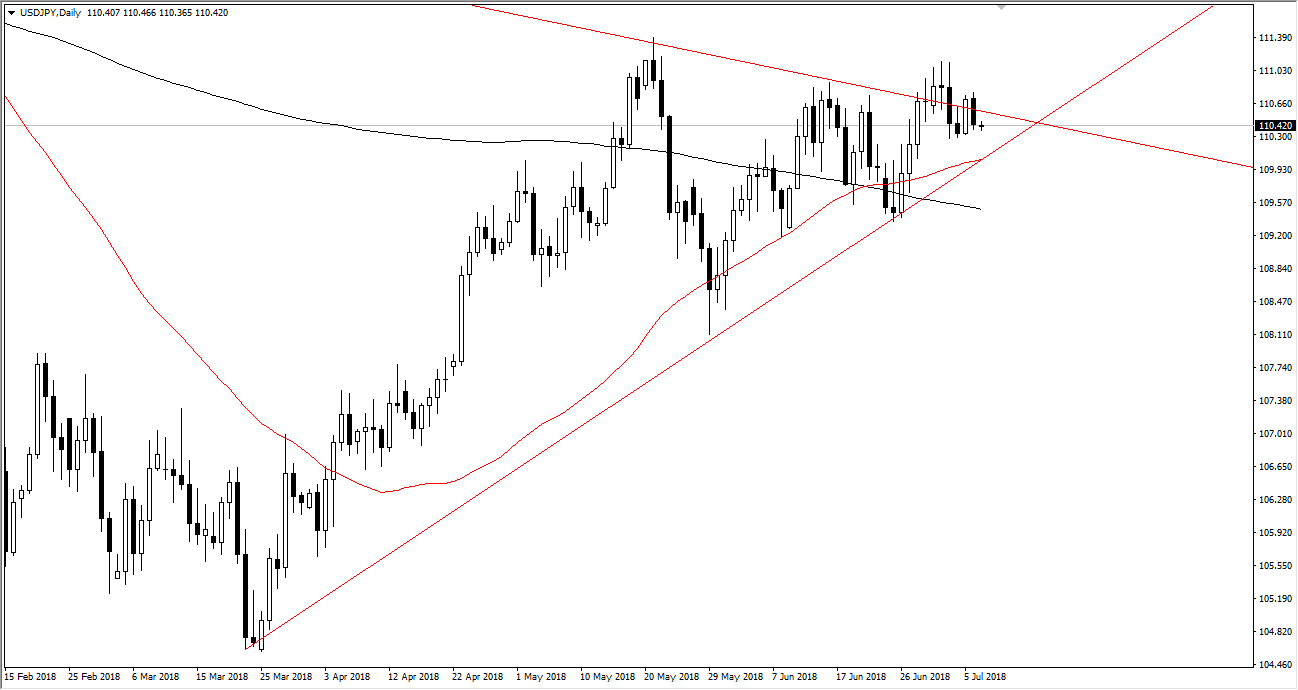

USD/JPY

The US dollar has been bearish against the Japanese yen during the Friday trading session, as the market continued to dance around the ¥110.50 level. This is a market that has open very quietly during morning hours in Asia, and it now looks as if we are ready to continue going sideways. The red 50 EMA underneath should continue to offer support, and it does look as if we are sustainably above the 200 day exponential moving average. Ultimately, I think that if we can break the ¥111 level on a daily close, then I would be very bullish. In the meantime, I think we are simply trying to build up the necessary momentum to go higher. I think that pullbacks will be supported at the ¥110 level, and possibly even the ¥109 level. I think we continue to see a lot of sideways grind.

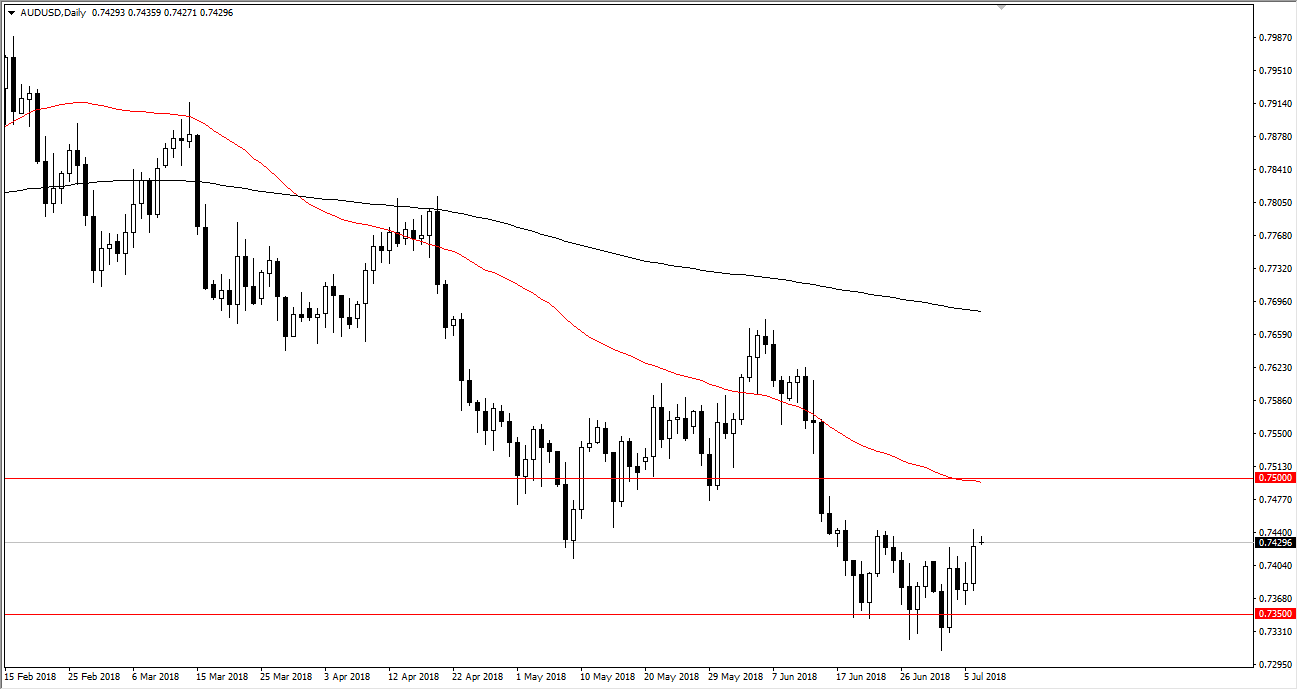

AUD/USD

The Australian dollar has gapped higher at the open on Monday in Asian trading, and it now looks as if we will try to make a move towards the 0.7450 level. If we can break above that level, it’s likely that we will then go looking towards the 0.75 level above that should be resistance, as well as the 50 EMA on the daily chart. I think that it will be difficult to break above that area, so I anticipate that we will have a short-term opportunity to go long, and then turned around the start selling again. If we do close above the 0.75 level on the daily chart, the market should continue to go higher, perhaps reaching towards the 0.7650 level above. It’ll be interesting to see how this plays out but gapped higher at the open is a good sign.