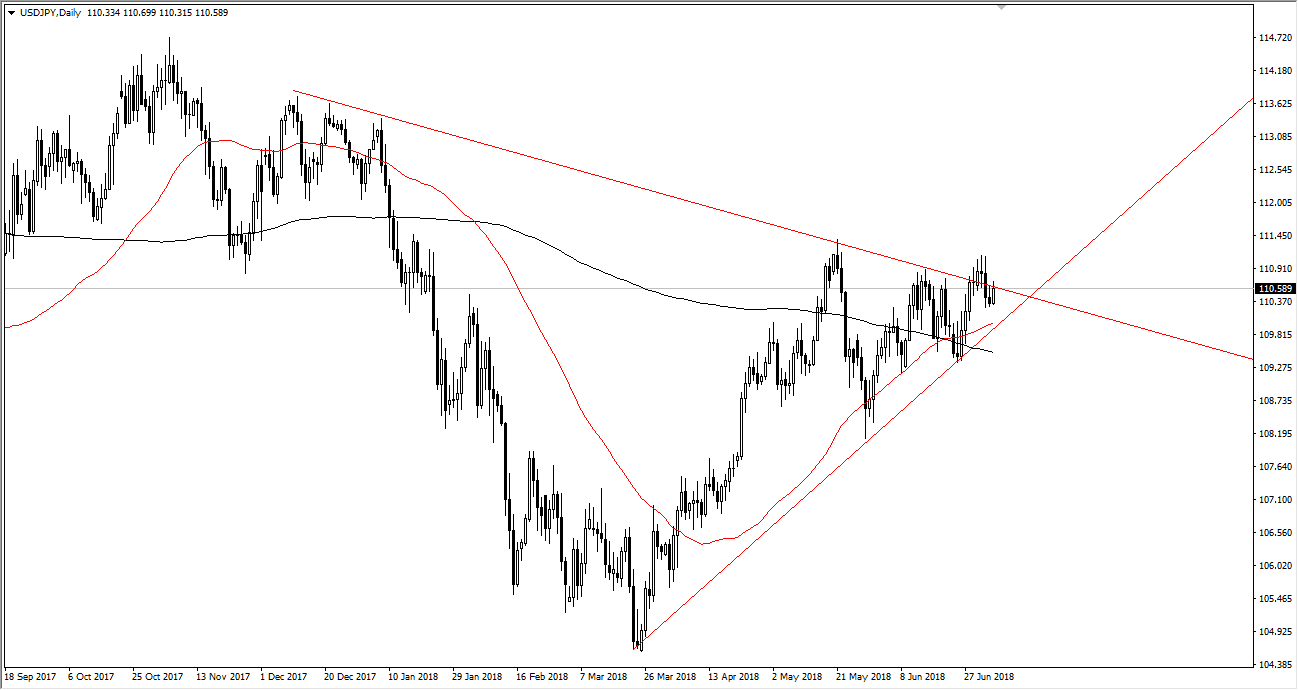

USD/JPY

The US dollar has rallied significantly during the trading session on Thursday, breaking above the top of the shooting star from Wednesday, which of course is a bullish sign. However, with the jobs number coming out today it’s very unlikely that we see an easy route higher, and I believe that at this point we need to break above the highs from earlier in the week to be comfortable buying, and at that point I think that the market probably goes to the ¥112.50 level. Keep in mind that the jobs number being better than expected quite often will help this pair, but at the same time we are focusing on the escalating tensions between the United States and China, which puts a bit of an anchor around the neck of this pair. Technically speaking, this market looks as if it is ready to go higher but be aware of the fact that it will be very volatile.

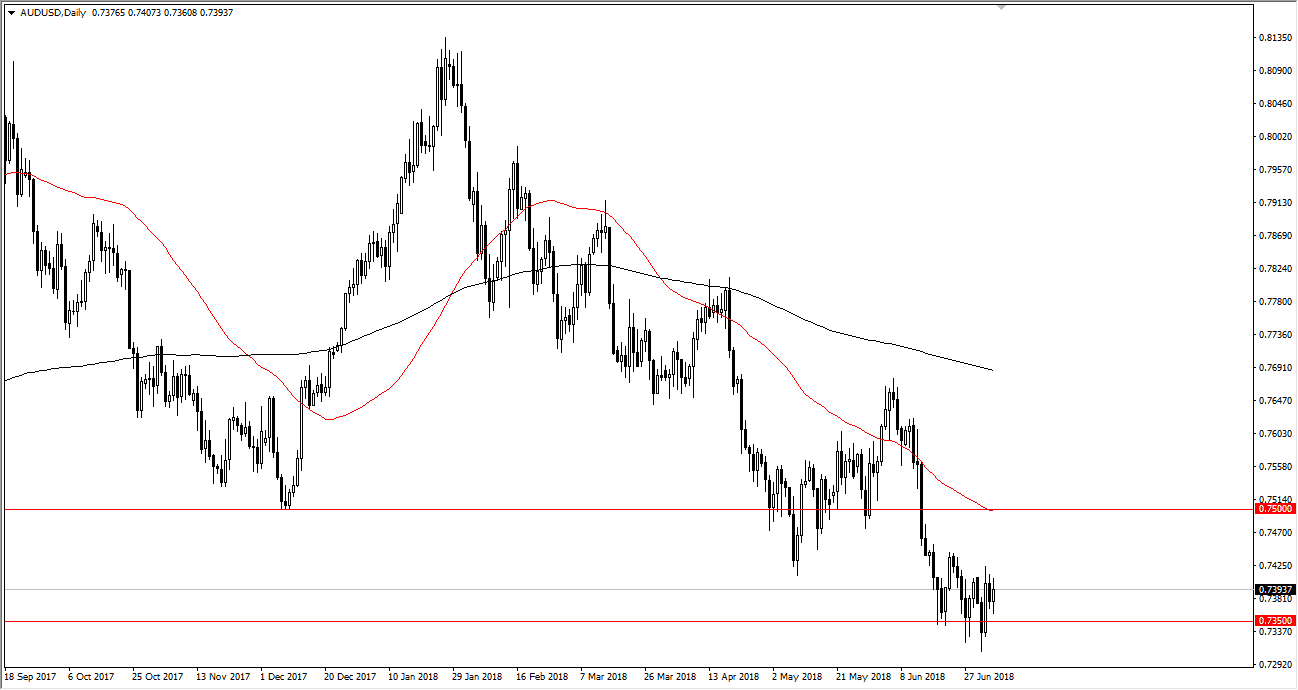

AUD/USD

The Australian dollar was noisy during the trading session on Thursday as well, as we continue to see the 0.74 level as a bit of resistance. The market is most certainly in a downtrend, and the 50 day EMA above is at the 0.75 level. Because of this, I think that the market will continue to see that round figure as resistance for not only the number itself, but the moving average. I believe in selling rallies, it until we can close above that level on the daily chart. Keep in mind that this pair will be highly sensitive to risk appetite, and it looks very unlikely that the markets will be willing to move too far to the upside as we have so many things around the world that have traders on edge.