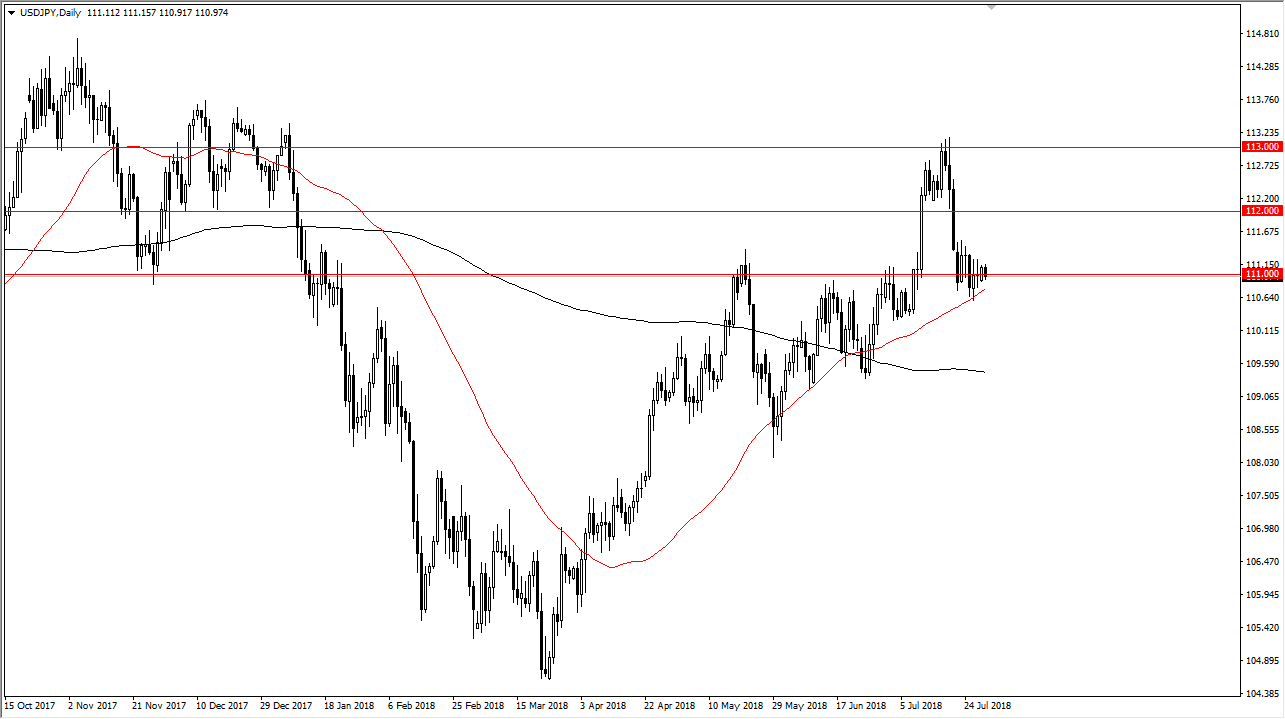

USD/JPY

The US dollar had a slightly negative session against the Japanese yen on Monday to kick off the week, but with the Bank of Japan meeting going on and ending today, it’s likely that we will see some type of volatility during the statement. The question now is whether the Bank of Japan is going to continue to keep its monetary policy alter loose, or is it going to tighten. We are at a major demand area, so I think the slightest hint of keeping the monetary policy the same should send this market higher. This is in line with the overall interest rate differential going forward, and I think at this point it’s only a matter time before value hunters come back into this pair and pick it up. I also believe that there is a significant amount of support extending down to the ¥110 level at the least.

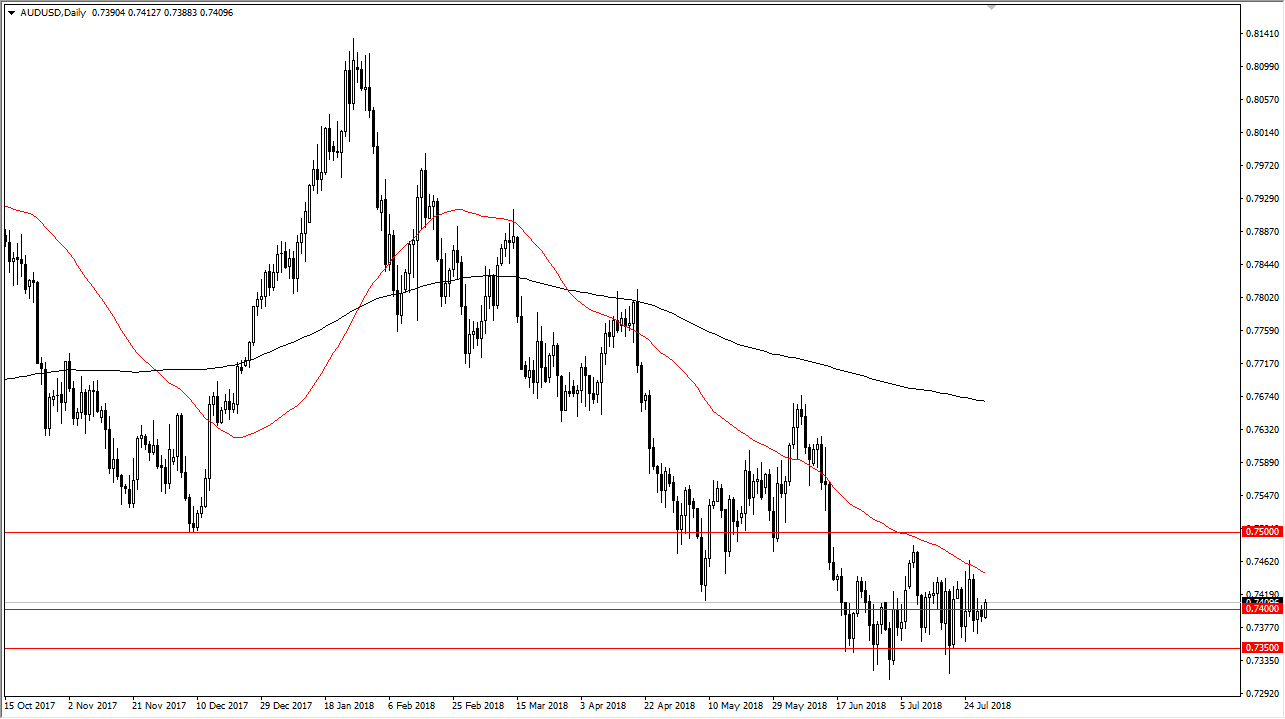

AUD/USD

The Australian dollar has rallied slightly during the day on Monday as we have seen a bit of US dollar weakness. We are hovering around the 0.74 level, which I think is the beginning of the major support to pick the market up. In fact, I believe there’s a bit of a “floor” summer closer to the 0.73 level that will continue to be very supportive. I think that longer-term charts dictate that we should bounce from here, but keep in mind that the Australian dollar is highly levered to what’s going on in Asia. Essentially, the Aussie is used as a proxy for the Chinese markets and currency, so I think we need some type of good news out of either the Chinese stock markets, or perhaps the trade war front to get the Aussie moving.