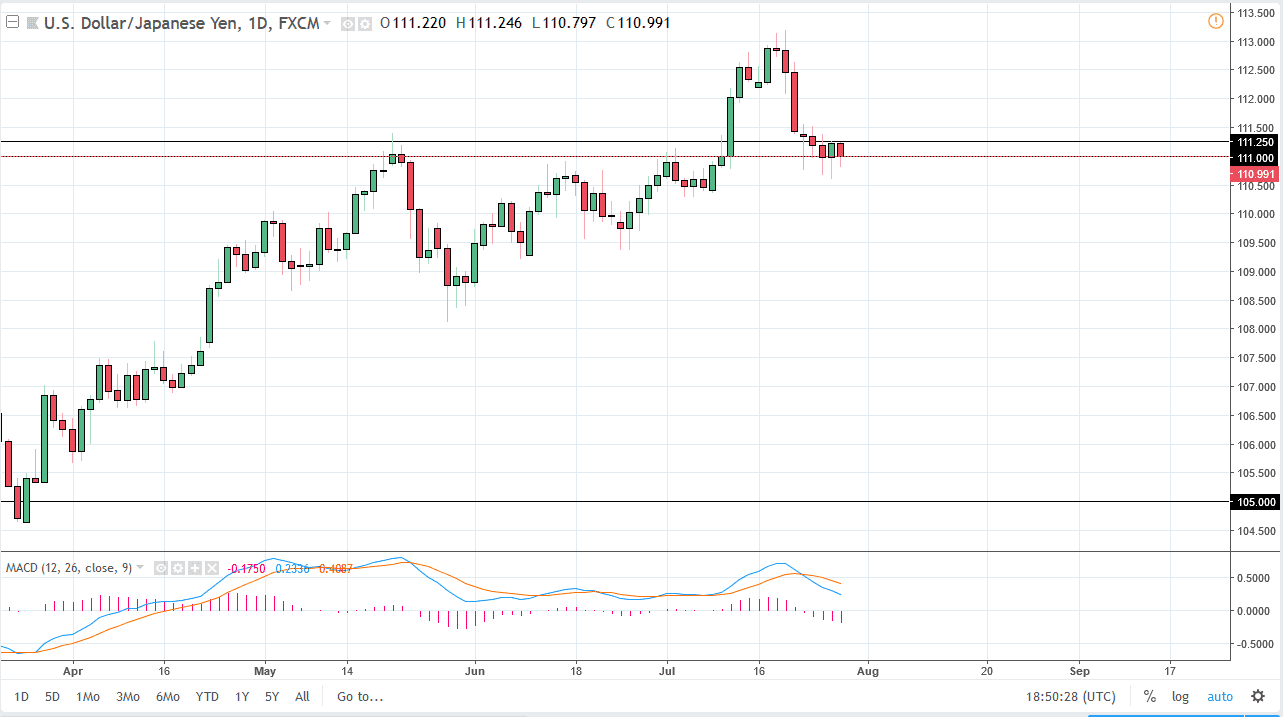

USD/JPY

The US dollar has fallen a bit against the Japanese yen but turned around of form a hammer again on Friday. The GDP number came out at 4.1%, a very strong sign indeed for the US economy. It looks as if the Japanese yen is starting to soften up against a few other currencies as well, so although the US dollar is on its back foot by the end of the day, I think it’s still stronger than the Yen. Overall, I believe that if we bounce from here, the market will probably go looking towards the ¥113 level, but it may take some time to get there. Beyond that, you can make an argument for trend line just below, so I think there are plenty of reasons to think that there is structural support underneath.

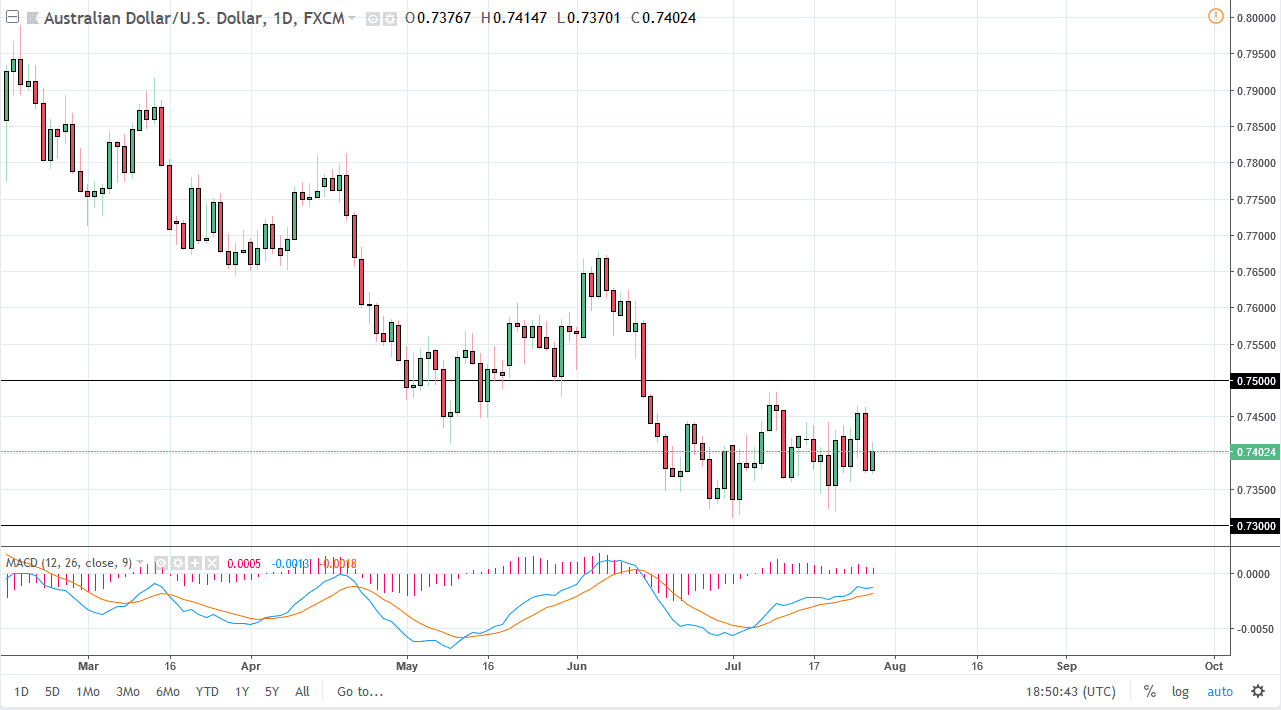

AUD/USD

The Australian dollar has rallied a bit during the day on Friday, as we continue to consolidate overall. We are consolidating between 0.730 on the bottom, and 0.75 on the top. Ultimately, I think that the market continues to go back and forth and it’s likely that short-term traders will go back and forth as well. If we can break above the 0.75 level, and I think we will eventually, the market could start to rally again. Longer-term charts, mainly the weekly ones, have formed several hammers which of course is a bullish sign and I think eventually we could see the Australian dollar recover.

The Aussie dollar of course is sensitive to the trade war and currency war situation between the United States and China, so if those things can calm down, it’s likely that the Aussie dollar will take off to the upside and recover quite nicely for the longer-term. Obviously, if we break down below the 0.73 level, that’s a very negative sign.